In this week’s edition of Economy and Society:

- Investor group urges SEC to oppose forced arbitration

- CalPERS hires new DEI chief

- JPMorgan shifts U.S. proxy voting to AI system

- Research shows growing preference for positive ESG strategies

- Research finds ESG drives value in private equity

In Washington, D.C., and around the world

Investor group urges SEC to oppose forced arbitration

What’s the story?

The Council of Institutional Investors (CII) sent a letter on Nov. 6, 2025, to Securities and Exchange Commission (SEC) Chairman Paul S. Atkins opposing recent SEC actions related to mandatory arbitration clauses in public company registration statements. The letter responded to a September 2025 SEC policy statement saying the presence of arbitration clauses will not affect whether the agency accelerates approval of registration statements, a step that allows companies to move more quickly toward public offerings.

CII also addressed remarks Atkins made in an Oct. 9 keynote speech suggesting state corporate law, including in Delaware, could permit mandatory arbitration provisions. The group said the policy statement and comments represent a reversal of the SEC’s long-standing position opposing forced arbitration in public company governing documents and said the change occurred without a formal public comment process.

Why does it matter?

Mandatory arbitration provisions can limit investors’ ability to bring claims in court, pursue class actions, or rely on public legal precedent. Changes in SEC policy could affect how companies structure initial public offerings and corporate charters, with implications for investor protections and corporate accountability across U.S. capital markets.

What’s the background?

The SEC has recently adjusted several long-standing practices affecting investor rights and corporate governance. In November 2025, the agency said it would limit staff responses to most no-action requests during the 2025–26 proxy season, reducing informal guidance on shareholder proposal exclusions.

In the states

CalPERS hires new diversity and inclusion chief

What’s the story?

The California Public Employees’ Retirement System (CalPERS), the largest public pension system in the United States, announced on Jan. 5, 2026, that it hired Shari Slate as its new chief diversity, equity, and inclusion officer. CalPERS said Slate will join the executive team and report directly to Chief Executive Officer Marcie Frost.

State job paperwork lists responsibilities including “integrating DEI principles into CalPERS’ investment practices,” in collaboration with the investment office. The description also cites work with investment groups on financial decision-making and portfolio strategies tied to sustainability and social responsibility.

Why does it matter?

CalPERS oversees retirement assets for millions of public employees, and its internal governance policies often draw national attention. The hire highlights ongoing debate over how large pension systems define the boundaries between workplace policy initiatives and fiduciary responsibilities.

What’s the background?

CalPERS serves nearly 2.4 million retirement system members and administers health benefits for more than 1.5 million people. As of Dec. 31, 2025, CalPERS reported the fund was 84% funded.

Public pension systems like CalPERS have increasingly adopted formal diversity and sustainability policies over the past decade. At the same time, pension governance has faced scrutiny from lawmakers and beneficiaries over how non-financial considerations intersect with fiduciary obligations.

ESG legislation update

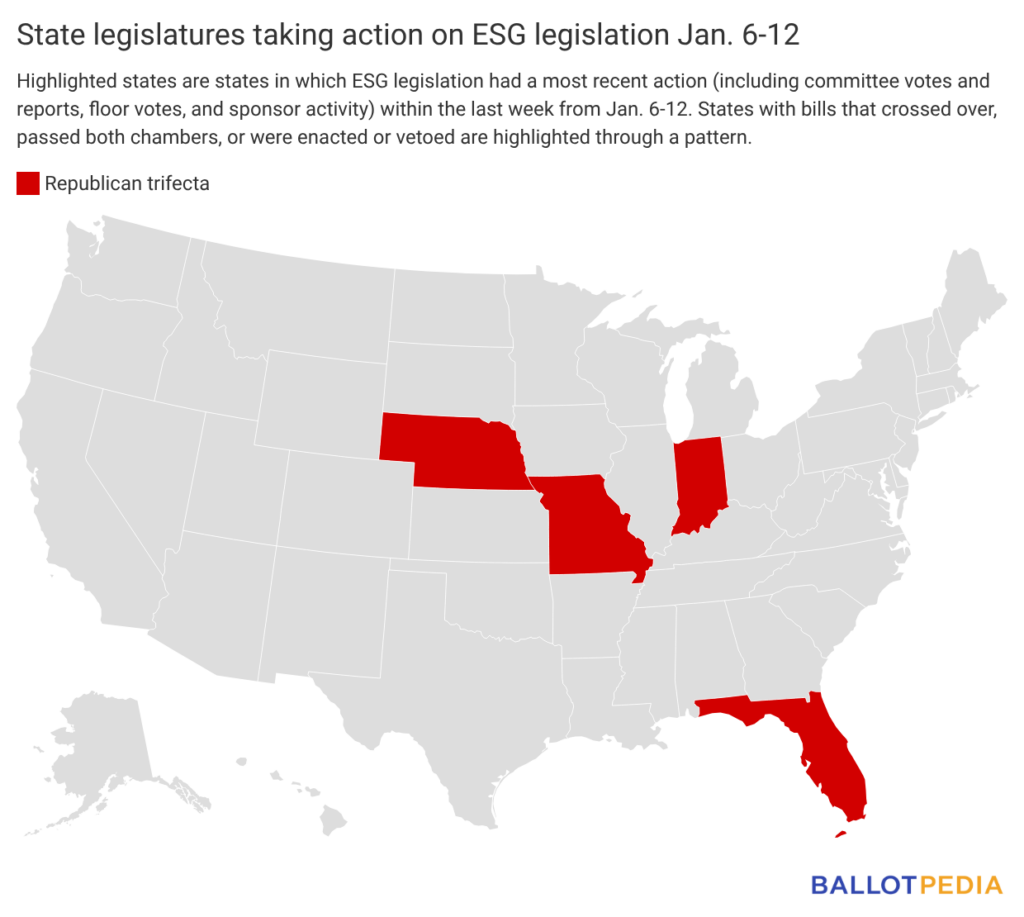

Four Republican states introduced 12 ESG-related bills last week (since Jan. 6). States with legislative activity on ESG last week are highlighted in the map below. Click here to see the details of each bill in the legislation tracker.

On Wall Street and in the private sector

JPMorgan shifts U.S. proxy voting to AI system

What’s the story?

J.P. Morgan Asset & Wealth Management said that it will stop using third-party proxy advisory firms for U.S. proxy voting on Jan. 7, 2026, and instead rely on a new internal artificial intelligence platform called Proxy IQ. ESG Today and ESG Dive reported that according to a company memo, the firm plans to complete the transition during the first quarter of 2026.

JPMorgan said the change makes it the first major investment manager to fully eliminate reliance on external proxy advisers for U.S. voting decisions. The firm will run Proxy IQ on its Spectrum investment data platform to manage voting across more than 3,000 U.S. company annual meetings.

Why does it matter?

The decision reduces the role of proxy advisory firms Institutional Shareholder Services and Glass Lewis, which together account for more than 90% of the proxy advisory market. The move also comes as proxy advisers face increased scrutiny from federal and state officials over their role in environmental, social, and governance (ESG)-related voting.

What’s the background?

JPMorgan Chief Executive Officer Jamie Dimon has publicly criticized proxy advisory firms in recent years and called for reducing their influence over shareholder voting. In December, President Donald Trump issued an executive order directing federal agencies to increase oversight of proxy advisers and review their market dominance and ESG practices.

From the ivory tower

Research shows growing preference for positive ESG strategies

What’s the story?

Researchers at Florida Atlantic University (FAU) reported on Jan. 12, 2026, that investors increasingly favor positive ESG screening over exclusion-based approaches, according to a newly published academic study. The paper, “Positive versus negative ESG portfolio screening and investors’ preferences,” analyzed U.S. ESG mutual fund data from 2002 to 2020 and examined how different screening strategies affect fund flows.

The study found that funds using positive screening—selecting companies with strong ESG performance—attracted higher net inflows than funds using negative or combined screening strategies. “Institutional investors are often more sophisticated in their strategies and have shown a stronger preference for positive screenings,” said Anna Agapova, a professor of finance at FAU. She added that “investments with higher ESG scores are able to mitigate risk better because of a lower downside exposure.”

Why does it matter?

The findings inform policy and market debates over how ESG approaches affect investor behavior and risk management. According to the study, positive screening expands diversification and attracts capital without reducing returns, particularly during periods of market volatility.

What’s the background?

ESG investing has historically relied on negative screening, which excludes certain industries such as tobacco or gambling. The FAU study found that, while negative screening remains common, positive screening attracted 23 to 34 basis points more in monthly net fund flows.

Research finds ESG drives value in private equity

What’s the story?

Researchers affiliated with Stanford University’s Long-Term Investing Initiative (SLTI) and British Columbia Investment Management Corporation (BCI) released a paper in January 2026 finding that ESG integration can generate measurable financial gains in private equity portfolios. The research, "ESG Value Creation in Private Equity: From Rhetoric to Returns," draws on anonymized case studies from BCI’s private equity investments and examines how ESG initiatives affected earnings, costs, and sales values.

Why does it matter?

ESG integration in private equity has faced skepticism due to limited disclosure and inconsistent metrics. This research provides case-based financial evidence that ESG initiatives tied to operating decisions can affect earnings quality, cost structures, and risk exposure. The findings may inform policy and fiduciary debates over whether ESG considerations align with return-focused investment mandates in private markets.

What’s the background?

Private equity investors have increasingly faced pressure to justify ESG practices using financial outcomes rather than commitments or ratings. Prior research has relied heavily on surveys or public-market data. This paper adds to a growing body of work examining ESG materiality in private assets, where investors seek clearer links between sustainability initiatives and value creation.