The deadline to qualify or withdraw a ballot initiative from the California ballot was June 27. This cycle, 12 ballot initiatives qualified for the ballot, but by the deadline, only five remained on the ballot. Six California ballot initiatives were withdrawn after qualifying for the ballot—the most since the practice was authorized in 2014 for initiated laws and amendments and 2023 for veto referendums.

Proponents withdrew the following six after compromises were reached with the governor and state legislature or the campaign announced a different strategy:

- Pandemic Early Detection and Prevention Institute Initiative

- Employee Civil Action Law and PAGA Repeal Initiative

- Require Personal Finance Course for High School Graduation Initiative

- Changes to the State Children's Services Program Initiative

- Oil and Gas Well Regulations Referendum

- Fast Food Restaurant Minimum Wage and Labor Regulations Referendum

A seventh ballot initiative that would have increased vote requirements for new state and local taxes was removed from the ballot by the state Supreme Court after it determined that the measure amounted to a constitutional revision, which cannot be enacted via citizen initiative.

The campaigns behind the withdrawn or disqualified initiatives reported receiving a total of $180.5 million in contributions through March 31. The campaign, Save Local Restaurants, which sponsored a veto referendum against the fast food minimum wage law, reported the most with $71.7 million.

The five remaining ballot initiatives include changes to Proposition 47 (2014) resulting in increased drug and theft penalties; an $18 minimum wage increase; permanent authorization of a tax on managed care organizations to fund Medi-Cal programs; prohibiting state limits on local rent control; and requiring health care providers to spend 98% of revenues from the federal discount prescription drug program on direct patient care.

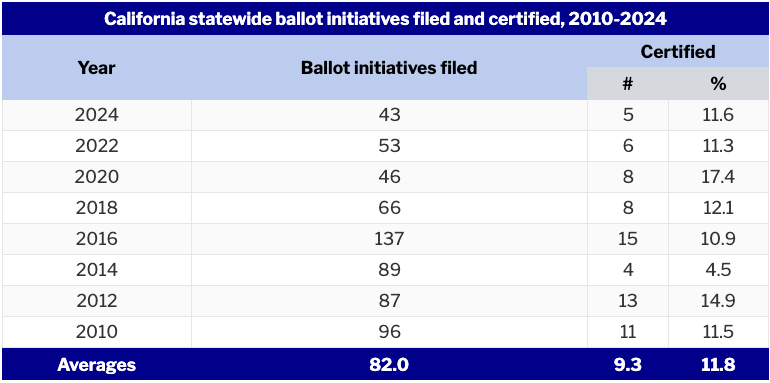

The table below shows the number of initiatives filed per election cycle and the number ultimately certified for the ballot.

Since sponsors have been able to withdraw ballot initiatives ahead of the deadline, 14 citizen initiatives have been withdrawn from 2016 to 2024.

In addition to the five initiatives, the state legislature voted to send four legislatively referred constitutional amendments to the ballot in November:

- to establish a right to marry and repeal Proposition 8 (2008);

- to require initiatives that change vote thresholds to supermajority votes to pass by the same vote requirement as is being proposed;

- to remove involuntary servitude as punishment for crime; and

- to lower the vote threshold from 66.67% to 55% for local bond measures to fund housing projects and public infrastructure.

Democratic legislators also announced their intent to put a competing measure related to drug and theft crimes on the ballot by July 4. The legislatively referred state statute would increase penalties for repeated theft if the offenses occur within three years of each other. It would also increase penalties for fentanyl dealers. The bill also includes a provision stating that any initiatives related to similar subjects are wholly in conflict with the legislative referral and would be void if the referral passes with more affirmative votes than the ballot initiative. This would apply to the initiative that proposes changes to Proposition 47.

The amendment to change vote thresholds for initiatives enacting supermajorities may be moved to the Nov. 3, 2026 ballot. The state legislature introduced Assembly Bill 440 on June 27, which would waive the provision in state election code that requires legislatively referred constitutional amendments to be on the ballot of the first statewide election occurring at least 131 days after its adoption by the state legislature. The amendment was proposed in response to the initiative that would have increased vote requirements for new taxes but was ultimately removed from the ballot by the Supreme Court.

A fifth legislative referral was withdrawn by its sponsor on June 24 that would have repealed Article 34, which requires local voter approval via a ballot measure for federal and/or state government-funded housing projects classified as low rent. Sen. Ben Allen (D), one of the sponsors of the amendment, explained the removal saying, "While (the repeal) was one of many efforts to help address the housing crisis, the November ballot will be very crowded and reaching voters will be difficult and expensive.”

In California, an average between eight and nine measures appear on statewide ballots each cycle. Between 1985 and 2022, a total of 402 measures appeared on statewide ballots with 231 approved and 171 defeated by voters.

Editor's note: this post originally reported that one of the legislatively referred constitutional amendments proposed lowering the vote threshold to pass special taxes. It has been updated to reflect that the amendment proposes lowering the vote threshold for bond measures.