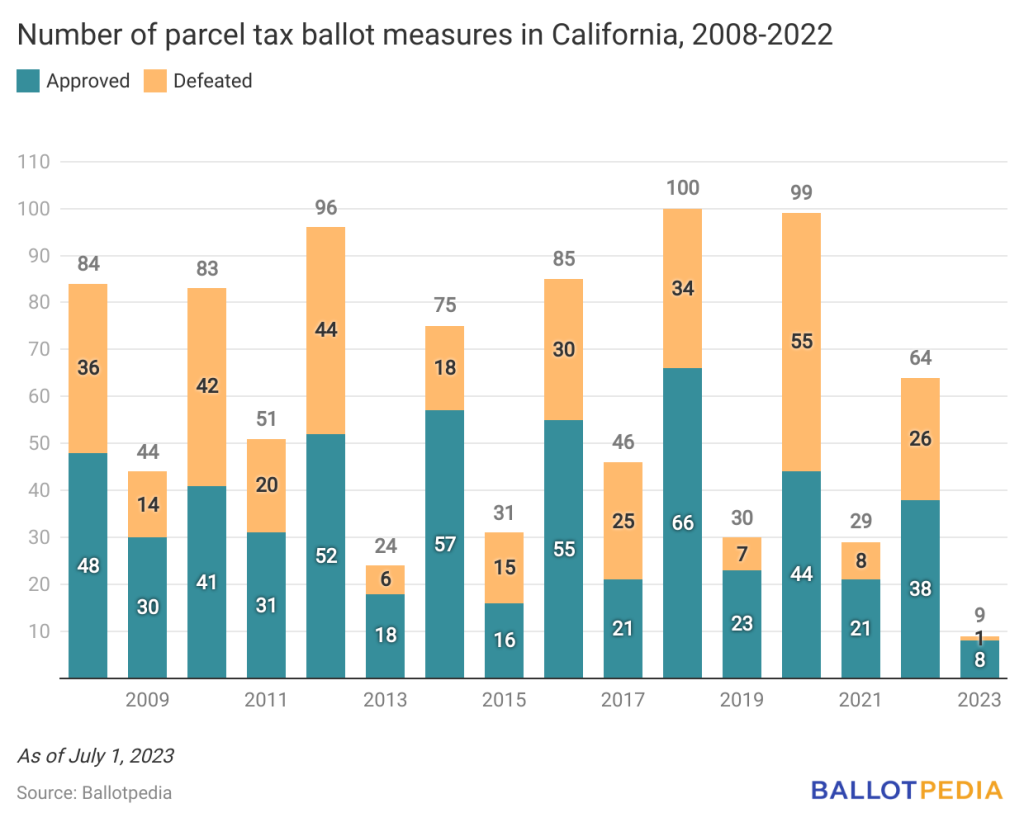

Californians have decided on 950 local parcel tax ballot measures from 2008 to 2022. Voters in Kirkwood Meadows Public Utility District, a 1.875-square-mile special district in the Sierra Nevada, will decide the next parcel tax measure on July 11, 2023. Between 2008 and 2022, 569 (59.89%) parcel tax ballot measures were approved and 381 (40.11%) were defeated.

From 2008 to 2022, the average number of parcel tax ballot measures in a given year was 68. During an odd-numbered year, like 2023, an average of 36 parcel tax measures were on the ballot in California. As of July 1, there have been nine parcel tax measures in 2023, and eight (89%) of those measures were approved and one (11%) was defeated.

In Kirkwood Meadows Public Utility District, the parcel tax ballot measure is called Measure E, and this measure would enact a tax on non-exempt residential and commercial parcels based on the number of parking spaces assigned to each parcel. The tax would be no more than $513 per parking space and would provide funding for the Kirkwood Volunteer Fire Department’s fire suppression and prevention services. Owners of the parcels would pay the tax. A two-thirds vote is required to approve Measure E.

While there are often several measures to tax parking lot parcels during an election cycle, a parcel tax based on the number of parking spots is uncommon.

Official arguments were published by the jurisdiction. The supporting argument said, “As a community, it is essential that we prioritize the safety and well-being of our residents. A fully funded fire department is critical to that effort. … Together, we can ensure that our community remains safe and secure, and that the Kirkwood Volunteer Fire Department has the resources they need to continue their vital work.” The opposing argument read, “Measure E establishes an unreasonable and disproportional tax on select lots based on a rather arbitrary allocation of parking spaces (even if your home has no designated parking) to fund a new fire department. The proposed methodology is unreasonable and illogical – parking does not drive the demand for emergency services.”

In California, a parcel tax is a specific type of tax imposed on individual parcels of land. It is a local tax enacted by cities, counties, school districts, or other local government entities to generate additional revenue for specific purposes, such as funding public schools, libraries, parks, fire stations, or other local services.

Parcel taxes differ from property taxes, which are determined based on property assessments. Instead, parcel taxes are fees imposed on each parcel of land, regardless of its assessed value.

Parcel taxes usually require voter approval through a local ballot measure, often requiring a two-thirds majority vote for passage. The revenue generated from parcel taxes is typically earmarked for specific purposes.

Ballotpedia provides comprehensive coverage of local ballot measures in California, as well as the top 100 largest cities in the U.S., state capitals, and local ballot measures related to policing and ranked-choice voting.

Related reading: