Tag: ballot measures

-

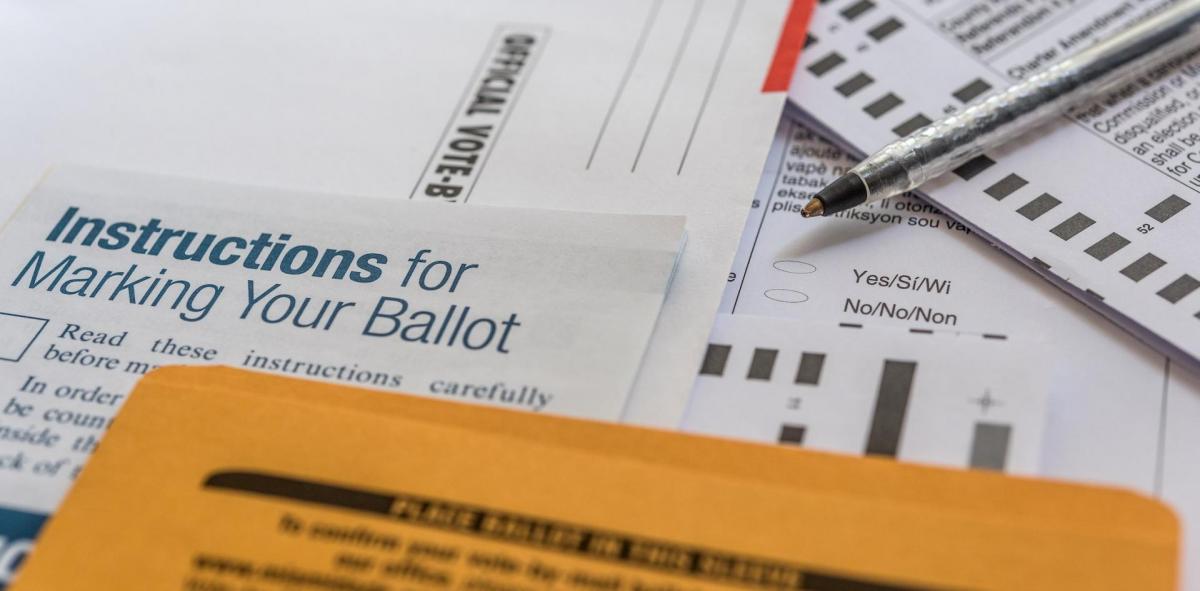

Utah voters have decided 220 ballot measures since 1895, beginning with constitution ratification ahead of statehood

Ballotpedia completed an inventory of all Utah ballot measures dating back to 1895, when voters approved the state constitution. Between 1895 and 2024, Utahns voted on 220 ballot measures—140 (63.6%) were approved and 80 (36.4%) were defeated. This count includes the ratification of the state constitution by voters in 1895, two months before the United States…

-

Maine voters to decide two citizen-initiated ballot measures in Nov. 2025 election, including voter ID and extreme risk protection orders

The Maine State Legislature adjourned on June 25, meaning voters will decide two indirect initiated state statutes at the election on Nov. 4, 2025. Signatures were submitted for two ballot initiatives in Jan. 2025—the Require Voter Photo ID and Change Absentee Ballot and Dropbox Rules Initiative and Extreme Risk Protection Orders to Restrict Firearms and…

-

Voters in Huntington Beach, California, to decide initiatives on children’s library book review board and library ownership on June 10

Voters in Huntington Beach, California, will decide on two ballot initiatives—Measure A and Measure B—concerning the city’s libraries on June 10, 2025. The initiatives require a simple majority vote to pass. To qualify for the ballot, supporters needed to collect signatures from 10% of the city’s registered voters for each initiative. Measure A would repeal…

-

One hundred years after Pierce v. Society of Sisters, ballot measures continue to shape school choice policy

One hundred years ago, on June 1, 1925, the U.S. Supreme Court issued a unanimous decision in Pierce v. Society of Sisters, striking down a voter-approved ballot initiative, Oregon Measure Nos. 314-315, which required children to attend public schools. The Court held that “the child is not the mere creature of the State” and “the fundamental…

-

Oklahoma State Legislature advances bill to change process of initiated ballot measures

The Oklahoma House of Representatives again advanced Senate Bill 1027 (SB 1027), a measure that would change the process of placing citizen-initiated amendments and laws on the ballot. SB 1027, which would take effect immediately after its passing, would make three changes to the initiative process in Oklahoma. First, it would implement a distribution requirement…

-

Iowa General Assembly adjourns the first year of the two-year legislative session, addresses two potential constitutional amendments

The Iowa General Assembly adjourned on May 1, ending the first year of the two-year legislative session. During this legislative session, legislators addressed two constitutional amendments that may be placed on the ballot for voters to decide in 2026 and 2028. Senate Joint Resolution 11 (2025) First, the Iowa State Senate passed Senate Joint Resolution…

-

Ballot measures certification update: First Texas 2025 amendment certified; five new 2026 measures in AR, ND, and TN

The number of certified statewide ballot measures for both 2025 and 2026 is trending above average compared to previous election cycles as of April 29. 2025 ballot measures For 2025, eight statewide ballot measures have been certified in five states—Louisiana, Ohio, Texas, Washington, and Wisconsin. This is two more than the average of six certified…

-

Texas voters in largest cities to decide 42 local ballot measures on May 3

Ballotpedia is covering 42 ballot measures in nine counties in Texas on May 3. All 42 ballot measures were referred to the ballot by a vote of a local governing board, such as a county board or city council. This is an increase in ballot measures compared to the previous even-year May election in Texas…

-

2025 marks record year as Kansas, Kentucky, and Wyoming join states with laws restricting foreign contributions to ballot measure campaigns

So far, during the 2025 legislative sessions, three states—Kansas, Kentucky, and Wyoming—have enacted new laws restricting foreign contributions to ballot measure campaigns. With these additions, 12 now have laws prohibiting foreign nationals, governments, or other entities from contributing to ballot measure committees. The 12 states with such laws are California, Colorado, Kansas, Kentucky, Maine, Maryland,…

-

Court strikes down Washington Initiative 2066, related to natural gas, as violating state’s single-subject rule; ruling will be appealed to state supreme court

Washington Initiative 2066, approved on Nov. 5, 2024, was struck down on March 21 as violating the state constitution’s single-subject rule. A single-subject rule is a state law that requires ballot initiatives to address a single subject, topic, or issue. Judge Sandra Widlan wrote, “… the body of the initiative is so broad and free…