New Jersey legislators are considering overriding the governor’s conditional veto of S1500, a bill that would require 501(c)(4)s, super PACs, and other entities to disclose donors who contribute $10,000 or more. A meeting scheduled for May 30 between lawmakers and the governor to discuss the bill was postponed. (Source: NJ.com)

- What does the governor say? In his May 13 veto statement, Gov. Phil Murphy (D) said, “I commend my colleagues in the Legislature for seeking to ensure that so-called ‘dark money’ is brought out into the open. However, I am mindful that such efforts must be carefully balanced against constitutionally protected speech and association rights. Because certain provisions of Senate Bill No. 1500 (Fifth Reprint) may infringe on both, and because the bill does not go far enough in mandating disclosures of political activity that can be constitutionally required, I cannot support it in its current form.” With his conditional veto, Murphy stated his objections to the bill and proposed amendments to address them. This differs from an absolute veto, which is an outright gubernatorial rejection of a proposed law. Both are subject to the same override provisions.

- What are lawmakers saying?

- Assemblyman Andrew Zwicker (D), a primary sponsor of S1500, said, “We are actively discussing the possibility of a veto override. It is not my preference. But I do feel very strongly that this is a good government bill and we need to act now.”

- Senator Troy Singleton (D), another S1500 sponsor, said, “I think the atmosphere was challenged a little bit by some of the governor’s comments. [We] took offense to the idea that what we sent was somehow weaker than what was sent back by the governor’s office … we didn’t want to have the discussion steeped in emotion. We’re trying to take a step back to see if there’s a path forward.”

- How can the legislature override the veto? The legislature can, by a two-thirds majority vote in each chamber, override Murphy’s veto and enact the bill. This means 54 assembly members and 27 senators would have to vote in favor of an override. The Senate approved the bill 33-0, with seven members not voting. The Assembly approved the bill 60-1, with two members not voting and 17 abstaining. Democrats have a 26-14 majority in the Senate and a 54-26 majority in the Assembly. The Legislature’s last successful override of a gubernatorial veto was in 1997.

- What does the legislation propose?

- As adopted, S1500 would define an independent expenditure committee as any person or group of persons organized under sections 501(c)(4) or 527 of the Internal Revenue Code spending $3,000 or more annually to influence or provide political information about any of the following:

- “the outcome of any election or the nomination, election, or defeat of any person to any state or local elective public office”

- “the passage or defeat of any public question, legislation, or regulation”

- Under S1500, independent expenditure committees would be required to disclose all expenditures exceeding $3,000. These committees would also be required to disclose the identities of donors contributing $10,000 or more.

The big picture

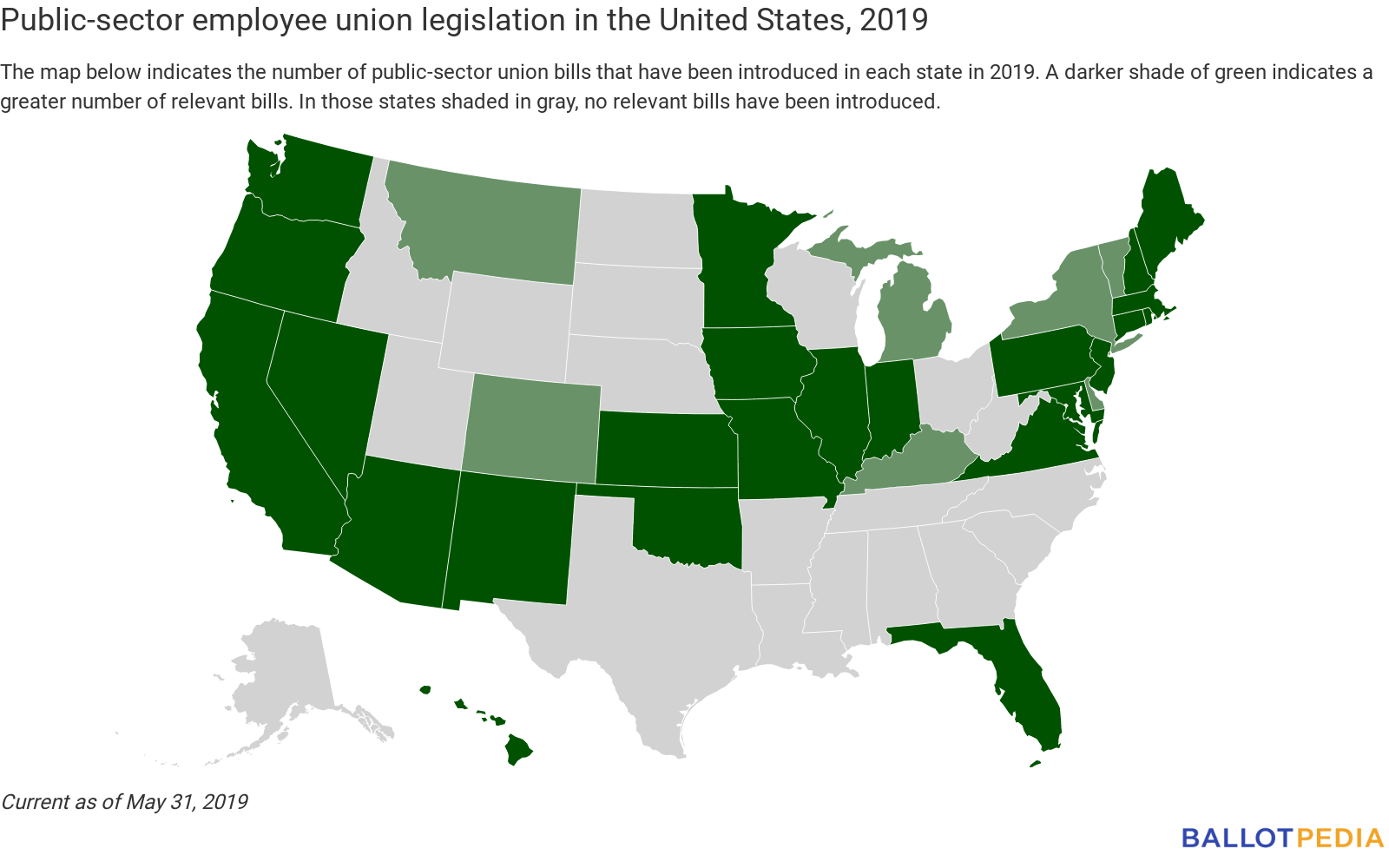

Number of relevant bills by state: We’re currently tracking 72 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here for a complete list of all the bills we’re tracking.

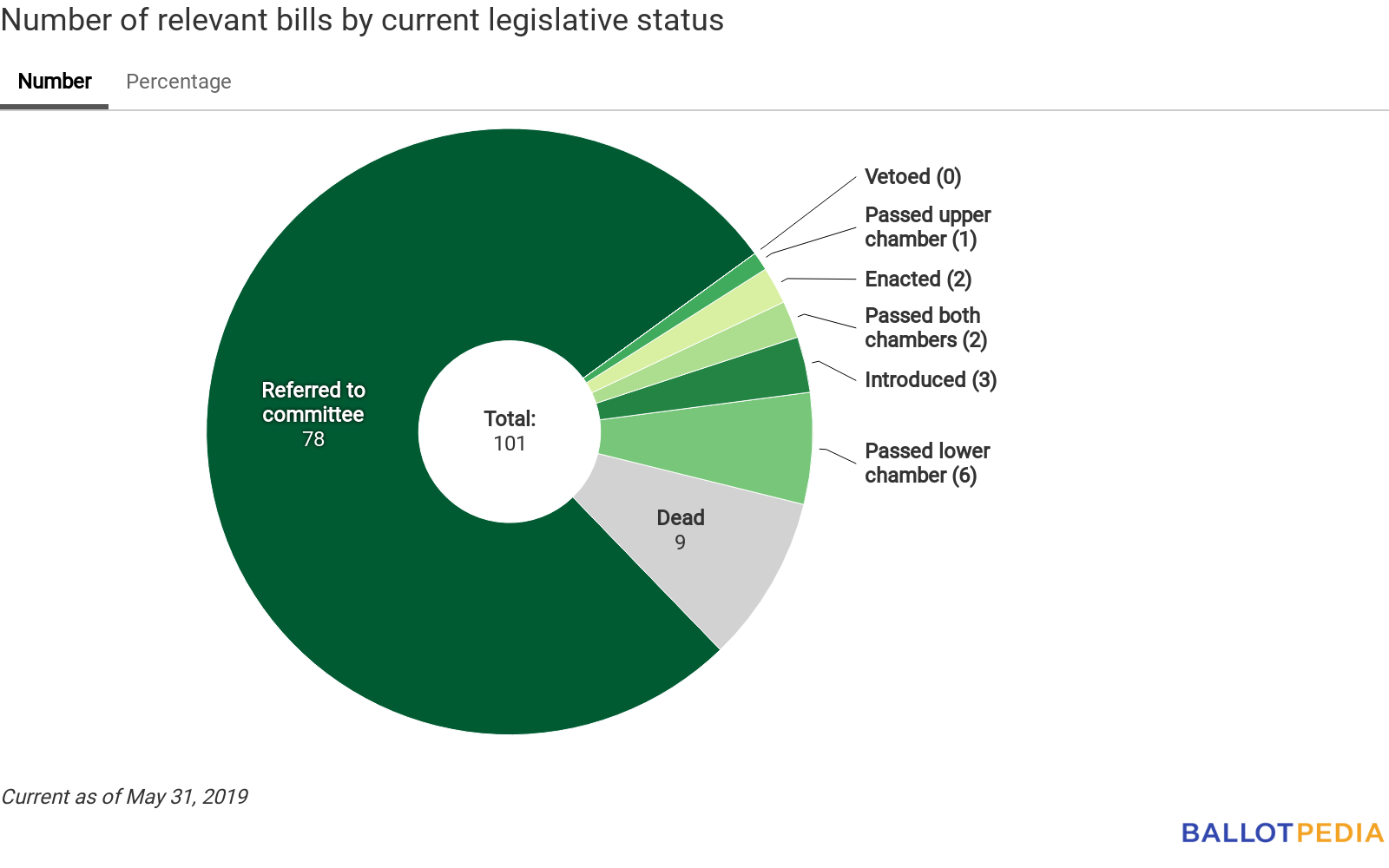

Number of relevant bills by current legislative status:

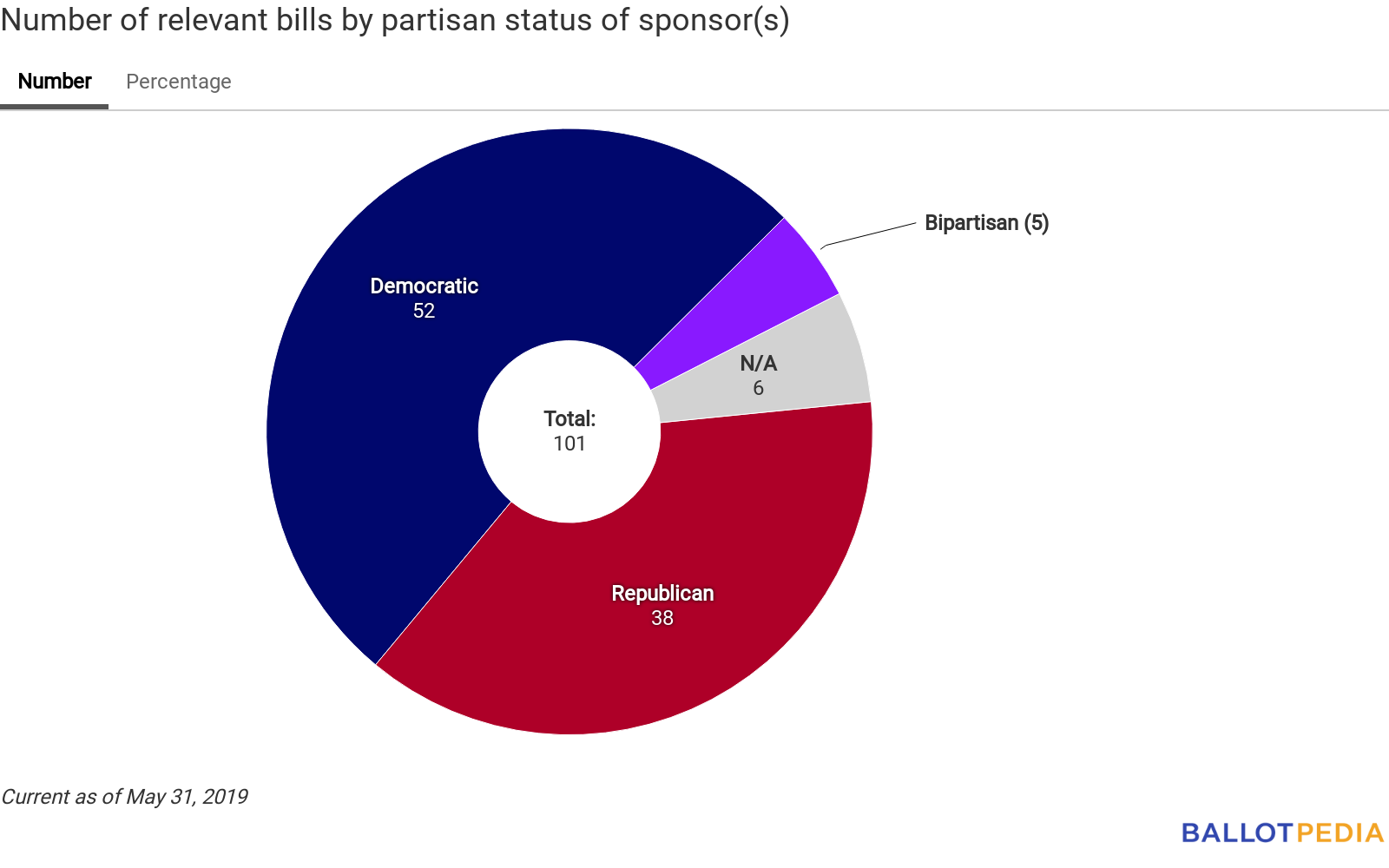

Number of relevant bills by partisan status of sponsor(s):

Recent legislative actions

Below is a complete list of legislative actions taken on relevant bills in the past two weeks. Bills are listed in alphabetical order, first by state then by bill number. Know of any legislation we’re missing? Please email us so we can include it on our tracking list.

- New Hampshire SB105: This bill would establish disclosure requirements for certain contributions made to inaugural committees.

- House Election Law Committee reported favorably May 21.

- New Hampshire SB156: This bill would require that political contributions made by limited liability companies be allocated to individual members in order to determine whether individuals have exceeded contribution limits.

- House Election Law Committee reported favorably May 21.