New applications for U.S. unemployment insurance benefits rose 2,000 for the week ending Sept. 7 to a seasonally adjusted 230,000. The four-week moving average as of Sept. 7 increased by 500 from the previous week’s revised average to 230,750.

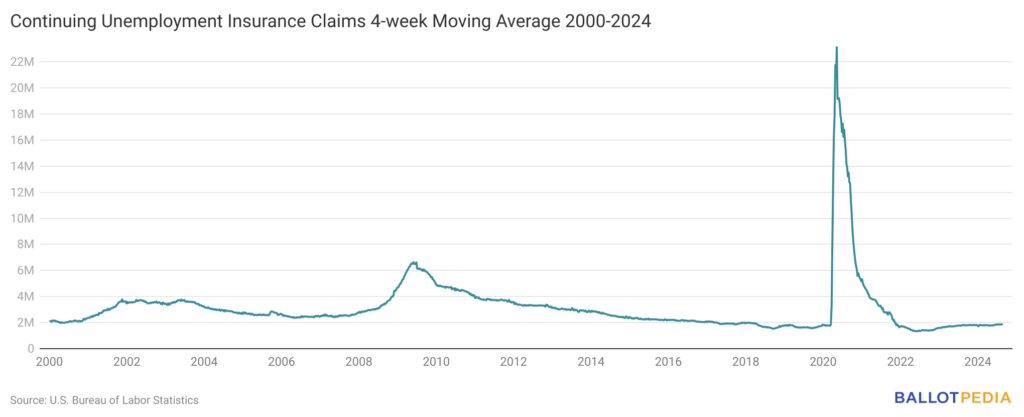

The number of continuing unemployment insurance claims, which refers to the number of unemployed workers who are actively receiving unemployment benefits from claims filed at least two weeks before, increased by 5,000 from the previous week’s revised number to a seasonally adjusted 1.85 million for the week ending Aug. 31. The 4-week moving average was 1,852,500, a decrease of 2,250 from the previous week’s revised average.

Weekly unemployment claims reached an 11-month high of 250,000 in late July before declining to 228,000 on Aug. 10. Since Aug. 10, weekly claims have remained steady.

The 4-week moving average of continuing unemployment claims reached its lowest point since 1970 in June 2022 at 1,350,000, and the federal unemployment rate remained below 4% from February 2022 until May 2024. Since June 2022, the 4-week moving average of continuing unemployment claims increased to September’s 1.85 million without any significant spikes or drops. The federal unemployment rate reached a nearly 3-year high of 4.3% in July 2024 before a slight decrease to 4.2% in August.

The Federal Reserve will meet on September 18 and, according to the CME FedWatch tool, is likely to reduce interest rates by either 0.25 or 0.5 percentage points. In his August 23 speech, Federal Reserve Chair Jerome Powell said, “The upside risks to inflation have diminished. And the downside risks to employment have increased. As we highlighted in our last FOMC statement, we are attentive to the risks to both sides of our dual mandate. The time has come for policy to adjust. […] We will do everything we can to support a strong labor market as we make further progress toward price stability.”

Unemployment insurance is a joint federal and state program that provides temporary monetary benefits to eligible laid-off workers who are actively seeking new employment. Qualifying individuals receive unemployment compensation as a percentage of their lost wages in the form of weekly cash benefits while they search for new employment.

Weekly unemployment claims data serves as an indicator of the overall health of the economy, providing timely insights into labor market conditions. The data’s significance lies in its ability to reflect sudden changes in employment trends, often signaling the onset of economic downturns or recoveries before they become apparent in other less frequently released data. A sustained increase in weekly jobless claims may suggest weakening economic conditions and potential contractions, while consistent declines typically indicate a strengthening job market and economic expansion.

The federal government oversees the general administration of state unemployment insurance programs. The states control the specific features of their unemployment insurance programs, such as eligibility requirements and length of benefits.

For information about unemployment insurance programs across the country, click here.