In this week’s edition of Economy and Society:

- EU adopts voluntary standards for carbon removal

- Judge blocks Texas fossil fuel boycott law

- ESG legislation update

- Global ESG funds record $84 billion in outflows in 2025

- Fortune 500 participation in HRC equality index drops 65%

- ESG-skeptic discusses proxy strategy

Around the world

EU adopts voluntary standards for carbon removal

What’s the story?

On Feb. 3, 2026, the European Commission announced that it adopted voluntary standards for carbon removal projects, creating a framework to enable certification and investment in permanently remove carbon dioxide from the atmosphere. The Commission adopted the standards under the Carbon Removals and Carbon Farming (CRCF) Regulation, enabling third-party certification schemes to certify qualifying projects for investment.

The standards apply to three types of projects that permanently remove carbon dioxide from the atmosphere:

- Direct air capture with carbon storage (DACCS): removes carbon dioxide from the air and stores it underground.

- Biogenic emissions capture with carbon storage (BioCCS): captures carbon dioxide from biological sources and stores it underground.

- Biochar carbon removal: converts biomass into biochar ((a form of charcoal) to keep carbon out of the atmosphere long term.

According to the Commission, the standards are voluntary and are intended to provide clear, legally grounded definitions that would help prevent greenwashing while supporting the development of a carbon removal market in the European Union.

Why does it matter?

The adoption of the methodologies allows carbon removal projects to apply for EU certification. Certification would make projects easier for investors and buyers to evaluate and compare, potentially lowering barriers to private investment.

The rules also establish a common reference point for how permanent carbon removals are defined and verified, which the Commission said would support the European Union’s (EU) climate-neutrality objective for 2050 and provide greater confidence in claims related to carbon removal.

What’s the background?

The European Union established the CRCF in December 2025, creating a voluntary framework to certify carbon removals, carbon farming, and carbon storage in products.

The delegated regulation will be transmitted to the European Parliament and the Council of the EU for a two-month scrutiny period, which may be extended. Absent objections, it is expected to take effect in April 2026.

In the states

Judge blocks Texas fossil fuel boycott law

What’s the story?

A U.S. district court judge last week struck down Texas Senate Bill 13, a 2021 law restricting state contracts and investments with companies that boycott fossil fuel businesses. U.S. District Judge Alan Albright, of the U.S. District Court for the Western District of Texas, ruled on Feb. 4, 2026, that the law violates the First and Fourteenth Amendments and is unconstitutional and unenforceable.

SB 13 prohibited state agencies and public investment funds from entering into contracts with or investing in companies that refuse to do business with fossil fuel firms. The law also directed the Texas comptroller to maintain a public list of companies deemed to be boycotting the fossil fuel industry.

In a 12-page summary judgment order, Albright said the statute’s definition of boycotting was overly broad and not susceptible to objective measurement. He wrote that the law permitted the state to penalize companies for free speech related to fossil fuels and raised due process concerns.

Why does it matter?

The ruling limits how far states can go in using contracting and investment decisions to influence corporate positions on climate and energy policy. Texas SB 13 was one of the most prominent state-level laws opposing environmental, social, and governance (ESG) investing, a framework that considers nonfinancial risks such as climate exposure.

The decision also affects public pension funds. After SB 13 took effect, large Texas investment funds, including the Teacher Retirement System of Texas, withdrew billions of dollars from financial firms. The court found the law’s enforcement had already resulted in discriminatory effects.

Acting Texas Comptroller Kelly Hancock (R) said the state would appeal, saying Texas has authority to protect its energy industry and prevent investment firms from using public funds to advance political agendas.

What’s the background?

Republican lawmakers passed SB 13 amid broader opposition to ESG investing, particularly among Republican-controlled states. Supporters said the law would protect Texas’ oil and gas industry from financial discrimination.

The American Sustainable Business Coalition filed suit in 2024 against then-Texas Comptroller Glenn Hegar (R) and Attorney General Ken Paxton (R), alleging violations of free speech and due process. The coalition sought summary judgment on several claims in January 2025, which Albright granted last week.

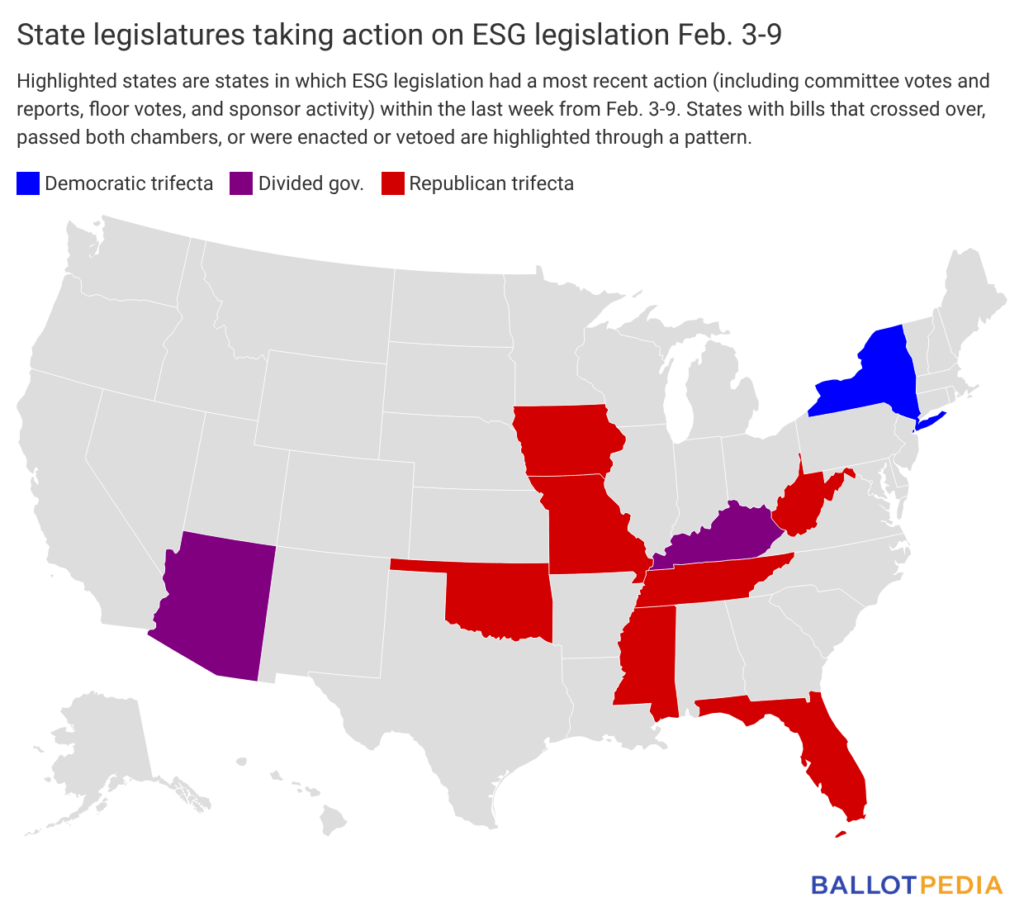

ESG legislation update

Ten states took action on 29 ESG-related bills last week (since Feb. 3). States with legislative activity on ESG last week are highlighted in the map below. Click here to see the details of each bill in the legislation tracker.

On Wall Street and in the private sector

Global ESG funds record $84 billion in outflows in 2025

What’s the story?

Global sustainable mutual funds and exchange-traded funds recorded $84 billion in net outflows in 2025, marking the first year of annual outflews since 2018, according to Morningstar data published Feb. 4. The fourth quarter saw $27 billion in outflows globally.

Why does it matter?

In the United States, sustainable funds experienced their 13th consecutive quarter of outflows, with $4.6 billion in redemptions in the fourth quarter and $21 billion for the full year. Despite the outflows, total US sustainable fund assets reached a record $368 billion at year-end, driven by stock market appreciation.

Europe had $20 billion in outflows in the fourth quarter and $49.6 billion in the third quarter. Morningstar attributed a substantial portion of European outflows to large UK institutional investors, including BlackRock, redeeming from pooled ESG funds and reallocating into bespoke ESG accounts that are segregated and not tracked in Morningstar's database.

What’s the background?

The 2025 outflows followed $38 billion in global inflows in 2024. This was the third consecutive year of outflows for US sustainable funds and the first year of outflows for Europe and the rest of the world. Global ESG funds also had outflows in the third quarter of 2025, marking the beginning of sustained redemptions for the year.

Europe accounts for approximately 86% of global sustainable fund assets, with the US accounting for 9%. Sustainable funds represent about 20% of the overall European fund universe, compared with 1% in the US.

Fortune 500 participation in HRC equality index drops 65%

What’s the story?

Fortune 500 companies' participation in the Human Rights Campaign's Corporate Equality Index fell 65% in 2026, according to data released Feb. 4, 2026 from the LGBTQ advocacy organization. The number of Fortune 500 companies participating in the annual survey dropped from 377 in 2025 to 131 in 2026. HRC said many companies that withdrew hold federal contracts.

Overall, 1,450 companies participated in the 2026 index, with 534 earning a score of 100 and receiving HRC's Equality 100 Award as Leaders in LGBTQ+ Workplace Inclusion. The participating companies collectively employ more than 22 million U.S. workers.

Why does it matter?

The drop in participation follows a period in which multiple major corporations, including Walmart, Ford, and Lowe's, publicly ended their participation in the index. According to CNBC, some of these companies said they had conversations with conservative activist Robby Starbuck before withdrawing.

HRC's separate State of the Workplace report found that 54% of workers at organizations that scaled back diversity and inclusion efforts reported experiencing stigma or bias in the past year, more than double the 25% rate at organizations that maintained inclusion practices.

What’s the background?

The Corporate Equality Index launched in 2002 and has become a target of anti-DEI (diversity, equity, and inclusion) advocacy in recent years and multiple major corporations withdrew from the index in 2024

The Trump administration has taken sweeping action against DEI programs. President Trump (R) signed executive orders on Jan. 20 and Jan. 21, 2025, titled "Ending Radical and Wasteful Government DEI Programs and Preferencing" and "Ending Illegal Discrimination and Restoring Merit-Based Opportunity." The orders directed federal agencies to terminate DEI programs and identify private sector companies with what the administration called egregious and discriminatory DEI programs for potential investigations.

In the spotlight

ESG-skeptic discusses proxy strategy

What’s the story?

IR Impact published a profile of Jerry Bowyer, co-founder and CEO of Bowyer Research, a Pennsylvania-based firm that developed ESG-skeptic proxy voting guidelines now available through all major proxy advisory services.

Bowyer told IR Impact that conservative investors have historically favored divestment over engagement but that his firm is working to change that approach. "The Jesus model is not that you shun but that you sit down and eat with tax collectors and prostitutes," Bowyer said. "You don't express your righteousness with a list of who you won't associate with."

The firm's voting guidelines are "designed for investors who wish to counter the promotion of ESG ideology by political activists through the use of the proxy voting system and to reassert the traditional understanding of shareholder primacy as their fiduciary duty," according to a previous company statement.

ESG advocates have pushed back, noting that anti-DEI shareholder resolutions at companies including Costco, Deere, Apple, and Disney were defeated by near-unanimous votes of 98% to 99%, according to As You Sow.

Why does it matter?

Bowyer Research has positioned itself as a counterweight to traditional ESG-focused proxy voting policies. The firm advises clients including the $57 billion Texas Permanent School Fund.

The company's guidelines became available through Institutional Shareholder Services in March 2024 and are now distributed by all major proxy advisory services.

What’s the background?

The Texas Permanent School Fund adopted Bowyer Research's proxy voting guidelines in April 2024, shortly after removing $8.5 billion from BlackRock's asset management over ESG concerns.