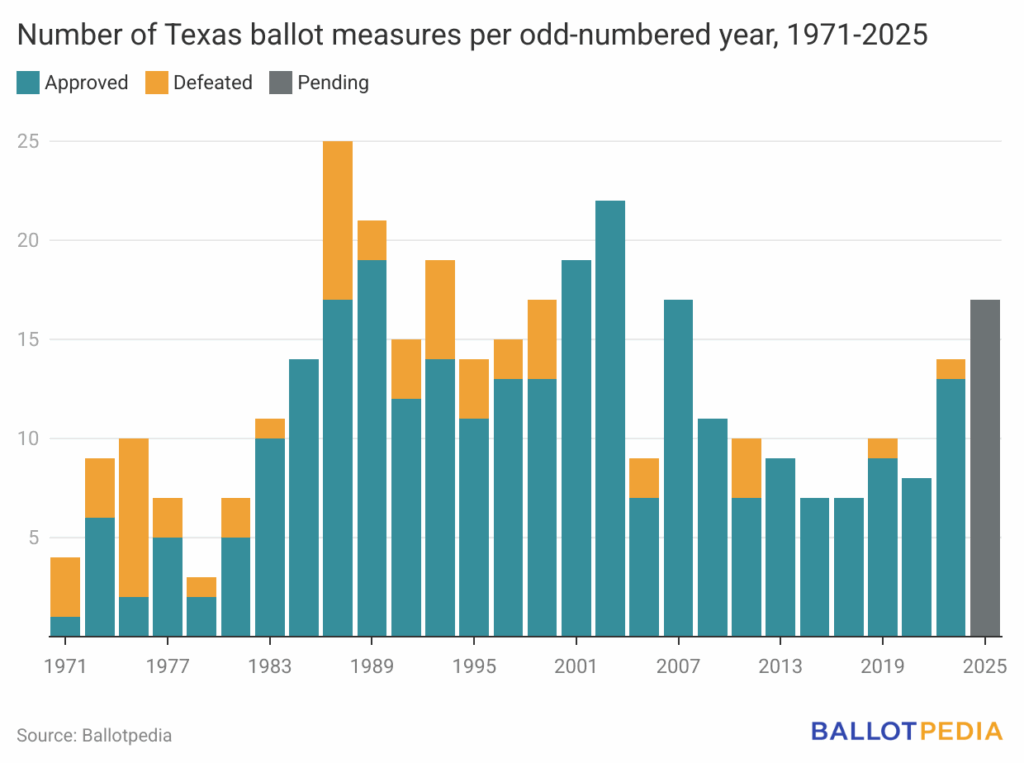

The 89th Regular Session of the Texas State Legislature adjourned on June 2. During the 140-day session, legislators referred 17 constitutional amendments to the Nov. 4, 2025, ballot—the highest number for a single election date in more than two decades. As Republicans hold majorities in both chambers but lack the two-thirds required to refer constitutional amendments, at least some Democratic support was required for each measure to advance to the ballot.

The constitutional amendments cover a range of policy areas, including homestead and property tax exemptions, bans on certain types of taxes, citizenship requirements for voting, parental rights, the judicial oversight commission, bail procedures, dementia research funding, and more.

Legislative Referrals and Partisanship

In Texas, the state legislature can place a constitutional amendment on the ballot with a two-thirds vote in a single legislative session—at least 100 votes in the House and 21 in the Senate, assuming no vacancies. While Republicans control both chambers of the Texas Legislature, they are currently 12 seats short of the two-thirds majority needed in the House and one seat short in the Senate to refer constitutional amendments to the ballot on their own. At least some Democratic votes are needed to place amendments on the ballot.

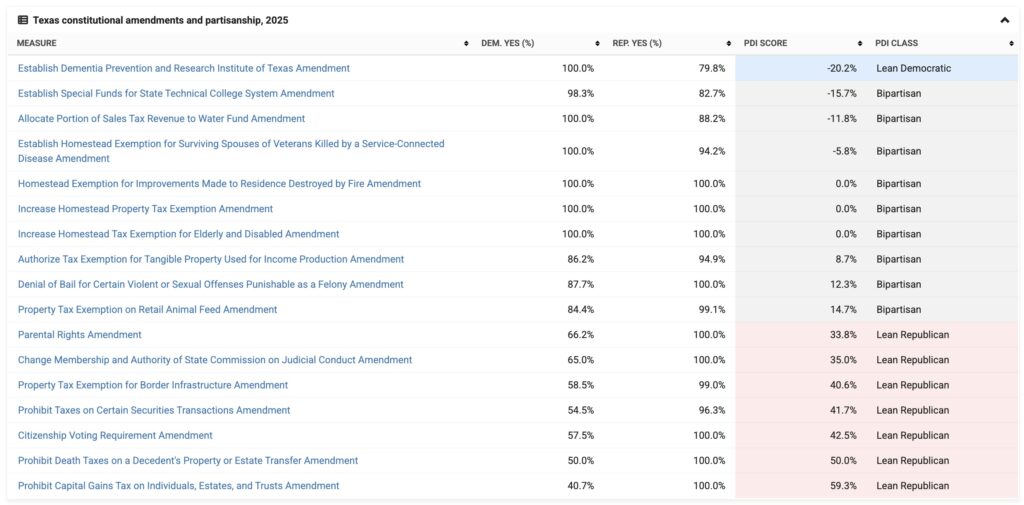

Of the 17 constitutional amendments placed on the ballot, nine received bipartisan support, defined as having less than a 20 percentage point difference between Republican and Democratic 'yes' vote rates. Three of those nine received unanimous support from all voting members. All three amendments that received unanimous support related to homestead exemptions.

Seven amendments were classified as lean Republican, meaning the Republican 'yes' vote rate exceeded the Democratic rate by between 20 and 60 percentage points. The largest difference (59.3 percentage points) was for the amendment to prohibit the legislature from enacting a tax on realized or unrealized capital gains for individuals, families, estates, or trusts, including taxes on the sale or transfer of capital assets. The parental rights and citizenship voting requirement amendments were also classified as lean Republican.

One amendment was classified as lean Democratic, receiving greater support from Democratic than Republican legislators, despite Republican control of the legislature. The amendment would establish the Dementia Prevention and Research Institute of Texas and allocate $3 billion from the general fund. It received support from 100% of Democratic legislators and 79.8% of Republican legislators.

Historical Context

With 17 constitutional amendments on the ballot, this is the most Texas has had in a single year since 2007, when voters also decided on 17 amendments. However, in 2007, the measures were split between two election dates. Seventeen is the highest number certified for a single election date since 2003, when 22 measures appeared on the ballot.

Since Texas adopted its current constitution in 1876, voters have decided 711 statewide ballot measures—all of them constitutional amendments. Of those, 530 (74.5%) were approved, resulting in 530 amendments to the constitution, while 181 (25.5%) were rejected.

Between 1876 and the 1970s, Texas averaged fewer than 10 ballot measures in odd-numbered years. That changed in the 1980s, when the average rose to 16 per odd-numbered year. The average stayed at 16 during the 1990s and 2000s, then dropped to 9 in the 2010s. So far in the 2020s, the average is 13.

The 17 Amendments

The Texas State Legislature referred the following 17 constitutional amendments to the ballot for Nov. 4, 2025:

- SJR 34 (Parental Rights): The amendment would provide that parents have the right "to exercise care, custody, and control of the parent’s child, including the right to make decisions concerning the child’s upbringing" and the responsibility "to nurture and protect the parent's child." The last state to vote on a parental rights amendment was Colorado in 1996, where voters rejected the initiative.

- SJR 37 (Citizenship Voting Requirement): The amendment would add noncitizens to the list of persons prohibited from voting under Section 1, Article 6 of the Texas Constitution. From 2018 to 2024, voters approved 14 ballot measures that added language to their state constitutions about citizenship requirements for voting.

- SJR 5 (Denial of Bail): The amendment would allow a judge to deny bail for individuals accused of certain crimes if there is clear and convincing evidence that the person might fail to appear in court or pose a threat to the community, law enforcement, or the victim. The amendment would apply to charges including murder, capital murder, certain forms of aggravated assault, aggravated kidnapping, robbery, sexual assault, indecency with a child, and human trafficking.

- SJR 27 (Judicial Conduct Commission): The amendment would change the composition of the 13-member State Commission on Judicial Conduct, including increasing the governor's appointees from five to seven members, and the composition of the tribunal that reviews the commission's recommendations.

- SJR 3 (Dementia Prevention and Research Institute): The amendment would establish the Dementia Prevention and Research Institute of Texas with $3 billion from the general fund.

- HJR 7 (Sales Tax Revenue for Water Fund): The amendment would allocate the first $1 billion of sales tax revenue each fiscal year, after collections exceed $46.5 billion, to the state water fund and allow the legislature to change the $1 billion allocation amount with a two-thirds vote.

- SJR 59 (Technical College System Special Funds): The amendment would create two special funds—the Permanent Technical Institution Infrastructure Fund and the Available Workforce Education Fund—outside the General Revenue Fund to support capital projects for the Texas Technical College System.

- HJR 2, HJR 4, and SJR 18 (Constitutional Bans on Certain Taxes): These three amendments prohibit state taxes on certain financial assets, transactions, or occupations. HJR 2 would prohibit the state from enacting an estate tax and would prohibit the legislature from enacting new taxes, not in effect as of Jan. 1, 2025, on the transfer of an estate, inheritance, or gift. HJR 4 would prohibit an occupation tax on registered securities market operators or a tax on securities transactions. SJR 18 would prohibit state taxes on realized or unrealized capital gains for individuals, families, estates, or trusts, including taxes on the sale or transfer of capital assets.

- HJR 133, SJR 2, SJR 84, and SJR 85 (Homestead Tax Exemptions): These four amendments affect how property taxes are applied to primary residences, also known as homesteads. SJR 2 would increase the general homestead property tax exemption for school district taxes from $100,000 to $140,000. SJR 85 would increase the homestead property tax exemption for school district taxes from $10,000 to $60,000 for individuals who are age 65 or older or disabled. HJR 133 would allow the legislature to create a homestead tax exemption for a surviving spouse of a veteran who died from a service-connected illness. SJR 84 would allow the legislature to create a temporary homestead tax exemption for improvements to homes that were completely destroyed by a fire.

- HJR 1, HJR 34, and HJR 99 (Property Tax Exemptions): These three amendments authorize the legislature to create new property tax exemptions, other than the homestead tax exemptions described above. HJR 1 would allow the legislature to exempt up to $125,000 of the market value of income-producing personal property from property taxes. HJR 34 would allow the legislature to exempt from taxes increases in a property's value, located in a county bordering Mexico, that result from the construction or installation of border security infrastructure. HJR 99 would allow the legislature to exempt animal feed held for retail sale from property taxes.

Additional reading: