Welcome to the Thursday, Oct. 2, 2025, Brew.

By: Lara Bonatesta

Here’s what’s in store for you as you start your day:

- Premium tax credits, work requirements, and rescission disputes are at the center of the government shutdown

- First time since 2009 that an incumbent is not on the ballot for King County, Washington executive

- An overview of the rules, agency documents, and notices published in the Federal Register last quarter

Premium tax credits, work requirements, and rescission disputes are at the center of the government shutdown

The federal government shut down at midnight on Oct. 1 after Congress did not pass a continuing resolution (CR) that would have kept government agencies open through Nov. 21. When that occurs, the Antideficiency Act prohibits the federal government from entering into a contract that is not fully funded. According to the Congressional Budget Office, an estimated 750,000 employees could also be furloughed. The last federal government shutdown occurred in 2018 when the government shut down for 35 days.

Today, we'll examine some of the policy disputes reportedly at the center of the funding conflict.

Republicans have said they want a clean CR, meaning a resolution extending all appropriations as Congress last passed them in March, with limited policy changes. On Sept. 19, the House passed a CR extending appropriations at current levels, apart from increased security appropriations for lawmakers, Supreme Court Justices, and executive branch officials.

Senate Democrats have advocated for changes in at least three policy areas in the next CR: premium tax credits, Medicaid work requirements, and presidential pocket rescissions.

Premium tax credits

Senate Democratic leaders said they would not vote for the appropriations bill to prevent the government from shutting down unless it halted the expiration of expanded premium tax credits (ePTCs) at the end of 2025. Some Republicans have said they are open to discussing extending the credits, but that a stopgap continuing resolution is not the right place for such a change. Other Republicans have said they believe Democrats want to provide health care coverage to people living in the U.S. without legal permission.

According to the Congressional Budget Office, the premium tax credit “is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace.” In this context, refundable means that the credit may be used even if the individual owes no tax for the year.

The credit, in its most commonly used form, is advanceable, meaning that payments for the credit may be disbursed throughout the year, not just when individuals file their taxes. In these cases, the federal government pays the credit directly to the individual’s health insurance provider.

Congress established PTC's with the Affordable Care Act in 2010, and they first became available for tax year 2014 to filers with incomes between 100% and 400% of the federal poverty level (FPL).

The American Rescue Plan Act (ARPA), signed in March 2021, created the expanded premium tax credit (ePTC) for tax years 2021 and 2022. It expanded the credit to those making more than 400% of the FPL if they couldn’t qualify for other government plans and could not otherwise purchase insurance with premiums not exceeding a certain percentage of household income. The bill also eliminated premiums for individuals and households claiming income between 100% and 150% of the FPL.

The 2022 Inflation Reduction Act (IRA) extended the ePTC through the end of 2025, at which point the original ACA provisions of the tax credit will take effect.

Medicaid changes

Democrats have said they want to reverse the One Big Beautiful Bill Act's (OBBBA) changes to Medicaid work requirements. Republicans have said they still want work requirements for “able-bodied, non-working adults.”

Medicaid work requirements are policies that require certain adult enrollees to work or participate in related activities to be eligible for Medicaid benefits. These activities may include employment, job training, education, or community service. The OBBBA, signed in 2025, created the first federally mandated Medicaid work requirements. The law requires states to implement a monthly 80-hour community engagement requirement for adults in the Affordable Care Act’s Medicaid expansion group by Jan. 1, 2027. States may apply for a good-faith delay until Dec. 31, 2028. Georgia is the only state with an active state-level Medicaid work requirement, though 13 states have previously sought waivers from the federal government to implement them.

Rescission

Rescission is the process through which a president can request the cancellation of congressionally-appropriated funds. A pocket rescission is when the president requests that Congress rescind unspent funds fewer than 45 days before the funds are scheduled to expire (usually Sept. 30, the end of the federal fiscal year). On Aug. 29, the White House announced that it was canceling $4.9 billion in congressionally appropriated foreign aid through pocket rescission.

Democrats have said that they want to make it harder to rescind funds and reverse President Trump’s use of the pocket rescission. Some Republicans have said they oppose Trump’s use of the pocket rescission and called it illegal. Others have said they agree with Trump’s announced cuts, but that they disagree with the use of the pocket rescission. A representative of the Office of Management and Budget called the pocket rescission a “lawful tool available to the executive branch to reduce unnecessary spending.”

In recent years, executive and legislative branch officials have debated the legality of pocket rescission. As recently as August, the Government Accountability Office (GAO), a nonpartisan independent agency within the legislative branch, wrote that pocket rescission is not permitted under the Impoundment Control Act. Officials with the executive branch Office of Management and Budget said pocket rescission is legal and said the GAO did not dispute this when presidents used the tool in the 1970s.

To learn more about rescission, check out the September edition of our Checks and Balances newsletter.

To learn more about each party’s budget goals and the president’s role in reaching an agreement, listen to our recent episode of On The Ballot featuring Semafor’s Congressional Bureau Chief Burgess Everett. You can also check out our episode from earlier this year to learn more about what happens when there is a federal government shutdown.

Click here to see more of our coverage of the shutdown.

First time since 2009 that an incumbent is not on the ballot for King County, Washington executive

Claudia Balducci and Girmay Zahilay are running in the nonpartisan general election for King County, Washington, executive on Nov. 4, 2025.

This is the first open race for the office since 2009. Dow Constantine held the office from that 2009 election until his resignation in March 2025. The King County Council appointed Shannon Braddock interim county executive on April 1. Braddock did not run for election following her appointment.

The county executive is the chief executive officer of the county. The executive has the power to sign and veto ordinances, and appoint various county officers, commissioners, and board members.

Balducci and Zahilay advanced from the eight-candidate primary on Aug. 5. Zahilay received 44.2% of the vote, and Balducci received 29.8%. Though the position is officially nonpartisan, both Balducci and Zahilay are Democrats.

Balducci and Zahilay currently serve on the King County Council. The Cascadia Advocate's Henry Leyden writes, "[Balducci and Zahilay] have repeatedly voiced agreement on values, principles, and policy directions. Both are emphasizing housing, public safety, and transportation as priorities in their campaigns, and both would govern as progressives. That has led many Democratic activists and nonprofit leaders to conclude that King County will be in good hands regardless of which frontrunner prevails."

Despite these similarities, Democrats and progressive organizations have split their endorsements between the two. Notable endorsements for Balducci include Washington Auditor Pat McCarthy (D), U.S. Rep. Marilyn Strickland (D), The Seattle Times, and SEIU Local 925. Notable endorsements for Zahilay include Gov. Bob Ferguson (D), Washington Attorney General Nick Brown (D), U.S. Rep. Pramila Jayapal (D), and Planned Parenthood Alliance Advocates.

Balducci is a labor attorney and was elected to King County Council District 6 in 2015. Balducci’s priorities include:

- Law enforcement and crime prevention

- Behavioral health responses

- Cost of living

- Affordable Housing

- Convenient and sustainable transportation

Zahilay is a business attorney and was elected to King County Council District 2 in 2019. The council unanimously appointed him chair on Jan. 14, 2025. Zahilay’s priorities include:

- Public safety

- Attracting employers and supporting small businesses

- Labor standards and promoting a healthy workforce

The county executive serves four-year terms. The winner of this election will only serve a three-year term because of Amendment 1, which voters passed in 2022. Amendment 1 moved King County elections from odd years to even years. The winner of the county executive election in 2028 will return to serving a four-year term.

Click here to learn more about elections in King County, Washington, this year.

An overview of the rules, agency documents, and notices published in the Federal Register last quarter

The federal government added 19,256 pages to the Federal Register last quarter for a year-to-date total of 47,228 pages. The Federal Register hit an all-time high of 95,894 pages in 2016. The Federal Register is a daily journal of federal government activity that includes presidential documents, proposed and final rules, and public notices. It is a common measure of an administration’s regulatory activity, accounting for both regulatory and deregulatory actions.

Here’s a look at changes to the federal register from the last quarter, spanning from July 1 to Sept. 20, and how that compares to the third quarter of 2021, the first year of the Biden Administration.

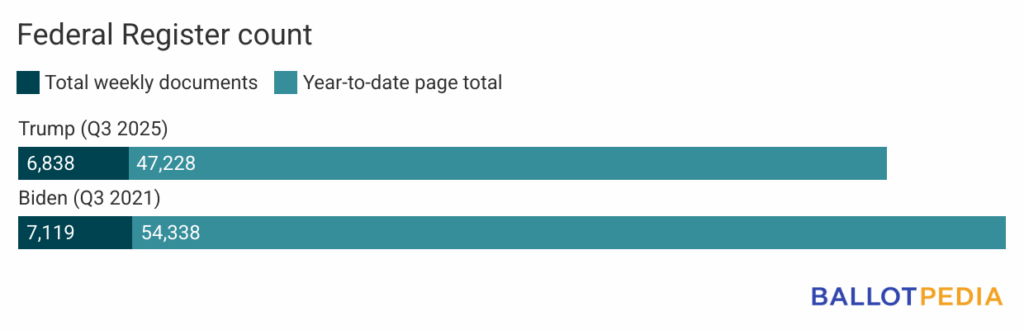

The government added 6,838 documents to the Federal Register this quarter. During the third quarter of 2021, the government added 7,119 documents, bringing the year-to-date page total to 54,338.

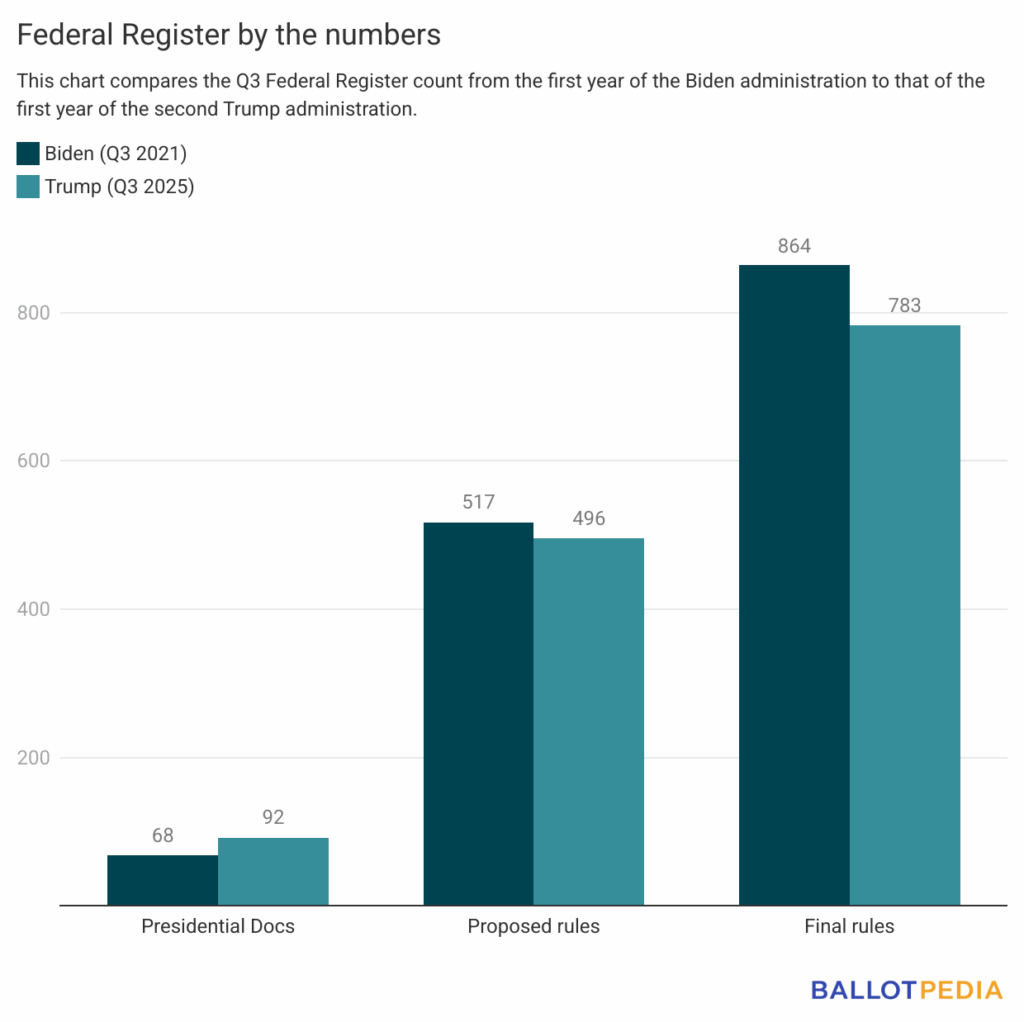

Here’s a breakdown of the 6,838 documents added last quarter:

- 5,467 notices

- 92 presidential documents

- 496 proposed rules

- 783 final rules

During the third quarter of 2021, the government added fewer presidential documents (68), more proposed rules (517), and more final rules (864).

Agencies proposed 28 significant rules and issued 25 significant final rules this quarter. A 1993 executive order defines significant rules as those that can potentially have large effects on the economy, environment, public health, or state or local governments.

The Office of Information and Regulatory Affairs (OIRA) determines which rules meet this definition and are subject to its review. Significant actions may also conflict with presidential priorities or other agency rules.

As of Sept. 30, the Trump administration has issued 43 significant proposed rules, 65 significant final rules, and seven significant notices this year.

Ballotpedia maintains page counts and other information about the Federal Register as part of our neutral, nonpartisan encyclopedic coverage of the administrative state. Click here to see our full coverage of changes to the Federal Register.