The California Supreme Court ruled on June 20 that the Taxpayer Protection Act (TPA), as supporters call it, cannot appear on the Nov. 5 ballot because its proposed changes to vote thresholds for new taxes amount to a revision of the state constitution, which cannot be enacted via a citizen initiative. Under the state constitution, a revision to the constitution can only occur through a constitutional convention ratified by popular vote or by submission to the voters from a supermajority of the state legislature.

Gov. Gavin Newsom (D) and several Democratic state legislators filed a lawsuit against the initiative. They argued that the initiative is not a constitutional amendment but a revision and that it violates the state’s single-subject rule.

The defendants for the initiative argued that the initiative is similar to other tax-related measures that voters approved—Proposition 13 (1978), Proposition 218 (1996), and Proposition 26 (2010). The defendants argued, “Petitioners do not explain, nor can they explain, how [the] TPA’s voter approval requirement is more damaging to their legislative power than any of the prior constitutional amendments and initiative statutes repealing a tax or fixing the rate and manner of assessing a tax.”

The court disagreed with the defendants, ruling that the TPA would go beyond Proposition 13 and the others to transform how the legislature and local governments levy taxes and fees. The court said, “The Legislature’s duty to ensure the welfare of our state and its people includes responsibility for fiscal planning, both short-term and long-term, that the Legislature historically has had authority to exercise without voter approval.”

Responding to the removal of the TPA, Rob Lapsley, president of the California Business Roundtable; Jon Coupal, president of the Howard Jarvis Taxpayers Association; and Matthew Hargrove, president and CEO of the California Business Properties Association said, "Direct democracy and our initiative process are now at risk with this decision, showing California is firmly a one-party state where the governor and Legislature can politically influence courts to block ballot measures that threaten their ability to increase spending and raise taxes."

A spokesperson for Gov. Gavin Newsom (D) said, “The governor believes the initiative process is a sacred part of our democracy, but as the court’s decision affirmed today, that process does not allow for an illegal constitutional revision.”

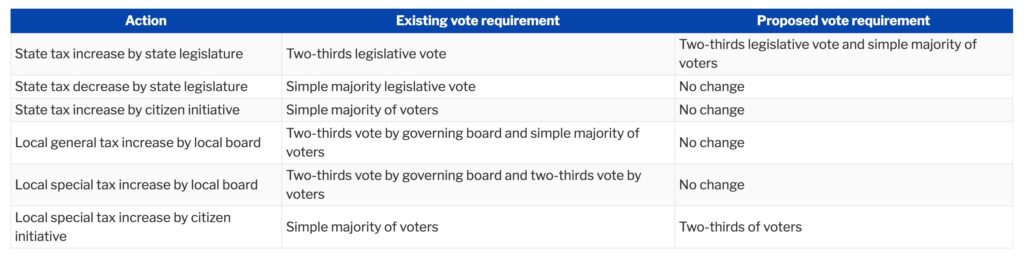

The state constitution and case law govern the vote requirements needed to increase or decrease state and local taxes. The table below describes the existing and proposed vote requirements for state and local tax changes.

Californians for Taxpayer Protection and Government Accountability, the campaign behind the initiative, reported over $17.8 million in contributions through March 31. The campaign collected over 1.4 million signatures, of which 1 million were determined to be valid during the signature verification process.

The removal of the initiative lowers the total number of ballot measures on California ballots this fall to 13. Nine citizen initiatives have qualified for the ballot, including one veto referendum. The initiatives relate to changes to drug and theft penalties, requiring a personal finance course in high school, pandemic prevention, the state's minimum wage, remediation for labor violations, local rent control, Medi-Cal RX program regulations, a tax on managed care organizations, and oil and gas well regulations.

The state legislature voted to send an additional four constitutional amendments to statewide ballots in November:

- an amendment to repeal the local voter requirement for publicly funded housing projects classified as low rent;

- an amendment to establish a right to marry and repeal Proposition 8 (2008);

- an amendment to require initiatives that change vote thresholds to supermajority votes to pass by the same vote requirement as is being proposed; and

- an amendment to lower the vote threshold from 66.67% to 55% for local special taxes to fund housing projects and public infrastructure.