Nebraska Governor Pete Ricketts (R) donated $100,000 to Gambling with the Good Life, the campaign opposing Initiatives 429, 430, and 431. Together, the initiatives would authorize, regulate, and tax gambling at licensed horse racetracks. Gambling with the Good Life reported receiving over $139,000 in cash contributions. The other top two donors to the campaign were the Archdiocese of Omaha and Cornhusker Bank.

Explaining his opposition, Governor Pete Ricketts said, “There are all sorts of social problems that come along with expanding gambling, which is why Nebraskans have historically rejected expanding gambling here in the state. I certainly support rejecting expanded gambling and would encourage other Nebraskans to support rejecting it as well.”

Initiatives 429, 430, and 431 are sponsored by Keep the Money in Nebraska, which reported receiving a total of $3.4 million in contributions from Ho-Chunk, Inc., a developer owned by the Winnebago Tribe of Nebraska.

Initiative 429 would amend the Nebraska Constitution to allow the enactment of Initiative 430, which would authorize and regulate gambling at licensed horse racetracks, and Initiative 431, which would impose an annual tax of 20% on gross gambling revenue. Without the approval of Initiative 429, Initiatives 430 and 431 would not take effect.

Mike Newlin, general manager of Horsemen’s Park and Lincoln Race Course, said, “[If this measure passes], we’d finally be able to reap the rewards that we’ve been giving our neighbor states in entertainment and gambling dollars. The overall impact is not only the tax revenue but the jobs that would be created. The ancillary work that would come with casino gambling, increased horse racing, and things like that will have a huge economic effect.”

Initiative 431 would impose an annual tax of 20% on gross gambling revenue of licensed gaming operators. The tax revenue would be distributed as follows:

- 70% to the Property Tax Credit Cash Fund

- 25% to the counties where gambling is authorized at licensed racetracks,

- 2.5% of tax revenue to the Compulsive Gamblers Assistance Fund, and

- 2.5% to the General Fund.

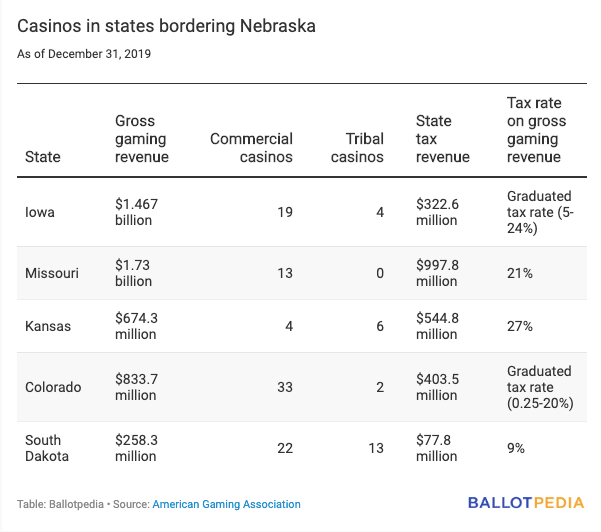

In 2019, Missouri had the highest gross gaming revenue ($1.73 billion) and taxes generated ($997.8 million) among the states bordering Nebraska. The average amount of taxes generated among the five states bordering Nebraska with commercial gaming was $469.3 million. South Dakota had the lowest flat tax rate with 9% on gross gaming revenue, and Kansas had the highest with 27%.

In 2020, three states will be voting on four measures related to gambling.

- Colorado Amendment 77 would allow voters in Central, Black Hawk, and Cripple Creek Cities — the only towns where gaming is legal in Colorado — to (1) approve a maximum single bet limit of any amount and (2) expand allowable game types in addition to slot machines, blackjack, poker, roulette, and craps.

- Colorado Amendment C would amend the state constitution to lower the number of years an organization must have existed before obtaining a charitable gaming license from five years to three years and to allow charitable organizations to hire managers and operators of gaming activities so long as they are not paid more than the minimum wage.

- Maryland Question 2 would authorize sports and events wagering at certain licensed facilities with state revenue intended to fund public education.

- South Dakota Constitutional Amendment B would amend the state constitution to authorize the South Dakota State Legislature to legalize sports betting within the city limits of Deadwood, South Dakota, with all net municipal proceeds (defined) dedicated to the Deadwood Historic Restoration and Preservation Fund.

Additional reading: