Author: Ballotpedia staff

-

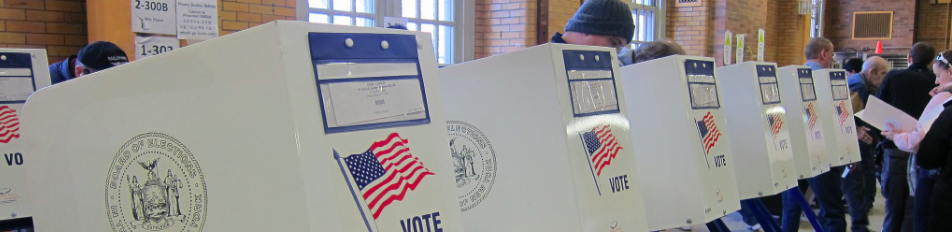

70% of last June’s elections were uncontested

Throughout June, Ballotpedia covered 900 elections in 20 states, 70% of which were uncontested. That’s up from May, when 43% of the 2,892 covered were uncontested. Ballotpedia defines an uncontested election as one where the number of candidates running is less than or equal to the number of seats up for election. This analysis does…

-

Vermont, Ohio, North Carolina, Oregon enact K-12 cellphone bans

What’s the story? Vermont, Ohio, North Carolina, and Oregon have all enacted statewide bans on cellphone use in K-12 schools since June 27. What’s the background? 25 states have enacted cellphone bans or limits in K-12 schools, and at least 17 states have adopted cellphone bans or limits so far in 2025. Three states require…

-

Utah voters to decide on the state’s first veto referendum in 18 years

Welcome to the Friday, June 27, Brew. By: Briana Ryan Here’s what’s in store for you as you start your day: Utah voters to decide on the state’s first veto referendum in 18 years, on public sector bargaining On Nov. 3, 2026, Utah voters will decide whether to uphold or repeal House Bill 267 (HB…