What’s the story?

Following the close of the 60-day legislative disapproval period under the Congressional Review Act (CRA) on May 12, 2025, President Donald Trump (R) signed resolutions nullifying a total of 11 rules from 7 agencies during his second term. Of those 11, a total of two resolutions of disapproval nullified rules administered by the Consumer Financial Protection Bureau.

The CRA resolutions nullified regulations from the following other agencies:

- Internal Revenue Service, one rule.

- Bureau of Ocean Energy Management, one rule.

- Environmental Protection Agency, two rules.

- National Park Service, one rule.

- Department of Energy, four rules.

On May 9, 2025, Trump signed S.J. Res. 18, overturning a final 2024 rule regulating fees on overdraft services offered by very large financial institutions. The rule defined very large financial institutions as those with assets over $10 billion. On the same day, he signed S.J. Res. 28, nullifying a final 2024 rule that gave the CFPB regulatory authority over larger vendors in the general-use digital consumer payment application market. Larger vendors were defined as nonbank providers of digital consumer payment applications that processed 50 million transactions or more annually.

President Trump removed CFPB Director Rohit Chopra on February 1, 2025, and appointed Russell Vought as acting director of the CFPB on February 7, 2025. Vought is also the director of the Office of Management and Budget (OMB). After his CFPB appointment, Vought posted on social media that he had stopped the bureau's scheduled funding draw, commenting, "The Bureau's current balance of $711.6 million is in fact excessive in the current fiscal environment. This spigot, long contributing to CFPB's unaccountability, is now being turned off."

The CFPB withdrew seven interpretive rules, 13 advisory opinions, eight policy statements, and 39 other guidance documents issued since 2011 on May 12, 2025. The rule defining the withdrawals stated, "In many instances, this guidance has adopted interpretations that are inconsistent with the statutory text and impose compliance burdens on regulated parties outside of the strictures of notice-and-comment rulemaking. But even where the guidance might advance a permissible interpretation of the relevant statute or regulation, or afforded the public an opportunity to weigh in, it is the Bureau's current policy to avoid issuing guidance except where necessary and where compliance burdens would be reduced rather than increased."

Five total CFPB-related resolutions of disapproval have been passed by both chambers of Congress since 2001, with four of them signed into law by President Trump across his two administrations. The other CFPB rule, Small Business Lending Under the Equal Credit Opportunity Act (Regulation B), was challenged by a 2023 resolution of disapproval that President Joe Biden (D) vetoed in 2024, maintaining the regulation. The Senate’s 54-45 vote did not meet the two-thirds majority required to override the veto. There were 49 Republicans, 3 Democrats, and 2 Independents who voted to override the veto, and 44 Democrats, 1 Independent, and no Republicans voted to sustain it.

Why does it matter?

The two CFPB rules nullified during President Trump's second term expanded the agency's regulatory authority over what the CFPB defines as very large financial institutions and product providers.

The rule nullified under S.J. Res. 18 concerned overdrafts. An overdraft occurs when a financial institution pays a transaction for a consumer who lacks sufficient funds in their account to pay for it, extending a type of credit to that consumer. The institution may then assess a fee for its extension of credit, requiring the consumer to repay the institution. The rule had three provisions.

- The first provision redefined overdraft fees as finance charges, subjecting them to disclosure of terms and fees under the Truth in Lending Act (TILA).

- The second provision required institutions to treat overdraft credit like the TILA treats loans with specific opt-in, fee disclosure, and repayment options requirements. Institutions were to offer consumers at least one method of repaying an overdraft balance other than automatic repayment by preauthorized electronic fund transfer. They could not automatically withdraw overdraft fees from consumer accounts and were also required to place overdraft credit in a credit account separate from consumers’ asset accounts.

- The third provision offered institutions options to limit overdraft fees, including a $5 daily cap, fees based on actual costs and losses, or compliance with TILA credit terms.

The rule nullified under S.J. 28 concerned digital payment applications in general use by consumers. It had three provisions.

- The first provision authorized the CFPB to regulate larger participants in the general-use digital consumer payment application market. Larger participants were defined as nonbanks (1) with an annual volume of at least 50 million transactions, and (2) that were not small businesses. Any nonbank qualifying as a larger participant would continue to be included in this category until two years from the first day of the tax year in which the entity last met the larger-participant test.

- The second provision defined relevant applications as those offering digital funds transfer or payment wallet functionalities for consumers' general use, excluding certain transactions. These applications are popularly referred to with names like peer-to-peer payment apps or P2P apps (as cited in the text of the rule).

- The third provision authorized CFPB to require submission of certain records, documents, and other information to assess whether a nonbank met the definition of a larger participant in the relevant market.

The Senate passed S.J. Res. 18 by a vote of 52-48 on March 27, 2025, with 52 Republicans in favor and 45 Democrats, one Republican, and one Independent voting opposed. The House passed the resolution by a vote of 217-211 on April 9, 2025, with 217 Republicans in favor, and 210 Democrats and one Independent opposed.. The Senate passed S.J. Res. 28 by a vote of 51-47 on March 5, 2025, with 51 Republicans in favor and 44 Democrats, one Republican, and two independents voting in opposition. The House passed S.J. Res. 28 by a vote of 219-211 on April 9, 2025, with 219 Republicans in favor and 211 Democrats opposed.

The Office of Management and Budget (OMB) issued a statement of administrative policy on March 26, 2025, writing the nullification of the overdraft rule was a way to advance the administrations deregulatory agenda and that the CFPB rule would, if left in place, limit consumer choice by "depriving Americans of the option to choose overdraft services to meet short-term liquidity needs, forcing them into higher-cost financial products.”

The Consumer Federation of America opposed nullification of S.J. Res. 18 in an April 15, 2025, letter, arguing that repeal of the CFPB’s rule limiting overdraft fees would not achieve Trump administration goals to address rising costs and "would leave Americans vulnerable to falling further behind financially."

In a legal action against the overdraft rule, banking and credit union trade groups filed a preliminary injunction on December 20, 2024, alleging that the CFPB did not have the authority to redefine classifications in the TILA. This legal action was invalidated when President Trump nullified the rule by signing the CRA on May 9, 2025.

House Committee on Financial Services Chairman French Hill (AR-02) commented on the president’s signing of S.J. 18: “S.J. Res. 18 nullifies the CFPB’s disastrous rule, which attempted to set government price caps on overdraft fees…Americans voted for consumer choice, not government overregulation.”

The Center for Responsible Lending opposed S.J. Res. 18 and wrote officials should …” stand with everyday people over big banks. Banks should not profit off the struggles of working families through excessive, back-end overdraft junk fees.”

What’s the background on the CFPB?

The CFPB is the regulatory body responsible for consumer protection in the financial sector. The CFPB may regulate institutions to ensure compliance with consumer protection laws, including those related to unfair practices, discrimination, or fraud. The CFPB can write and enforce regulations for financial institutions with assets exceeding $10 billion and their affiliates. State-level agencies regulate smaller institutions. A list of institutions regulated by the CFPB, organized by year, is available on their website.

The CFPB's rule "Overdraft Lending: Very Large Financial Institutions" was issued on December 12, 2024. CFPB Director Rohit Chopra stated, "For far too long, the largest banks have exploited a legal loophole that has drained billions of dollars from Americans' deposit accounts…The CFPB is cracking down on these excessive junk fees and requiring big banks to come clean about the interest rate they're charging on overdraft loans."

The Consumer Bankers Association argued that overdraft fees were not “junk fees” but legitimate charges for overdraft services that consumers can choose to use.

The CFPB's rule "Defining Larger Participants of a Market for General-Use Digital Consumer Payment Applications" was issued on December 10, 2024. The CFPB wrote that its supervisory authority was needed "...because this market has large and increasing significance to the everyday financial lives of consumers. Consumers are growing increasingly reliant on general-use digital consumer payment applications to initiate payments."

Presidents may control CFPB leadership as a result of the Supreme Court's ruling in Seila Law v. Consumer Financial Protection Bureau (2020). In a 5-4 decision, the court held that it was unconstitutional for the agency's leaders, who exercised independent executive powers, to be protected from removal by the president. The majority ruled that those leaders should be subject to at-will presidential termination.

What's the background on the Congressional Review Act (CRA)?

The CRA is a law passed in 1996 that allows Congress to review and reject new federal regulations created by government agencies. Under the CRA, Congress has 60 working days after a rule has been submitted to Congress to introduce a joint resolution of disapproval. If Congress approves the resolution and the president signs it, these actions nullify the targeted rule. The deadline for the 119th Congress to file CRA resolutions was May 12, 2025.

Forty-six CRA resolutions of disapproval have been passed by both chambers since 2001, and 29 resolutions of disapproval have been enacted as of June 3, 2025. More than 500 joint resolutions of disapproval were introduced between 1996 and March 2025. Over 109,000 federal rules were promulgated in that time. Ballotpedia has tracked joint resolutions of disapproval under the CRA since the beginning of the 118th Congress.

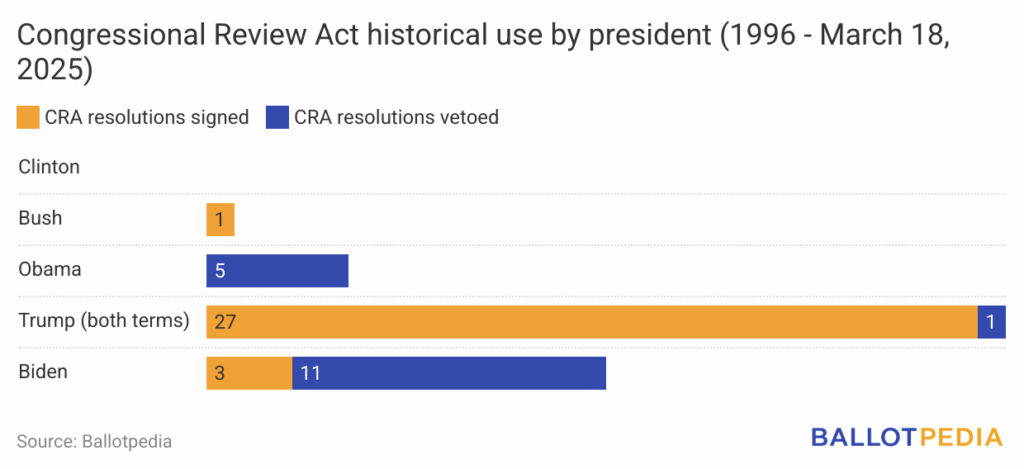

Presidents Bush, Obama, and Biden signed a combined total of four CRA resolutions. President Bush signed one CRA resolution; President Obama signed none; and President Biden signed three. During his first term, Trump signed 16 CRA resolutions and 11 in his second term.

In the last two Congresses, 26 CRA resolutions passed both chambers and 11 were enacted; President Biden vetoed 11 and President Trump signed 11. Four have passed both chambers as of May 23.

Additional reading: