What's the story?

President Donald Trump (R) signed the formerly titled One Big Beautiful Bill Act (OBBB) into law on July 4, enacting the first federal private school choice program. Under the program:

- Donors can lower their tax liability by $1 for every $1 donated to accredited Scholarship-Granting Organizations (SGOs) up to $1,700 for individual filers.

- Scholarships will be available to families earning up to 300% of the median income in their region to cover private school tuition and other qualified educational expenses, including fees, tutoring, educational therapies, transportation, and technology. In participating states, scholarships may also help cover supplemental costs for students enrolled in public schools.

- States can opt in or out of the school choice program—it's not mandatory.

The tax credit program will apply to donations made starting in 2027.

What's the background?

The bill passed the U.S. House of Representatives 215-214 on May 22, with 213 Republicans supporting it and two Republicans and all Democrats opposing. The U.S. Senate passed the bill 51-50 on July 1, with 50 Republicans supporting it and three Republicans joining all 47 Democrats to oppose it; Vice President J.D. Vance (R) cast the tiebreaking vote to pass the bill.

The enacted version of the bill contained different provisions from the version that was originally introduced in the House. The introduced version included the following provisions, which were later amended:

- Donors could have lowered their tax liability $1 for every $1 donated to accredited Scholarship-Granting Organizations (SGOs) up to 10% of their adjusted gross income or $5,000 for individual filers.

- The total amount of credits would have been capped at $5 billion through 2029, with 5% annual increases after.

- The scholarships would have been capped at $5,000 per student.

- The scholarships would have been explicitly available to homeschooling families.

- Private schools receiving money from the scholarships would have been required to provide accommodations to students with disabilities.

What's an education tax credit program?

Education tax credits allow corporations and individuals to receive tax credits for contributing to scholarship programs. Some states also have policies allowing individuals to write off approved educational expenses from their state income taxes.

There are three different types of education tax credit programs:

- Tax-Credit Education Savings Accounts (ESAs): Tax-credit ESAs allow taxpayers to receive full or partial tax credits when they donate to nonprofit organizations that fund and manage parent-directed K-12 education savings accounts.

- Tax-Credit Scholarships: Tax-credit scholarships allow taxpayers to receive full or partial tax credits when they donate to nonprofits that provide private school scholarships. Eligible taxpayers can include both individuals and businesses.

- Individual K–12 Tax Credits and Deductions: Tax credits and deductions allow parents to receive state income tax relief for approved educational expenses, which can include private school tuition, books, supplies, computers, tutors, and transportation. Tax credits lower the total taxes a person owes; a deduction reduces a person’s total taxable income.

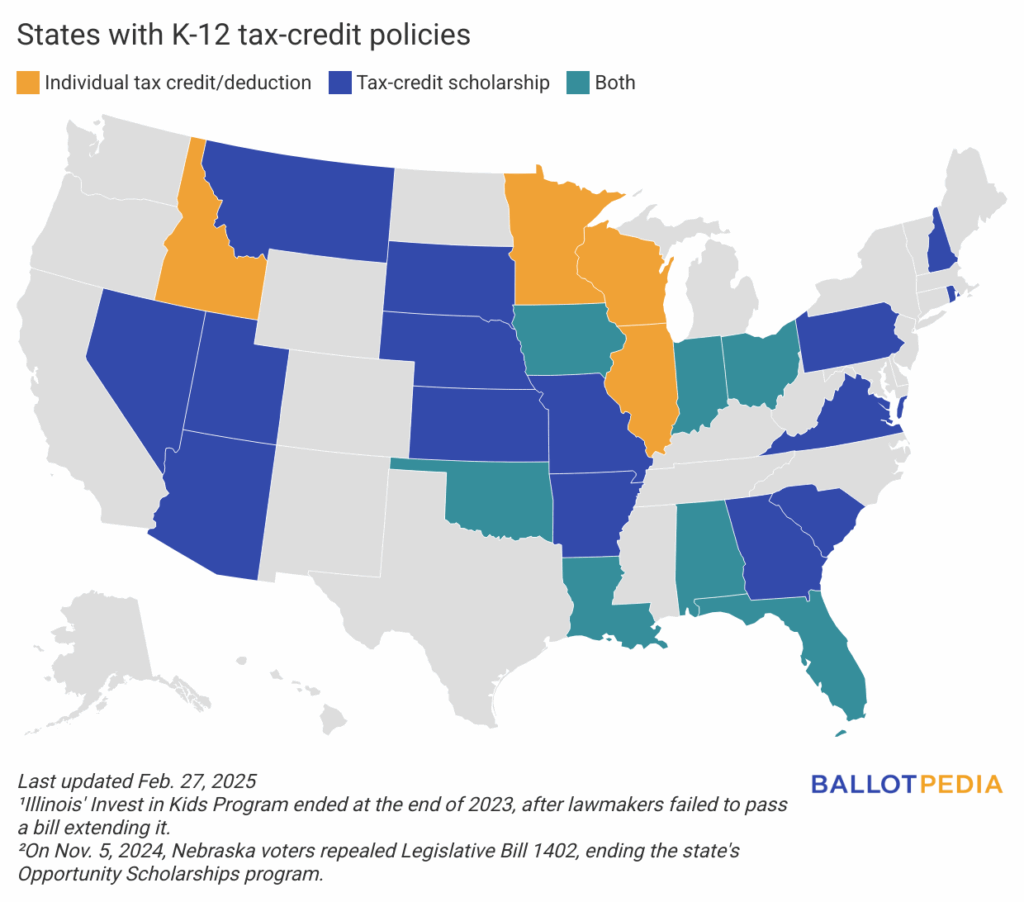

Twenty-five (25) states ran 38 education tax credit programs as of June 2025.

Additional reading