In this week’s edition of Economy and Society:

- JP Morgan Asset Management reduces restrictions on defense investment

- Republican attorneys general raise antitrust concerns with Ceres

- ESG legislation update

- Companies promoting ESG goals less, but continuing to meet them

- Study finds EU ESG rules had little effect on investors

- State financial officers group relaunches fiduciary network

Around the world

JP Morgan Asset Management reduces restrictions on defense investment

What’s the story?

JP Morgan Asset Management (JPMAM) lifted defense-related investment exclusions across dozens of its United Kingdom and European funds, allowing those funds to invest in a wider range of defense and aerospace companies, according to notices issued to shareholders. The changes apply to 95 Luxembourg-based funds, 29 Ireland-based funds, and five environmental, social, and corporate (ESG) funds in the United Kingdom. The notices cite “evolving client expectations relating to defence preparedness” and the changing regulatory environment as reasons for the updates.

The Luxembourg and Irish funds are described as Article 8 funds. The changes also include updates to how the funds apply restrictions connected to weapons-related revenue and nuclear weapons-related issuers. The set of affected funds includes JPMAM’s two largest exchange-traded funds in the region — the U.S. Research Enhanced Index Equity Active fund and a global equivalent — reported as $13 billion and $10 billion in size, respectively.

Why does it matter?

JPMAM’s move aligns it with other global asset managers that have revised ESG fund mandates to allow broader exposure to defense-related companies. Firms including Franklin Templeton, Columbia Threadneedle, DWS, and Allianz Global Investors have made similar changes as NATO member countries committed to increasing defense spending to 5% of GDP.

As defense spending increases across Europe, asset managers are revisiting how defense companies fit within ESG-labeled products, particularly those classified under Article 8 rather than stricter Article 9 standards.

What’s the background?

European ESG funds historically excluded weapons manufacturers, often grouping them with tobacco or fossil fuel companies. That approach began to change after Russia’s invasion of Ukraine, as European defense and aerospace stocks rose sharply and ESG funds expanded the number of defense companies eligible for investment and increased sector exposure.

Regulatory clarification at the European Union level reinforced that shift. The European Commission confirmed that nuclear weapons are not classified as prohibited weapons under EU sustainable finance rules and that mandatory ESG exclusions apply only to specific weapons banned under international law. As a result, ESG funds are not automatically barred from holding companies involved in recognized nuclear deterrence programs, leaving inclusion decisions to fund managers.

In October, JP Morgan also announced plans to invest $1.5 trillion over 10 years in U.S. industries described as critical to national economic security and resiliency.

In the states

Republican attorneys general raise antitrust concerns with Ceres

What’s the story?

On Jan 21, a coalition of Republican attorneys general, led by Florida Attorney General James Uthmeier (R), warned the climate advocacy group Ceres that its alleged efforts to pressure companies to adopt climate and net-zero policies may violate state antitrust and consumer protection laws. In a letter published by The Daily Wire, the officials said Ceres may be artificially influencing markets by coordinating pressure campaigns aimed at reshaping corporate behavior. Uthmeier said the group’s actions amounted to an “assault on American families and businesses” and warned that failure to change course could result in multistate enforcement actions.

Ceres denied the allegations in a statement, saying it has never violated U.S. antitrust or consumer protection laws. The group said it lawfully educates and engages investors and companies on business and financial issues, and that investment and corporate decisions are made independently and based on each firm’s own best interests.

Why does it matter?

The warning reflects growing Republican scrutiny of climate activism and ESG-related pressure on corporations, particularly when it involves coordinated investor or stakeholder campaigns. Republican officials argue that such efforts can distort markets, suppress competition, and undermine companies’ fiduciary duties. The dispute also highlights broader political and legal tensions over whether climate advocacy crosses the line into unlawful collusion when groups coordinate shareholder resolutions, investor engagement, or director replacement campaigns.

What’s the background?

Ceres describes itself as working to accelerate the transition to a cleaner and more resilient economy and has played a role in initiatives such as Climate Action 100+, an international initiative of asset managers, the signatories of which commit to using ESG investing approaches to investing approaches to influence high-emission companies to reduce their carbon output.

Republican attorneys general said the group’s strategy relies on coordinated pressure across financial institutions and companies, raising antitrust concerns. The letter asked Ceres to explain how its activities comply with antitrust and consumer protection laws.

ESG legislation update

Seven states took action on nine ESG-related bills last week (since Jan. 26). Eight of these bills were introduced.

On Jan. 21, Indiana’s HB1273, the Proxy Advisory Transparency Act, crossed over to the state Senate after previously passing the House. The bill would require proxy advisors to disclose whether ESG-related recommendations against company management are based on written financial analysis and share that information with stakeholders.

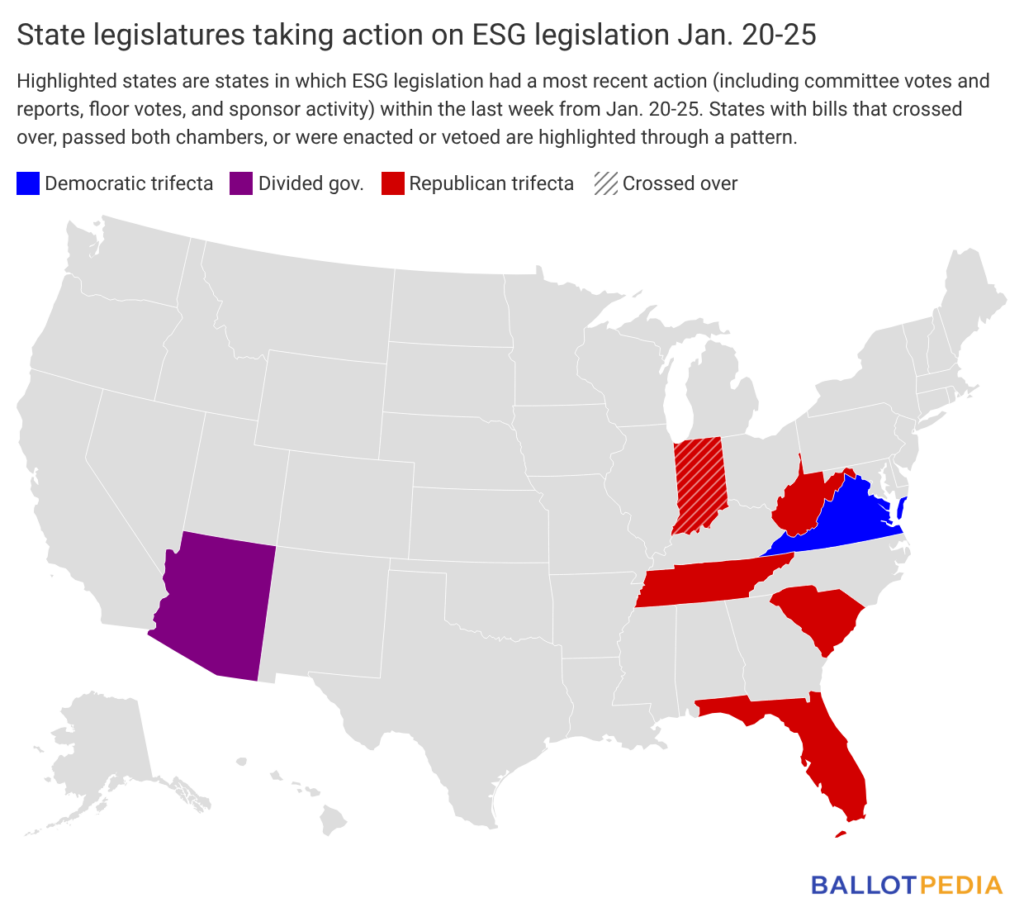

States with legislative activity on ESG last week are highlighted in the map below. Click here to see the details of each bill in the legislation tracker.

On Wall Street and in the private sector

Companies promoting ESG goals less, but continuing to meet them

What’s the story?

Large companies are using ESG-related terms less frequently in public-facing communications, according to a Conference Board analysis of S&P 100 sustainability reports. The analysis found that references to “ESG” declined in 2024 and early 2025 compared to previous years, even as many companies continued to disclose climate, energy transition, and net-zero goals.

Communications professionals interviewed by ESG Dive said companies are adjusting how they describe sustainability efforts rather than eliminating them. Ben Carr, a director at public relations and communications firm MHP Group, said companies are holding their sustainability strategies steady while reducing use of terms such as ESG, green, and eco-friendly in corporate messaging.

Why does it matter?

The shift in language reflects how political and regulatory scrutiny is affecting corporate communications around sustainability. Republican lawmakers and state officials have increased oversight of ESG-related policies, shareholder activism, and corporate climate commitments, prompting some companies to take a more cautious approach in how they describe those activities publicly.

Reduced use of ESG terminology may affect how investors and consumers assess corporate sustainability practices. Communications professionals interviewed by ESG Dive said companies are prioritizing descriptions tied to business strategy, risk management, and long-term operations rather than broad ESG labels, which have become politically charged.

What’s the background?

Scrutiny of ESG practices has intensified at both the state and federal levels, including investigations, legislation, and executive actions targeting ESG investing and corporate climate policies. Republican officials have argued that ESG considerations can conflict with fiduciary duties or distort markets, while companies and investors have said sustainability factors remain relevant to long-term financial performance.

At the same time, corporate climate commitments have continued to expand. Separate research cited in the article shows that a growing share of large global companies have adopted net-zero targets, even as public references to ESG terminology have declined. This divergence suggests that changes in corporate language have not necessarily been matched by changes in underlying sustainability strategies.

From the ivory tower

Study finds EU ESG rules had little effect on investors

What’s the story?

A January 2026 working paper from the National Bureau of Economic Research examined whether the European Union’s Sustainable Finance Disclosure Regulation changed investor behavior or fund sustainability. The authors analyzed European mutual fund data and conducted investor surveys and experiments. They found that the regulation, which classifies funds as Article 6, 8, or 9 based on sustainability characteristics, had little effect on mutual fund flows or portfolio sustainability after it took effect in March 2021.

Why does it matter?

The findings suggest that the EU’s ESG disclosure framework did not meaningfully change how investors allocate capital. Although surveyed investors said they care about sustainability, the study found that SFDR classifications provided limited new information beyond what investors could already infer from fund names, mandates, and existing ratings. As a result, the regulation did not lead to measurable shifts in fund flows or portfolio composition, indicating limits to disclosure-based approaches as tools to influence investor behavior or reduce greenwashing.

What’s the background?

The EU adopted the Sustainable Finance Disclosure Regulation to increase transparency and reduce misleading sustainability claims in financial products. The rules require asset managers to classify funds and disclose sustainability risks and impacts, imposing significant compliance costs. According to the study, many funds already followed sustainability mandates before the regulation took effect, and investors struggled to understand the Article 6, 8, and 9 classifications, limiting the regulation’s practical impact.

In the spotlight

State financial officers group relaunches fiduciary network

What’s the story?

The State Financial Officers Foundation (SFOF) is relaunching its Public Fiduciary Network (PFN) this week, beginning with an online meeting open to public fiduciaries. The network expands the group’s reach beyond state treasurers and auditors to include county, municipal, and other public financial officers and staff. According to the organization, the network will provide education and training focused on traditional fiduciary duties, which it says are increasingly important amid debates over ESG policies and concerns about state and local government-assistance fraud.

Why does it matter?

The relaunch reflects continued efforts by some state-level financial officials and advocacy groups to push back against ESG practices in public finance. Supporters of the initiative argue that pension and public fund managers should prioritize fiduciary duty, generally defined as acting solely in the financial interests of beneficiaries, rather than incorporating political or social objectives into investment decisions.

What’s the background?

In May 2024, the SFOF announced the formation of two affiliated organizations: SFOF Action, a 501(c)(4) political arm, and the PFN. SFOF Action was created to engage in lobbying and political activity in defense of state financial officers opposed to ESG investment strategies, while the PFN was established to educate public fiduciaries about ESG considerations in public pension funds and to oppose what the group describes as politicized investing.