On May 6, 2019, New Jersey Attorney General Letitia James (D) and New York Attorney General Gurbir Grewal (D) sued the U.S. Department of the Treasury and the Internal Revenue Service (IRS). They are seeking information as to how the agency arrived at its decision to stop requiring donor information from select nonprofit groups. (Sources: Associated Press, Nonprofit Quarterly)

- What is at issue? On July 16, 2018, the IRS issued Revenue Procedure 2018-38, which exempts 501(c) nonprofit entities from reporting the names and addresses of their contributors to the IRS. The rule modification does not apply to 501(c)(3) organizations.

- In a separate suit filed on April 17, 2019, Montana Governor Steve Bullock (D), the Montana Department of Revenue, and the state of New Jersey asked a federal judge to overturn the rule. The case name and number are Bullock v. Internal Revenue Service, 4:18-cv-00103.

- Who are the parties to the suit, and what are they saying?

- The plaintiffs are James and Grewal. In a press release, James said, “Not only was this policy change made without notice, the Treasury and the IRS are now refusing to comply with the law to release information about the rationale for these changes. No one is above the law – not even the federal government – and we will use every tool to ensure they comply with these regulations to provide transparency and accountability.”

- The defendants are the U.S. Department of the Treasury and the Internal Revenue Service. Neither agency had commented publicly on the suit at the time of its filing. Upon adoption of the rule change, Secretary of the Treasury Steven Mnuchin said, ” Americans shouldn’t be required to send the IRS information that it doesn’t need to effectively enforce our tax laws, and the IRS simply does not need tax returns with donor names and addresses to do its job in this area. It is important to emphasize that this change will in no way limit transparency. The same information about tax-exempt organizations that was previously available to the public will continue to be available, while private taxpayer information will be better protected.”

- The suit was filed in the U.S. District Court for the Southern District of New York. The case name and number are State of New York et al. v. U.S. Department of the Treasury et al., 1:19-cv-04024.

What we’re reading

- The Colorado Independent, “Capitol Review: Lawmakers expanded voter access, took aim at dark money,” May 10, 2019

- Politico, “Sources: Murphy to conditionally veto ‘dark money’ bill, potentially dooming it,” May 9, 2019

- Real Clear Politics, “Dems’ Campaign Finance Bill Could Be a Privacy Nightmare,” May 9, 2019

The big picture

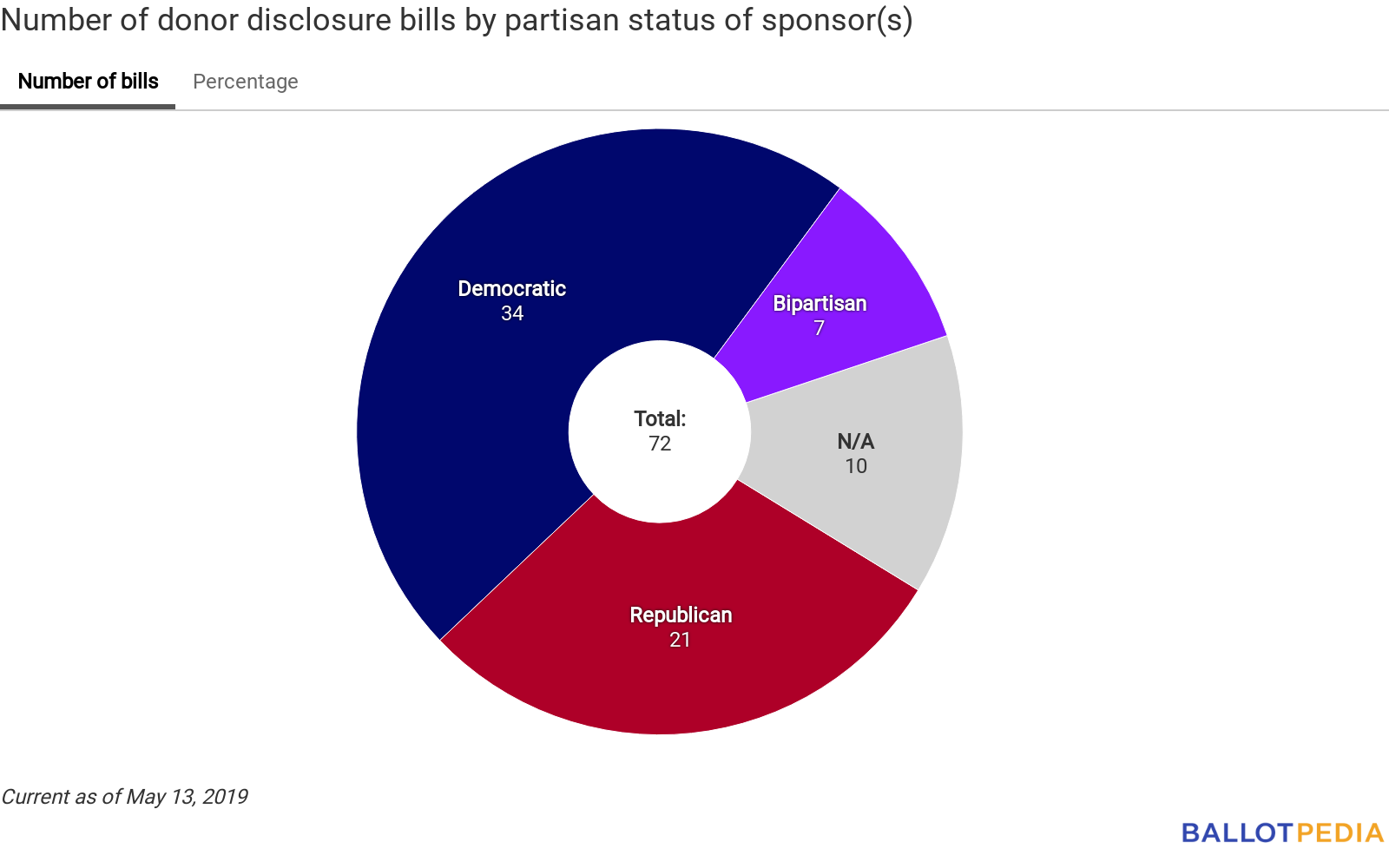

Number of relevant bills by state: We’re currently tracking 72 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here for a complete list of all the bills we’re tracking.

Number of relevant bills by current legislative status:

Number of relevant bills by partisan status of sponsor(s):

Recent legislative actions

Below is a complete list of legislative actions taken on relevant bills in the past week. Bills are listed in alphabetical order, first by state then by bill number. Know of any legislation we’re missing? Please email us so we can include it on our tracking list.

- Massachusetts H686: This bill would require groups producing electioneering communications to disclose certain information about donations coming from foreign sources.

- Joint Election Laws Committee hearing scheduled May 15.

- New Hampshire SB105: This bill would establish disclosure requirements for certain contributions made to inaugural committees.

- House Election Law Committee executive session May 16.

- New Hampshire SB156: This bill would require that political contributions made by limited liability companies be allocated to individual members in order to determine whether individuals have exceeded contribution limits.

- House Election Law Committee executive session May 16.