Tag: 2024 ballot measures

-

Update on this year’s and next year’s ballot measure certifications

In 2023, 41 statewide measures were certified for the ballot in eight states, 10 more measures than the average number certified in other odd-numbered years from 2011 to 2021. There are no more pending state ballot measures for 2023. The final election for state ballot measures was on Sat., Nov. 18 in Louisiana, where voters approved…

-

Voters in Huntington Beach, California, to decide charter amendments on elections, voter ID, flags, budgets, and more in March 2024

Voters in Huntington Beach, California, will decide on three charter amendments on March 5, 2024, which the Huntington Beach City Council referred to the ballot on Oct. 5, 2023. Measure 1 would make various changes to the election procedures of Huntington Beach, including requiring voter identification for elections and requiring ballot drop boxes to be…

-

Signatures submitted for Washington initiative to repeal the state's 2021 Climate Commitment Act and prohibit carbon cap-and-trade programs

On Nov. 21, Let's Go Washington, a committee sponsoring six citizen-initiated ballot measures, submitted signatures for one of them—Initiative 2117. The initiatives would appear on the ballot at the general election in Nov. 2024. Initiative 2117 was designed to prohibit carbon tax credit trading and repeal provisions of the 2021 Washington Climate Commitment Act (CCA),…

-

Massachusetts ballot initiative campaigns related to education, psychedelics, tipped workers, app-based drivers, and state auditor responsibilities file signatures with local clerks for the 2024 ballot

Massachusetts ballot initiative campaigns related to education, psychedelics, tipped workers, app-based drivers, and state auditor responsibilities filed signatures with local clerks for the 2024 ballot. The deadline to file signatures with local clerks in order to qualify for the 2024 ballot was Nov. 22. Several campaigns related to education, psychedelics, tipped workers, app-based drivers, and…

-

Colorado top-four ranked-choice voting initiative to be filed targeting 2024 ballot

Voters in Colorado could decide on a ballot initiative to adopt top-four ranked-choice voting in Nov. 2024. Kent Thiry, the former CEO of DaVita, said he plans to file the ballot initiative, which would change state executive, state legislative, and congressional elections. The new electoral system would go into effect beginning in 2026. The initiative…

-

Update on this year’s and next year’s ballot measure certifications

In 2023, 41 statewide measures were certified for the ballot in eight states, 10 more measures than the average number certified in other odd-numbered years from 2011 to 2021. There are no more pending state ballot measures for 2023. The next—and final—election for state ballot measures is on Sat., Nov. 18 in Louisiana, where voters will…

-

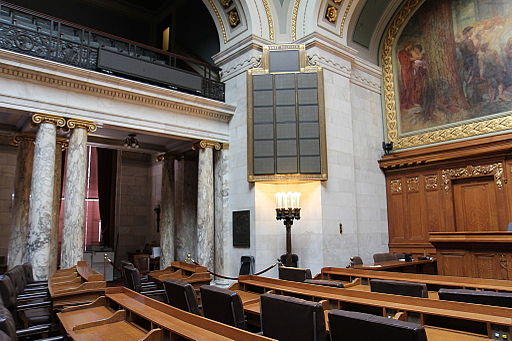

Wisconsin to vote on prohibiting private funds in elections and a second question related to election officials at the April primary election

The Wisconsin State Legislature voted to send one constitutional amendment as two ballot questions to the April 2, 2024, ballot. The first question asks voters to prohibit governments from applying or accepting non-governmental funds or equipment for the administration of any primary, election, or referendum. The second question asks voters to provide that only election…

-

Wisconsin could become the eighth state to add language to its state constitution authorizing "only" United States citizens to vote in elections

The Wisconsin State Legislature took the final vote on Nov. 9 to send a constitutional amendment to the Nov. 2024 ballot that would add language to the state constitution to provide that only U.S. citizens who are 18 years old or older can vote in federal, state, local, or school elections. Currently, the constitution says,…

-

Update on this year’s and next year’s ballot measure certifications

In 2023, 41 statewide measures were certified for the ballot in eight states, 10 more measures than the average number certified at this point in other odd-numbered years from 2011 to 2021. For 2024, 52 statewide measures have been certified in 23 states. That’s four more measures than the average number certified at this point…

-

Nebraska voters to decide on veto referendum to repeal tax credits for education scholarship accounts

The Nebraska Secretary of State announced that a veto referendum to repeal Legislative Bill 75—an act that established tax credits for taxpayers who contribute to education scholarships for students to attend private schools—qualified for the November 2024 ballot on Oct. 10. Support Our Schools, the committee behind the referendum, submitted over 117,000 signatures on Aug.…