Voters in Louisiana will decide on 56 local ballot measures in 27 of the state’s 64 parishes, along with four state constitutional amendments, on March 29, 2025. The local ballot measures cover a range of jurisdictions, including parishes, cities, school districts, and special districts, such as the Tangipahoa Parish Mosquito Abatement District (MAD).

The ballot measure would renew the MAD's 4.98-mill tax on properties, which amounts to $498 per $100,000 of assessed value, for 10 years.

In Louisiana, a MAD is a political subdivision whose boundaries align with those of a parish, such as Tangipahoa Parish. The district's purpose is to abate, control, eradicate, and study "mosquitoes and other arthropods of public health importance." MADs have five-member appointed boards unless otherwise authorized to have more members. To fund their operations, including administrative staff, machinery, and equipment, MADs can levy taxes, either as ad valorem millages or flat-rate assessments, with voter approval. In this context, an ad valorem tax is based on the assessed value of a property, while a flat rate tax is a fixed amount applied uniformly to each parcel of land or a defined class of property.

In 1958, voters passed a constitutional amendment authorizing parishes to create MADs. State Rep. Alvin Dyson (D) introduced the amendment into the Louisiana State Legislature as House Bill 497 in 1958. In the state Senate, the amendment was approved 32-1, with six members absent. In the state House, the amendment was approved 78-1, with 21 members absent and one vacant seat. The Daily Advertiser reported, “Proponents contend this measure will provide the legal framework necessary to place a full scale mosquito abatement program into effect." John R. Thistlethwaite, editor of the Daily World, said, "This would create another government setup, to be financed by taxes – with taxpayer approval – and we aren't convinced of the necessity." On Nov. 4, 53.2% of electors voted to approve the amendment.

Voters were asked to repeal the constitutional amendment on Feb. 1, 1972. Based on a recommendation from a Constitutional Revision Commission, the legislature referred Amendment 5 to the ballot, which sought to repeal the constitutional provision authorizing MADs, contingent on the approval of Amendment 2. Amendment 2 was designed to authorize the state legislature to provide for special districts through statutes rather than constitutional amendments. However, voters rejected both Amendment 2 and Amendment 5.

MADs were removed from the constitution two years later, in 1974, when voters approved a new state constitution. The revised constitution incorporated changes similar to those proposed in 1972's Amendments 2 and 5. With the Louisiana Constitution of 1974, Article VI, Section 19 empowered the legislature to provide for special districts in statute. MADs are now codified as Chapter 23 of Louisiana Revised Statutes Title 33 (Municipalities and Parishes).

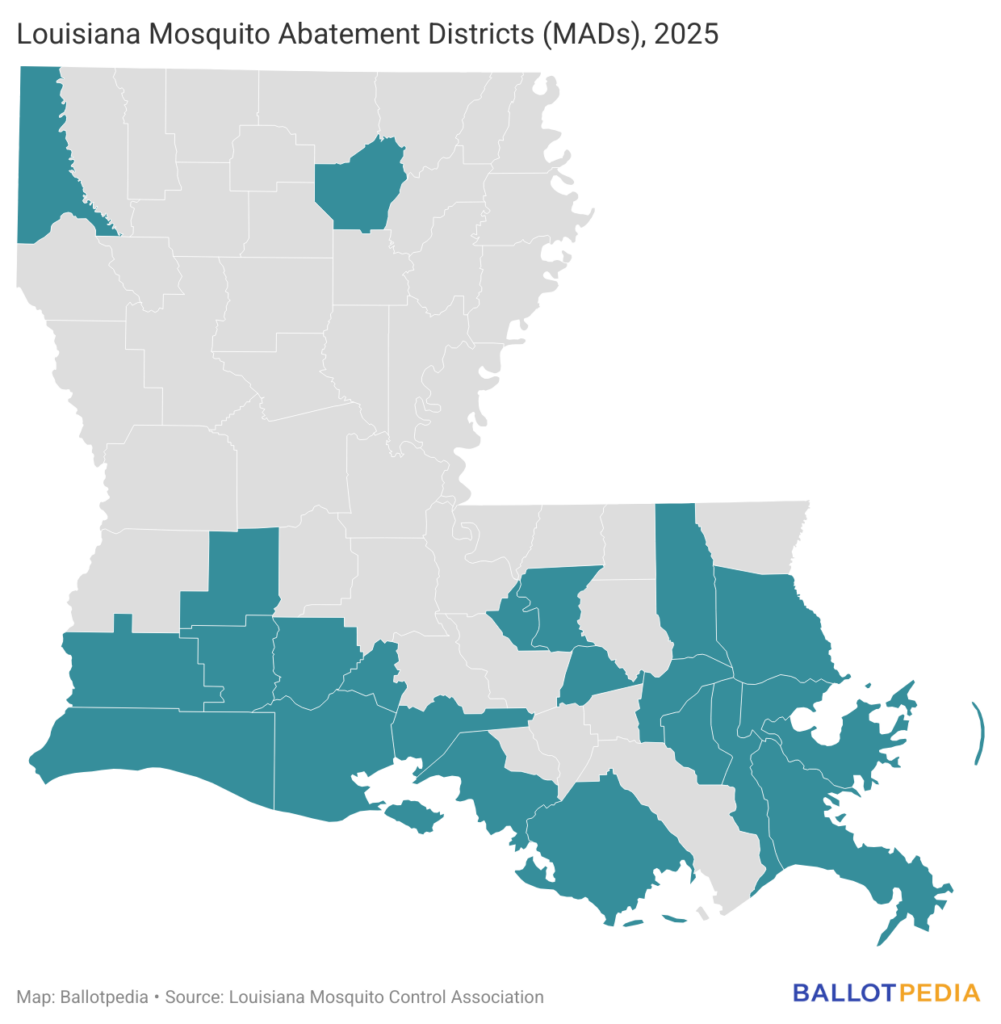

As of 2025, there are 24 parish-wide MADs in Louisiana.

Additional reading: