The California Secretary of State announced on May 8 that Californians for Financial Education had submitted 693,676 valid signatures—surpassing the signature requirement of 546,651 and qualifying for a place on the Nov. 5 ballot.

The initiated state statute would require students graduating during the 2029-2030 academic year to complete a one-semester personal finance course. The measure would also require a personal finance course to be offered by the 2026-2027 academic year. The personal finance course would have to meet the A-G requirements, which are the course requirements for admission to the state’s public universities, or be approved by the local governing board.

According to the initiative, the topics of the personal finance course may include but are not limited to:

- budgeting skills,

- an understanding of the tax system,

- an understanding of retirement accounts and investment alternatives (e.g. 401K programs, Individual Retirement Accounts (IRA), stocks, bonds, mutual funds, and index funds),

- types of credit and predatory lending practices,

- identity theft prevention,

- financing college or other workforce education, and

- features of bank accounts.

The campaign has reported over $7.8 million in cash and in-kind contributions. The top donor to the campaign is Tim Ranzetta, who has contributed over $5 million. Ranzetta co-founded Next Gen Personal Finance, a 501(c)(3) nonprofit with a mission to require every high school graduate to take a one-semester personal finance course by 2030. The organization provides grants to schools and school districts, teacher education, and online personal finance courses.

The initiative received endorsements from U.S. Rep. Ro Khanna (D), State Controller Malia Cohen (D), State Treasurer Fiona Ma (D), and Superintendent of Public Instruction Tony Thurmond (D).

Treasurer Fiona Ma (D) said, “As California’s Treasurer, investing in our youth through initiatives like the California Personal Finance Education Initiative will pay off big for individuals, families, and our state’s economy. Teaching financial literacy in high school sets students up for success, giving them an advantage in today’s world. Let’s empower students and build economic equality, one step at a time.”

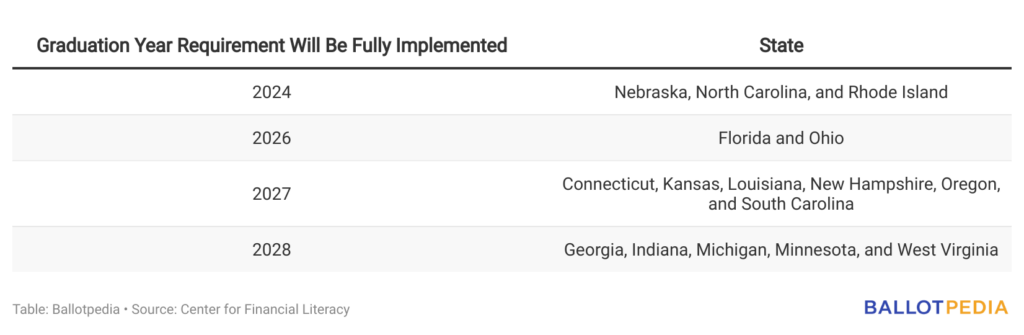

Currently, seven states—Alabama, Iowa, Mississippi, Missouri, Tennessee, Utah, and Virginia—require students to take a personal finance course to graduate. The Center for Financial Literacy at Champlain College released a report in December 2023 analyzing state requirements for personal finance classes to graduate high school. The report states that another 16 states (listed below) will require a personal finance course by 2028.

This is the seventh initiative to qualify for the ballot, including one veto referendum. The initiatives relate to pandemic prevention, the state’s minimum wage, remediation for labor violations, vote requirements for new taxes, local rent control, and oil and gas well regulations.

California voters will also be deciding on four legislatively referred constitutional amendments related to:

- repealing the local voter requirement for publicly-funded housing projects classified as low rent;

- establishing a right to marry and repealing Proposition 8 (2008);

- requiring initiatives that change vote thresholds to supermajority votes to pass by the same vote requirement as is being proposed; and

- lowering the vote threshold from 66.67% to 55% for local special taxes to fund housing projects and public infrastructure.

Between 2010 and 2022, the average number of initiatives to qualify for the ballot in California was nine. There are three petitions currently pending signature verification. The signature verification deadline is June 27 (131 days before the general election).