In this week’s edition of Economy and Society:

- House passes bill limiting ESG use in retirement plans

- EU allows nuclear weapons companies in ESG funds

- EU regulator issues guidance to curb greenwashing

- EU regulators issue ESG stress test guidelines

- ESG legislation update

- New York Times says Wall Street retreated from climate pledges

In Washington, D.C., and around the world

House passes bill limiting ESG use in retirement plans

What’s the story?

On Jan. 15, 2026, the Republican-led U.S. House of Representatives passed the Protecting Prudent Investment of Retirement Savings Act (H.R. 2988) by a 213–205 vote, advancing legislation that would limit when fiduciaries may consider environmental, social, and governance (ESG) factors in employer-sponsored retirement plans governed by the Employee Retirement Income Security Act (ERISA).

Rep. Rick Allen (R-Ga.) sponsored the bill and three Democrats — Reps. André Carson (D-Ind.), Henry Cuellar (D-Texas), and Adam Gray (D-Calif.) — joined Republicans in voting for the bill, though Carson later said the vote was cast in error.

The legislation would amend ERISA to require fiduciaries to base investment decisions solely on pecuniary factors — defined as factors expected to have a material effect on risk or return — while allowing nonpecuniary considerations only in limited circumstances, such as when fiduciaries are unable to distinguish between otherwise equivalent investment alternatives.

Why does it matter?

If enacted, the bill would codify into statute limits on ESG considerations in retirement investing, reducing the Department of Labor’s discretion to reinterpret fiduciary standards through regulation. That shift would mark a change from recent administrations’ reliance on rulemaking and guidance to shape ESG policy under ERISA.

The vote also reflects continued partisan division over ESG investing, particularly in retirement plans, where policymakers disagree over whether ESG factors represent financially relevant information or nonpecuniary considerations that conflict with fiduciary duties.

What’s the background?

Title I of the Employee Retirement Income Security Act (ERISA) governs private-sector retirement plans and requires fiduciaries to act prudently and in the sole interest of participants and beneficiaries. The Department of Labor has long interpreted those duties through regulation, including guidance on whether nonfinancial considerations may factor into investment decisions.

In 2020, the first Trump administration finalized the Financial Factors in Selecting Plan Investments rule, which emphasized that fiduciaries must base decisions on pecuniary factors tied to risk and return and limited the role of ESG considerations. The Biden administration replaced that rule in 2023 with Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights, which clarified that ESG factors may be considered when financially relevant and used as a tiebreaker between otherwise equivalent investments.

In May 2025, the second Trump administration announced it would no longer defend the Biden-era rule in federal court. The Department of Labor has since listed a replacement ESG rule on its regulatory agenda, indicating another potential shift in ERISA investment standards.

EU allows nuclear weapons companies in ESG funds

What’s the story?

In late December 2025, the European Union issued a Commission Notice clarifying how weapons manufacturers are treated under the EU’s sustainable finance rules. The guidance confirms that ESG funds may hold shares in companies involved in nuclear weapons programs because nuclear weapons are not classified as prohibited weapons under EU law.

The clarification applies to the Sustainable Finance Disclosure Regulation (SFDR). Under SFDR’s Principal Adverse Impact indicator on controversial weapons, mandatory exclusions apply only to anti-personnel mines, cluster munitions, chemical weapons, and biological weapons. Nuclear weapons are not included on that list. As a result, companies involved in nuclear deterrence programs recognized under the Nuclear Non-Proliferation Treaty are not automatically excluded from ESG funds.

The notice also confirms that companies dealing with depleted uranium and white phosphorus are not categorically barred from ESG funds, because those materials are not prohibited under EU law.

Why does it matter?

The guidance removes a formal ESG exclusion that previously kept companies linked to nuclear weapons out of many sustainable investment products. ESG funds may now hold shares in those companies without violating EU disclosure rules, leaving inclusion decisions to fund managers and ratings providers.

The change comes as the EU seeks to mobilize up to €800 billion for defence investment over the next four years.

What’s the background?

Under SFDR, controversial weapons are defined by reference to weapons banned by international law binding on the EU. Nuclear weapons are excluded from that definition. Only three EU member states have signed the Treaty on the Prohibition of Nuclear Weapons, while all EU member states are parties to the Nuclear Non-Proliferation Treaty, which allows recognized nuclear weapons programs.

EU regulator issues guidance to curb greenwashing

What’s the story?

The European Securities and Markets Authority issued a new thematic note on greenwashing on January 15, 2026, setting out expectations for how firms market sustainability and ESG investment strategies. The guidance is aimed at investment firms, fund managers, issuers, and other market participants communicating ESG claims to investors.

The note focuses on how firms describe ESG integration and exclusion strategies in marketing materials, particularly for retail investors. ESMA said these strategies are widely used but often poorly explained, creating a risk that investors are misled. The regulator emphasized that sustainability claims must be accurate, accessible, substantiated, and up to date, and published examples of practices it considers acceptable and unacceptable.

Why does it matter?

The guidance raises supervisory expectations around ESG marketing without creating new legal obligations. ESMA signaled that unclear or vague ESG claims may be treated as greenwashing and subject to closer regulatory scrutiny.

The note also supports more consistent enforcement across EU member states as sustainability disclosures expand under EU financial rules.

What’s the background?

ESMA defines greenwashing as sustainability-related claims that are misleading, exaggerated, vague, incomplete, or not supported by evidence, regardless of whether they are made intentionally. Such claims can misrepresent the sustainability profile of a firm or product and undermine investor trust.

The new publication is ESMA’s second thematic note on sustainability-related claims. A first note issued in July 2025 focused on ESG labels, ratings, and certifications. This follow-up narrows in on ESG strategies, where ESMA says inconsistent use of terms like ESG integration and ESG exclusions has created confusion for investors.

EU regulators issue ESG stress test guidelines

What’s the story?

The European Union’s three financial regulators — the European Securities and Markets Authority, the European Banking Authority, and the European Insurance and Occupational Pensions Authority — published final joint guidelines on how ESG risks should be integrated into supervisory stress tests for banks and insurance companies on Jan. 8, 2026. The guidelines set out common standards for national regulators when assessing how financial institutions would perform under adverse ESG scenarios.

The guidelines are designed to promote a consistent, long-term approach to ESG stress testing across the EU while allowing flexibility as data quality and methodologies evolve. They do not create new legal requirements for national regulators but establish expectations for how ESG risks should be incorporated into existing stress-testing frameworks. The guidelines will be subject to a “comply or explain” process, requiring national authorities to either follow them or publicly explain deviations.

Why does it matter?

Stress tests are a core supervisory tool used to assess whether financial institutions can withstand severe shocks. By standardizing how ESG risks are included, the guidelines aim to reduce inconsistencies across EU member states and improve comparability of supervisory outcomes.

The move also signals continued regulatory focus on climate and other ESG risks as part of financial stability oversight, even without mandating new ESG stress tests.

What’s the background?

EU regulators have increasingly incorporated ESG risks into supervisory stress testing, but approaches have varied by country. In July 2025, the three authorities proposed draft ESG stress-testing guidelines to improve consistency across the EU. The final guidelines follow a public consultation and fulfill requirements under EU banking and insurance laws to publish joint guidance by January 2026. The guidelines are expected to apply from the beginning of 2027.

In the states

ESG legislation update

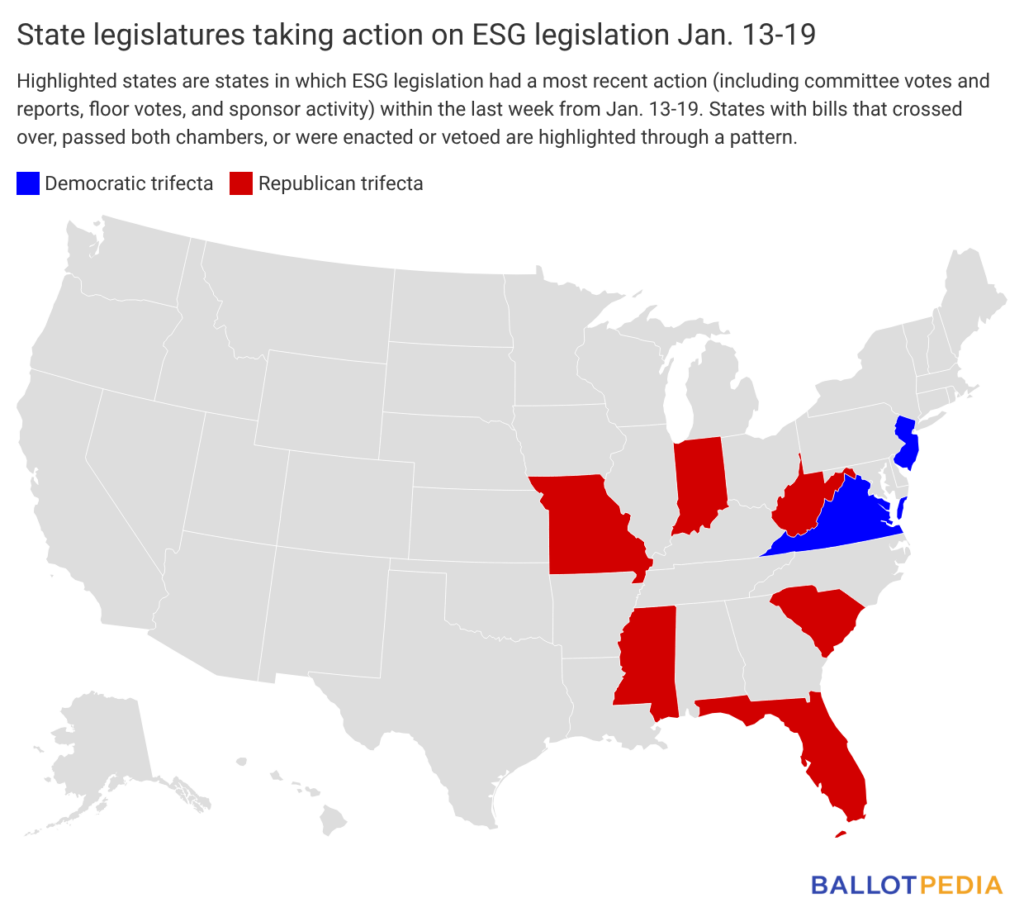

Eight states introduced 12 ESG-related bills last week (since Jan. 13). States with legislative activity on ESG last week are highlighted in the map below. Click here to see the details of each bill in the legislation tracker.

In the spotlight

New York Times says Wall Street retreated from climate pledges

What’s the story?

The New York Times published an analysis by climate reporter David Gelles on Jan. 17, 2026, arguing that Wall Street has largely abandoned its recent push to address climate change through ESG investing. The article traces the rise of ESG from January 2020, when BlackRock CEO Larry Fink pledged to use the firm’s assets to confront global warming, to what Gelles describes as a broad retreat from climate commitments by major financial institutions.

According to the article, large banks and asset managers initially joined net-zero alliances, pledged trillions in sustainable finance, and promoted ESG investing as central to their strategies. Gelles writes that many of those commitments have since been scaled back or abandoned, citing withdrawals from net-zero alliances, reduced support for climate-related shareholder proposals, and declining public emphasis on climate issues by financial firms.

Why does it matter?

The article frames Wall Street’s retreat as a response to sustained political and legal pressure, particularly from Republican state officials and conservative groups opposed to ESG investing. If accurate, the shift could affect the availability of capital for climate-focused investments and reshape how financial institutions approach climate risk and sustainability commitments.

The analysis also highlights the growing politicization of ESG in the U.S., where climate-related finance has become a target of state legislation, investigations, and litigation.