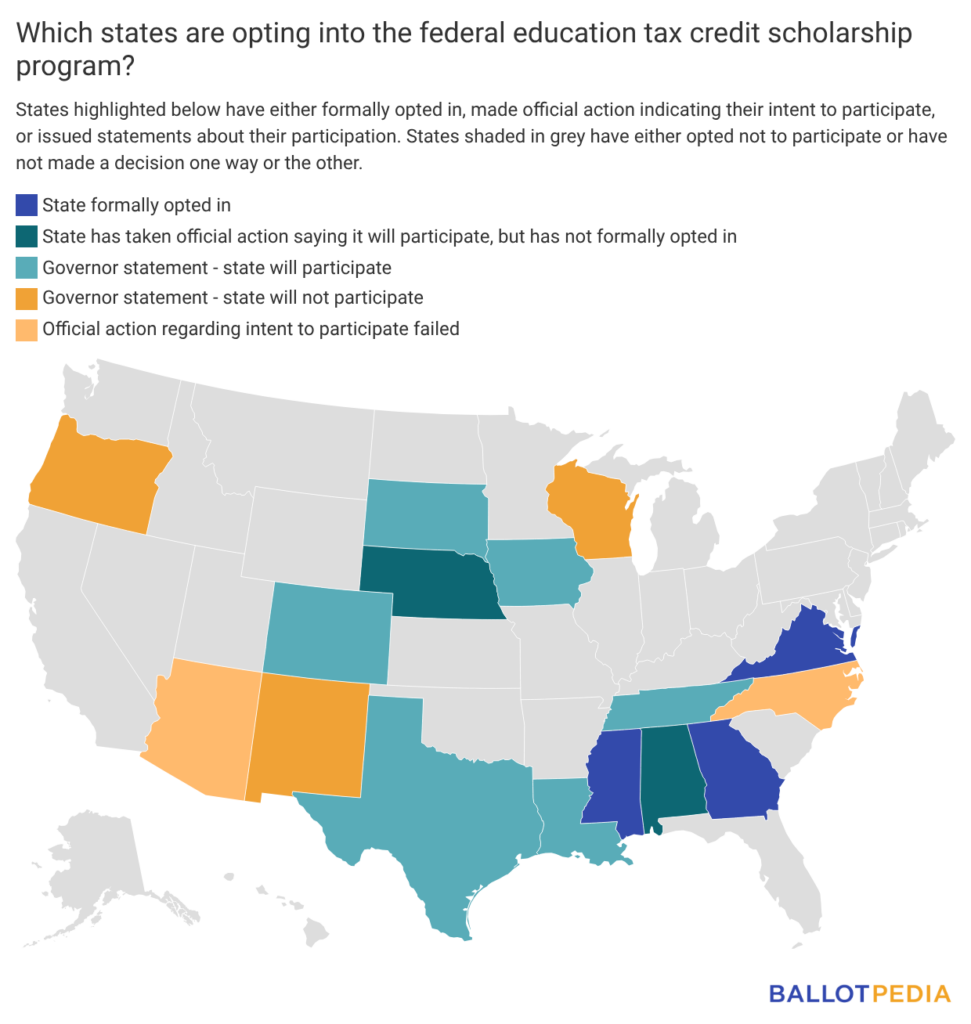

As of Jan. 21, 2026, three states have formally opted into the U.S. school choice tax credit scholarship program. States that have formally opted into the program are those that have submitted Form 15714, Advance Election to Participate Under Section 25F for 2027 to the U.S. Treasury.

Virginia became the first state to do so when then Gov. Glenn Youngkin (R) announced that the state had submitted the required form on Jan. 9. On Jan. 19, Mississippi Gov. Tate Reeves (R) announced his state's participation, and Gov. Brian Kemp (R) announced Georgia's participation the next day.

Several other states have indicated that they will participate in the program—either through official actions such as executive orders or passing legislation, or governors' statements on the matter—but Virginia was the first to submit the form verifying participation.

Participating states must submit a list of eligible scholarship-granting organizations (SGOs) to the Treasury. Virginia submitted a list upon electing to participate in the program; it included eight SGOs that the state said was subject to change as the Treasury releases guidance. Mississippi said it would designate SGOs in the coming months, and Georgia had not announced the status of an eligible SGO list as of Jan. 21.

Background

The One Big Beautiful Bill Act (OBBBA) established the federal school choice tax credit scholarship when President Donald Trump (R) signed the bill into law in July 2025. It is a nonrefundable tax credit that allows individuals to receive up to $1,700 of federal tax credits for donations to SGOs.

SGOs are non-profit organizations that manage contributions and distribute scholarship funds to eligible families or individuals, who can use the funds on a variety of private or public educational expenses, including private school tuition, tutoring services, and textbooks. Because many states have some form of state-level tax credit for certain educational expenses, SGOs already exist in many states, with some providing services in multiple states.

States can opt into the federal U.S. school choice tax credit program by submitting Form 15714 and submitting a list of SGOs in the state. Those who can opt into the program include the governor or other individuals, agencies, or entities designated under each state's law to make elections on behalf of the state regarding federal tax benefits.

Students in states that do not opt in cannot receive scholarships funded under the program, but donors in those states can still receive a federal tax credit by donating to SGOs in participating states. In order to qualify for a scholarship under the program, students must live in households earning no more than 300% of the area's median gross income and be eligible to enroll in K-12 schools.

The U.S. Treasury must issue regulations for the program. The Internal Revenue Service (IRS) issued a notice requesting comments on proposed implementation of the program on Nov. 26. Though the comment period closed on Dec. 26 after gathering over 2,000 comments, the IRS was accepting late comments as of Jan. 16.

Who is participating

In addition to the three states that have submitted Form 15714, officials in the following states have taken action or made statements regarding participation in the program:

- Alabama Gov. Kay Ivey (R) signed an executive order on Jan. 16, 2026 to signal participation in the program.

- Arizona lawmakers passed legislation saying the state would participate in the program, but Gov. Katie Hobbs (D) vetoed the bill on Jan. 16.

- North Carolina lawmakers passed legislation saying the state would participate in the program, but Gov. Josh Stein (D) vetoed the bill on Aug. 6, 2025. Stein said the legislation was unnecessary because he would opt North Carolina into the program "[o]nce the federal government issues sound guidance."

- Nebraska Gov. Jim Pillen (R) signed an executive order on Sept. 29, 2025, to signal participation in the program.

- Governors of six states—Colorado, Iowa, Louisiana, South Dakota, Tennessee, and Texas—said they would participate, but had not taken official action.

- Governors of three states—New Mexico, Oregon, and Wisconsin— said they would not participate.

Of the states that have indicated whether they will participate:

- Four have Democratic trifectas. Two states—Virginia and Colorado—have indicated participation in the program, and two states—New Mexico and Oregon—said they would not participate. Virginia's trifecta status changed from a divided government to a Democratic trifecta when Abigail Spanberger (D) was sworn in as governor on Jan. 17, after the state had opted in.

- Nine have Republican trifectas. All nine states—Alabama, Georgia, Iowa, Louisiana, Mississippi, Nebraska, South Dakota, Tennessee, and Texas—said they would participate in the program.

- Three have divided trifectas. In North Carolina and in Arizona, legislation to indicate participation failed, and Wisconsin Gov. Tony Evers (D) said the state wouldn't participate, though the legislature is considering a bill that would require the state to participate.

Additional reading: