In this week’s edition of Economy and Society:

- SEC reviews ESG disclosure rule

- European Central Bank issues climate-risk fine

- New York Senate passes $1B emissions reporting bill

- Anti-ESG laws in other states face new legal challenge

- Disney adds three anti-ESG proposals to ballot

In Washington, D.C.

SEC reviews ESG disclosure rule

What’s the story?

Securities and Exchange Commission (SEC) Chairman Paul Atkins testified Feb. 11 before the U.S. House Financial Services Committee that the agency is reviewing regulations adopted during the Biden administration, including the 2023 amendments to the Investment Company Names rule (Names rule). When asked about rules finalized under former SEC Chairman Gary Gensler, Atkins said he asked division directors and staff to review existing regulations and that the Names rule is one example.

The 2023 amendments require certain funds whose names suggest a focus on a particular type of investment — such as environmental, social, and governance (ESG) strategies — to invest at least 80% of their assets in line with that focus. Atkins did not provide a timeline for the review.

Why does it matter?

Revisiting the Names rule would continue the SEC’s shift away from Biden-era ESG-related regulations. The 2023 amendments sought to address greenwashing — when funds use sustainability-related language that may not reflect their actual holdings.

If the Commission rolls back or revises the rule, it could change how ESG-labeled funds market themselves and how strictly the 80% investment requirement is enforced. It would also signal further regulatory changes at the SEC.

What’s the background?

The SEC adopted Rule 35d-1, known as the Names rule, in 2001 to prevent materially deceptive or misleading fund names. The rule requires funds whose names suggest a specific investment focus to invest at least 80% of assets in line with that focus. In October 2023, the SEC amended the rule to expand its scope, including funds using ESG-related terms. The amendments took effect Dec. 11, 2023.

Around the world

European Central Bank issues climate-risk fine

What’s the story?

On Feb. 16, 2026, the European Central Bank (ECB) said that it had fined Paris-based bank Crédit Agricole more than €7.5 million (about $9 million) for failing to meet a deadline to assess the materiality of its climate-related and environmental risks. Materiality refers to whether a risk is significant enough to affect a bank’s financial condition or business operations.

According to the ECB, the bank was required to complete the assessment by May 31, 2024, but missed the deadline by 75 days. The ECB said the penalty reflects factors including the materiality of the breach, its duration, and the bank’s daily turnover, the average amount of revenue the bank generates per day.

Crédit Agricole acknowledged the decision but described the penalty as administrative and said the ECB had recognized the difficulty of responding to the request within the timeline.

Why does it matter?

The fine follows previous ECB supervisory guidance by and climate stress tests. Banks operating in the euro area are required to identify and assess climate and environmental risks as part of broader risk-management expectations.

The ECB's action also reinforces that missing reporting or assessment deadlines, even when tied to complex climate-risk methodologies, can result in financial penalties. The ECB has indicated it would continue using climate oversight into its supervisory priorities for 2026.

What’s the background?

The ECB began formal climate-risk supervision in 2020, when it published a guide outlining expectations for how banks should manage climate-related and environmental risks. In 2022, the ECB conducted a climate stress test and later sent feedback letters to banks with timelines for compliance. The ECB would apply binding requirements, including periodic penalty payments, when banks do not meet deadlines.

The penalty marks the second time the ECB issued a climate-risk-related fine. In November 2025, the ECB fined Spanish bank ABANCA €187,650.

In July 2025, the ECB said banks had made progress in integrating climate risk into risk-management but noted areas requiring further improvement.

In the states

New York Senate passes $1 billion emissions reporting bill

What’s the story?

The New York Senate passed Senate Bill 9072A, the Climate Corporate Data Accountability Act, on Feb. 10, 2026, by a 40–22vote. The vote fell along party lines, with Democrats in favor and Republicans opposed.

The bill would apply to companies that do business in New York and generate more than $1 billion in annual revenue. It would require annual public disclosure of:

- Scope 1 emissions — direct emissions from company operations, beginning in 2028

- Scope 2 emissions — emissions from purchased electricity, steam, heating, or cooling, beginning in 2028

- Scope 3 emissions — indirect emissions from supply chains and product use, beginning in 2029

The measure now moves to the New York Assembly, where a companion bill has been introduced.

Why does it matter?

The vote adds momentum to state-level climate reporting efforts and signals that large-market states may move forward with corporate disclosure requirements independent of federal rulemaking.

If enacted, the measure would require affected companies to formalize emissions tracking and disclosure practices in one of the country’s largest state economies. Businesses that operate in multiple states would need to coordinate reporting systems across jurisdictions if similar laws are adopted elsewhere.

What’s the background?

New York’s proposal mirrors California’s Senate Bill 253, the Climate Corporate Data Accountability Act, which Gov. Gavin Newsom (D) signed into law in October 2023. SB 253 requires companies doing business in California with more than $1 billion in annual revenue to disclose emissions.

California also enacted Senate Bill 261, the Climate-Related Financial Risk Act, in October 2023. It required companies with more than $500 million in annual revenue doing business in California to disclose climate-related financial risks and mitigation strategies.

Business groups challenged both laws in federal court. In November 2025, the U.S. Court of Appeals for the Ninth Circuit temporarily blocked enforcement of SB 261 while litigation proceeds. The order did not apply to SB 253’s emissions disclosure requirements.

Anti-ESG laws in other states face new legal challenge

What’s the story?

Analysts said a recent U.S. District Court ruling striking down Texas’ 2021 Energy Discrimination Elimination Act would affect similar anti-ESG laws in other states, according to Reuters. In a Feb. 4, 2026 decision, Judge Alan Albright of the U.S. District Court for the Western District of Texas ruled that SB 13 violates the First Amendment because it penalizes companies for speech and association related to fossil fuels.

Reuters reported that Bryan McGannon, of the U.S. Sustainable Investment Forum, said the decision provides a roadmap for challenges to comparable laws in other states. McGannon said, "The ruling's challenge to the faulty premise that climate or ESG considerations must be motivated by social or political purposes and ignores 'ordinary business purpose' clears the way to contest many anti-ESG laws,"

Why does it matter?

Texas’ 2021 law restricted state contracts and public investments with financial firms the state determined were boycotting energy companies. It became one of the earliest and most closely watched state laws opposing ESG investment practices, which consider nonfinancial risks such as climate exposure.

Reuters reported that about 14 other states adopted similar measures after Texas enacted its law, including Oklahoma, Kentucky, West Virginia, Tennessee, and Utah. If courts apply the same First Amendment reasoning elsewhere, the ruling could affect those statutes and shape how states use contracting and investment authority in disputes over fossil fuel policy.

What’s the background?

Governor Greg Abbott (R) signed SB 13 into law on June 14, 2021. It prohibited state agencies and public investment funds from contracting with or investing in companies deemed to be boycotting fossil fuel firms and directed the Texas comptroller to maintain a public list of those companies.

The American Sustainable Business Coalition filed suit in 2024 against then-Texas Comptroller Glenn Hegar (R) and Attorney General Ken Paxton (R), alleging violations of the First and Fourteenth Amendments. In his 12-page summary judgment order, Judge Albright said the statute’s definition of boycotting was overly broad and allowed the state to penalize protected speech, raising due process concerns.

Paxton said the state would appeal the ruling.

ESG legislation update

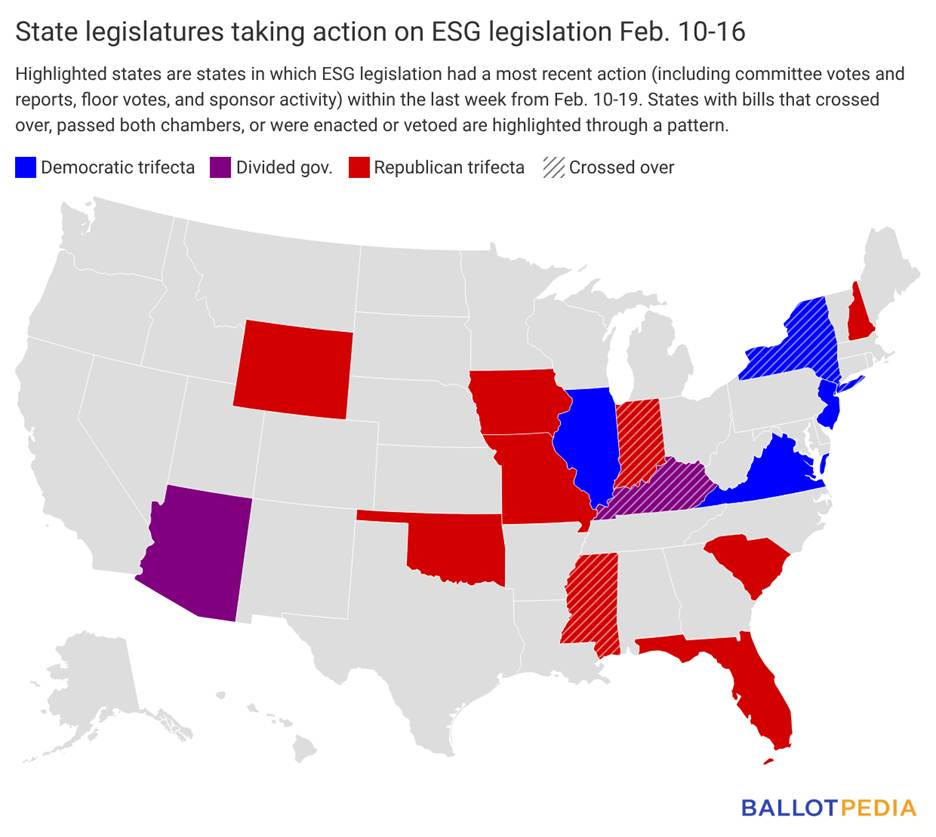

Fifteen states took action on 27 ESG-related bills last week (since Feb. 10).

States with legislative activity on ESG last week are highlighted in the map below. Click here to see the details of each bill in the legislation tracker.

On Wall Street and in the private sector

Disney adds three anti-ESG proposals to ballot

What’s the story?

According to Governance Intelligence, the Walt Disney Company said it will include three anti-ESG shareholder proposals in its 2026 annual meeting materials after previously filing SEC no-action requests to exclude them. Disney’s annual meeting is scheduled for Mar. 18, 2026, and the ballot will include four shareholder proposals total. Bowyer Research, the National Center for Public Policy Research, and the National Legal and Policy Center submitted the three anti_ESG proposals.

Disney shifted course after the SEC said it would not respond to no-action requests during the 2026 proxy season. Governance Intelligence reported Disney said the National Center for Public Policy Research and Bowyer Research proposals did not comply with proxy rules and included misleading statements, but Disney chose to include them to avoid legal exposure.

Why does it matter?

The SEC’s decision not to respond to most no-action requests shifts responsibility for exclusion decisions from agency staff to companies. Without informal SEC views, companies must decide independently whether a shareholder proposal qualifies for exclusion under Rule 14a-8.

That change increases legal risk for companies that choose to omit proposals. As a result, firms may opt to include disputed proposals rather than risk litigation. The shift could affect how many ESG-related proposals appear on corporate ballots during the 2026 proxy season.

What’s the background?

Rule 14a-8 allows shareholders who meet certain ownership thresholds to submit proposals for inclusion in a company’s proxy statement. Companies that believe a proposal may be excluded typically request a no-action letter from SEC staff indicating whether the agency would recommend enforcement if the proposal is omitted.

On Nov. 17, 2025, the SEC said it would not respond to most no-action requests during the 2025–26 season and would provide views only on exclusion requests involving a company’s jurisdiction under state law. The agency said the change stems from resource constraints and the availability of existing guidance.