Texas voters approved 17 constitutional amendments on Nov. 4, with support ranging from 57% to 89%. The average approval rate was 70%.

The measure with the closest margin was Proposition 6, which prohibits the state legislature from enacting laws that impose an occupation tax on a registered securities market operator or a securities transaction tax. As of Nov. 5, the margin was 55% to 45%. As of 2025, no state levied a financial transaction tax on securities.

Proposition 6 was part of a trio of measures in Texas to prohibit certain future taxes. Proposition 2, which prohibits taxes on realized and unrealized capital gains, was approved with 65% of the vote, and Proposition 8, which prohibited taxes on the transfer of an estate, inheritance, legacy, succession, or gift, was approved with 72% of the vote. While Texas does not currently levy these taxes, the amendments add new prohibitions to the state constitution, which can only be changed with a two-thirds legislative vote and voter approval.

Proposition 17, which authorized the state legislature to provide for a property tax exemption for the construction of border infrastructure on property located in a county that borders Mexico, had a similarly close margin with 57% to 43%. Of the 14 counties bordering Mexico that the exemption would apply to, voters in one county, Presidio, rejected the measure by a margin of 61% to 39%. The other 13 counties favored the amendment.

The measure with the widest margin was Proposition 10, which provides for a temporary homestead exemption for improvements made to residences destroyed by fire. The margin was 89% to 11%.

Texas voters also approved a third increase to the general homestead tax exemption in as many years. The 2025 measure, which was passing with 79% of the vote, increased the exemption from $100,000 to $140,000. The approval rate is below the 2023 measure, which increased the exemption from $40,000 to $100,000, that passed with 83% of the vote, and the 2022 measure, which increased the exemption from $25,000, that passed with 85% of the vote.

Voters also approved an amendment to add parental rights, including the rights "to exercise care, custody, and control of the parent’s child, including the right to make decisions concerning the child’s upbringing", to the state’s constitution. Proposition 15 was approved with 70%.

Texas also became the 15th state to adopt a constitutional amendment explicitly prohibiting noncitizens from voting in state and local elections since 2018. Proposition 16 was approved by a margin of 72% to 28%.

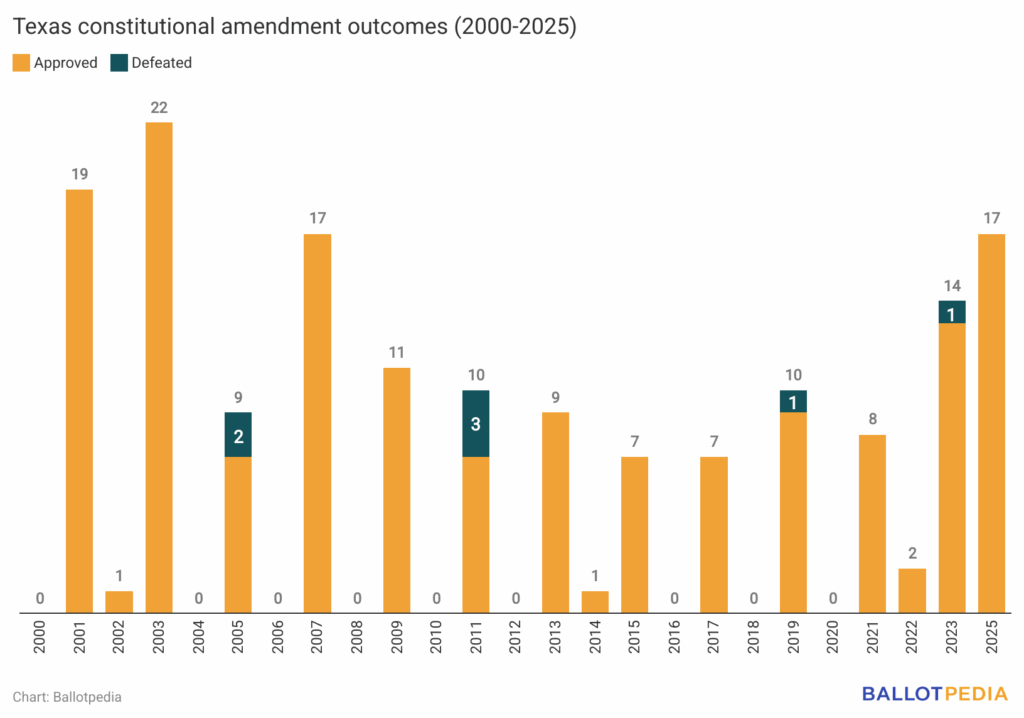

In Texas, 16 of the last 25 years featured statewide ballot measures. Twelve of the 16 years saw all constitutional amendments on the ballot approved.

Since the Texas Constitution was adopted in 1876, voters have decided on 729 measures—all constitutional amendments. Of those, 548 (75%) were approved, including the original Constitution of 1876 and the 2025 amendments.