Welcome to the Wednesday, Jan. 14, 2025, Brew.

By: Lara Bonatesta

Here’s what’s in store for you as you start your day:

- OpenAI and Common Sense Media announce joint California ballot initiative to regulate minors' use of AI chatbots

- Record number of candidates and contested primaries in the 2026 Texas state legislative elections

- House passes three-year extension of expanded ACA subsidies

OpenAI and Common Sense Media announce joint California ballot initiative to regulate minors' use of AI chatbots

On Jan. 9, OpenAI, the developer of ChatGPT, and Common Sense Media, a nonprofit that focuses on kids’ digital safety, announced that they had filed a joint ballot initiative in California to regulate minors’ use of artificial intelligence (AI) chatbots. As we covered back in December, the two groups had previously filed separate, competing ballot initiatives.

The campaign has titled the initiative the “Parents & Kids Safe AI Act.” The initiative would adopt a new state law governing AI companion chatbots that would:

- Require AI chatbot developers to restrict content when minors use them

- Prohibit the sale of a minor's data without parental consent

- Require independent audits of chatbot technology for safety risks to minors, and require those audits to be reported to the state attorney general

- Prohibit the promotion of isolation from family or friends or romantic relationships by AI chatbots to minors

Common Sense Media Founder and CEO James P. Steyer said, “Rather than confuse voters with competing measures, we're working together to enact strong protections for kids, teens, and families.”

Common Sense Media filed its original initiative on Oct. 22. It included provisions similar to those in the recently proposed measure. It would have:

- Prohibited minors from using certain AI-powered chatbots

- Prohibited smartphone use during the school day

- Established statutory damages for actual harm caused by AI chatbots or social media

- Prohibited the selling or sharing of data from minors without their consent if they were between 13 and 18 years old or without a parent or guardian's consent if they are younger than 13

OpenAI filed its initial initiative on Dec. 5. The initiative would have:

- Required developers of chatbots to disclose to users under the age of 18 that the chatbot is AI

- Required developers to have a protocol to prevent AI chatbots from promoting suicidal ideation, suicide, or self-harm content to the user

- Required developers to report to the Office of Suicide Prevention on suicide prevention protocols

Three other initiatives were filed in California that also propose various regulations on artificial intelligence and its developers. These include the:

- Oversight of Nonprofit Scientific and Technological Research Organizations Initiative

- Establish AI Safety Commission Initiative

- Establish Public Benefit AI Accountability Commission Initiative

Click here to see our coverage of these three initiatives and what they would do in our Dec. 23 edition of the Daily Brew.

All of the AI initiatives are statutes that require 546,651 signatures (5% of the votes cast in the last gubernatorial election). The deadline for signature verification is June 25. However, the secretary of state recommends a signature deadline of Jan. 12, for initiatives requiring a full check of signatures, and April 17 for initiatives requiring a random sample of signatures to be verified.

Since 1985, an average of between 19 and 20 ballot measures have appeared on even-year ballots in California. Since 2010, the average number of initiatives certified per election cycle is nine.

Click here to read more about California’s 2026 ballot measures.

Record number of candidates and contested primaries in the 2026 Texas state legislative elections

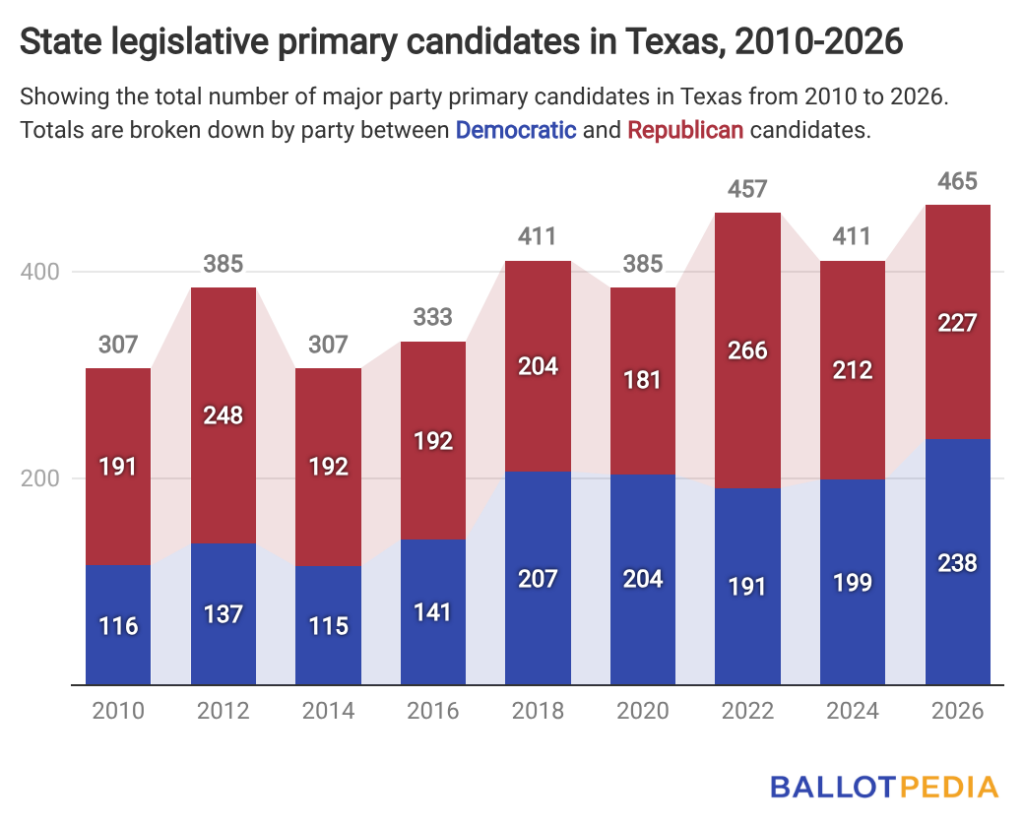

Texas has 465 major party candidates running for the Legislature on March 3, the most in any election dating back to 2010. There are 238 Democrats running, up 20% from the 199 Democratic candidates who ran in 2024. There are 227 Republicans running, up 7% from 212 in 2024.

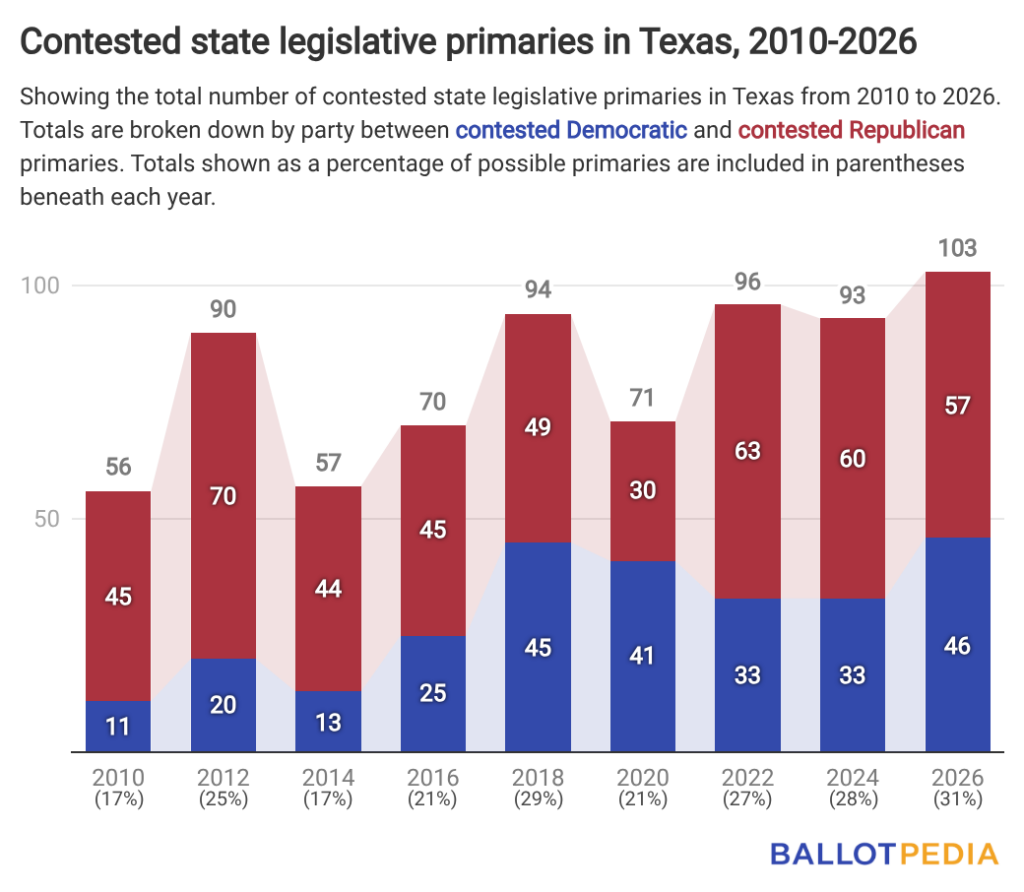

Texas has 103 contested state legislative primaries this year, an 11% increase from 2024 and the most since 2010. There are 46 Democratic primaries, a 39% increase from 33 in 2024 and a record high for the party. Republicans have 57 contested primaries, down 5% from 60 contested primaries in 2024.

Forty-four incumbents have primary challenges, representing 31% of all incumbents running for re-election. An average of 29% of incumbents faced contested primaries between 2010 and 2024.

Sixteen of the 31 total Senate seats and all 150 House seats are up for election. Twenty-six seats are open, meaning no incumbents are running. This means newcomers will make up at least 14% of the Legislature next year. An average of 18 seats were open from 2010 to 2024.

Texas has had a Republican trifecta since they assumed control of the House in 2003. Republicans have an 88-62 majority in the House and an 18-11 majority in the Senate, with two vacancies.

Click here to learn more about Texas’ 2026 House elections and here to learn more about the state Senate elections.

House passes three-year extension of expanded ACA subsidies

On Jan. 8, the U.S. House voted to approve a three-year extension of Affordable Care Act (ACA) subsidies, also known as premium tax credits. Seventeen Republicans joined Democrats to pass the measure 230–196. The legislation would revive the expanded premium tax credit (ePTC), which expired on Dec. 31.

The extension of the tax credits was a major point of contention during the 2025 government shutdown, which lasted from October into November and became the longest on record.

Premium tax credits are subsidies that help eligible individuals and families pay for health insurance purchased through federal or state marketplaces established under the Affordable Care Act. Congress created the credits in 2010, and they first became available in the 2014 tax year to households with incomes between 100% and 400% of the federal poverty level (FPL).

In 2021, Congress enacted the American Rescue Plan Act (ARPA), which temporarily expanded the credits. The expansion—known as the expanded or enhanced premium tax credit (ePTC)—removed the upper income limit for eligibility and lowered the share of income households were required to pay toward premiums. The Inflation Reduction Act later extended these expanded provisions through the end of 2025.

The ePTC expired on Dec. 31, returning eligibility and premium contribution rules to their original ACA structure. As of 2025, approximately 22.4 million people received the advanced premium tax credit.

The House-passed bill would extend the ePTC for three additional years. The U.S. Senate has discussed alternative proposals that would include a shorter extension combined with changes such as income caps, minimum premium contributions, and additional program integrity measures.

In addition to the ARPA and Inflation Reduction Act extensions, the One Big Beautiful Bill Act made several administrative and enforcement changes to the program, including eliminating caps on repayment of excess advanced credits and tightening eligibility verification requirements. That law did not alter eligibility thresholds or premium contribution caps under the expanded credit.

To learn more about the history and implementation of ACA subsidies, visit here.