On May 13, Governor Phil Murphy (D) conditionally vetoed S1500, legislation that would require 501(c)(4)s, super PACs, and other entities to disclose their donors who contribute $10,000 or more.

In his veto statement, Murphy said, “I commend my colleagues in the Legislature for seeking to ensure that so-called ‘dark money’ is brought out into the open. However, I am mindful that such efforts must be carefully balanced against constitutionally protected speech and association rights. Because certain provisions of Senate Bill No. 1500 (Fifth Reprint) may infringe on both, and because the bill does not go far enough in mandating disclosures of political activity that can be constitutionally required, I cannot support it in its current form.”

- What comes next? With his conditional veto, Murphy delineated his objections to the bill and proposed amendments to address them. This differs from an absolute veto (i.e., an outright gubernatorial rejection of a proposed law). Should the legislature adopt an amended version of the bill, it will return to Murphy’s desk for his consideration.

The legislature can also, by a two-thirds majority vote in each chamber, override Murphy’s veto and enact the bill. The Senate

approved the bill 33-to-0, with seven members not voting. The Assembly approved the bill 60-to-1, with two members not voting and 17 abstaining. Democrats control both chambers of the state legislature, with a 26-to-14 majority in the Senate and a 54-to-26 majority in the Assembly. - The bill’s sponsors, Sen. Troy Singleton (D) and Asm. Andrew Zwicker (D), said: “The governor says that this bill ‘falls short’ of the goal to bring greater transparency to our political process. That is a gross misrepresentation of months and, frankly, years of hard work. The only thing that fell short today was the governor’s will to truly address the behemoth of dark money that has eroded the public’s trust in our government.”

- What does the legislation propose?

- As adopted, S1500 would define an independent expenditure committee as any person or group of persons organized under sections 501(c)(4) or 527 of the Internal Revenue Code spending $3,000 or more annually to influence or provide political information about any of the following:

- “the outcome of any election or the nomination, election, or defeat of any person to any state or local elective public office”

- “the passage or defeat of any public question, legislation, or regulation”

- Under S1500, independent expenditure committees would be required to disclose all expenditures exceeding $3,000. These committees would also be required to disclose the identities of donors contributing $10,000 or more.

What we’re reading

- Tulsa World, “Does Citizens United apply to Cherokee elections? Candidates for chief weigh in on this and other issues at televised forum,” May 17, 2019

- RealClearPolicy, “Selling Dark Money as Grassroots Transparency,” May 16, 2019

- Nonprofit Quarterly, “501c4 Nonprofits’ Image Problem Is a Problem for All of Us,” May 15, 2019

The big picture

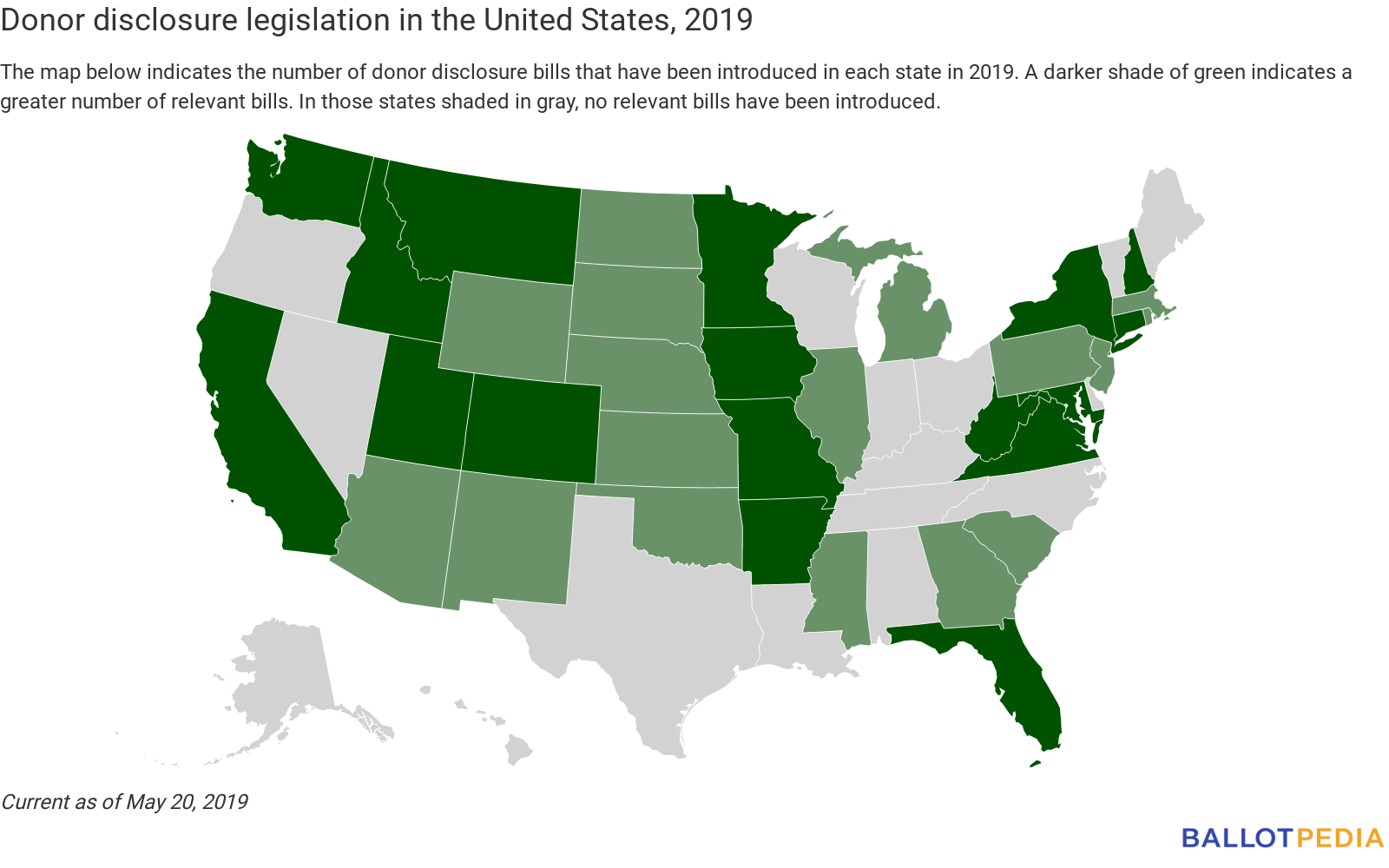

Number of relevant bills by state: We’re currently tracking 72 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here for a complete list of all the bills we’re tracking.

Number of relevant bills by current legislative status:

Number of relevant bills by partisan status of sponsor(s):

Recent legislative actions

Below is a complete list of legislative actions taken on relevant bills in the past week. Bills are listed in alphabetical order, first by state then by bill number. Know of any legislation we’re missing? Please email us so we can include it on our tracking list.

- Massachusetts H686: This bill would require groups producing electioneering communications to disclose to the public certain information about donations coming from foreign sources.

- Joint Committee on Election Laws hearing May 15.

- Missouri HB394: This bill would require any entity not a defined as a committee under the state’s campaign finance laws that spends $500 or more to support or oppose candidates or ballot measures to file quarterly donor reports. Included in those reports would be the names and addresses of donors who gave more than $50 to the entity in that quarter.

- Referred to House General Laws Committee May 17.

- Missouri HB513: This bill would require any committees that receive contributions or make expenditures for inaugural activities to file disclosure reports with the Missouri Ethics Commission.

- Referred to House General Laws Committee May 17.

- Missouri HB886: This bill would lower the disclosure threshold for contributors to ballot measure campaigns from $500 in aggregate to $25 or more in aggregate during an election cycle.

- Referred to House Elections and Elected Officials Committee May 17.

- New Hampshire SB105: This bill would establish disclosure requirements for certain contributions made to inaugural committees.

- House Election Law Committee executive session May 16.

- New Hampshire SB156: This bill would require that political contributions made by limited liability companies be allocated to individual members in order to determine whether individuals have exceeded contribution limits.

- House Election Law Committee executive session May 16.

- New Jersey S1500: This bill would require disclosure of donors to 501(c)(4)s, super PACs, and other similar entities who give $10,000 or more.

- Conditionally vetoed May 13.