Tag: marijuana

-

Idaho voters to decide on amendment preempting citizen-initiated marijuana and psychedelics legalization measures in 2026

Idaho voters will decide on a constitutional amendment saying that only the state legislature can legalize or regulate marijuana. This would mean that citizens cannot initiate measures to legalize marijuana in the state. Voters will vote on the amendment at the general election on Nov. 3, 2026. The amendment, House Joint Resolution 4 (HJR 4),…

-

Arkansas medical marijuana initiative found not to meet signature threshold, leaving 57 citizen-initiated measures for 2024

The last ballot initiative pending signature verification for the election on Nov. 5, 2024—Arkansas Issue 3—failed to make the ballot, according to Secretary of State John Thurston. The total number of statewide ballot measures certified for elections in 2024 is 160. Several measures are facing litigation, which could result in them being voided before the…

-

Two initiatives qualify for the ballot in Oregon proposing increased corporate taxes and cannabis worker labor policy

Oregon voters will decide on two citizen initiatives this fall alongside three legislative referrals. Measure 118 was certified for the ballot on July 24 after the secretary of state determined that 122,276 of the 165,426 signatures submitted were valid. Measure 118 would increase the minimum tax on corporations with Oregon sales by enacting a 3%…

-

Campaigns sponsoring medical marijuana legalization, paid sick leave, and abortion-related ballot initiatives submit signatures in Nebraska

The signature deadline for initiated laws and amendments was July 3 in Nebraska. Campaigns sponsoring medical marijuana legalization, paid sick leave, and abortion-related initiatives filed signatures with the secretary of state. The medical marijuana and paid sick leave initiatives are initiated statutes, while the abortion-related initiatives are initiated constitutional amendments. Nebraskans for Medical Marijuana filed…

-

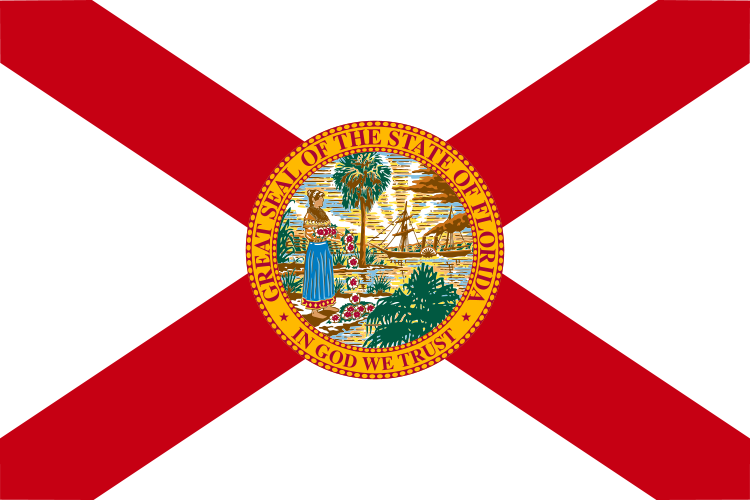

Marijuana legalization initiative will be on Nov. ballot, Florida Supreme Court rules

In November, voters in Florida will decide on a citizen-initiated constitutional amendment, Amendment 3, to legalize marijuana. The final step was for the amendment to receive approval from the Florida Supreme Court, which occurred on April 1. The campaign submitted enough signatures to meet the state’s requirement of 891,523. Smart & Safe Florida is leading…

-

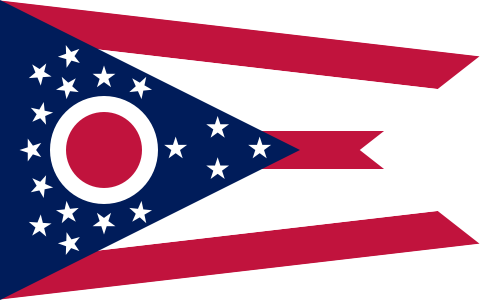

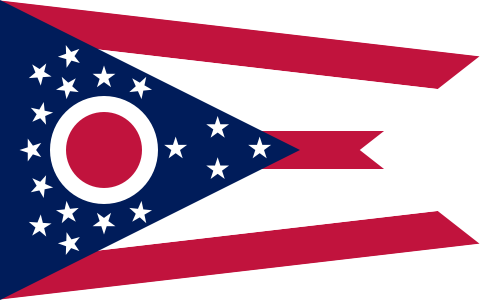

Voters in Republican trifectas have rejected marijuana legalization initiatives at a higher rate than voters in other states. Ohio will vote on marijuana next on Nov. 7

Voters in Ohio will vote on Issue 2, an initiative to legalize marijuana, on Nov. 7. Ohio is a Republican trifecta, meaning the Republican Party controls the office of governor and both chambers of the state legislature. Since 2010, there have been 23 state ballot measures to legalize marijuana for recreational or personal use. Ohio…

-

Florida marijuana initiative estimated to generate between $200 and $430 million per year if approved by voters; state supreme court ruling still needed to get on ballot

The Florida Financial Impact Estimating Conference released a report on July 13 finding that approval of the marijuana initiative would generate between $195.6 and $431.3 million in annual state and local revenue if approved by voters. The initiative would legalize marijuana for adults 21 years old and older. Individuals would be allowed to possess up…

-

Ohio could join 23 states that legalized recreational marijuana in Nov. 2023 as signatures are submitted for ballot initiative

On July 5, 2023, signatures were submitted for a marijuana legalization initiative that may appear on the ballot for Ohio voters in November. If the measure appears on the ballot and voters approve it, Ohio will join 23 states that have already legalized marijuana—including 14 of those states and D.C. that have legalized marijuana through…

-

Marijuana legalization campaign to continue signature gathering in Ohio for 2023 ballot

The Coalition to Regulate Marijuana Like Alcohol, the campaign supporting a marijuana legalization initiative in Ohio, began collecting a second round of signatures to qualify the initiative for the ballot on Nov. 7, 2023. Previously, the Coalition to Regulate Marijuana like Alcohol submitted 136,729 valid signatures to the secretary of state in two separate rounds…

-

Florida marijuana legalization initiative has 94% of signatures needed to appear on 2024 ballot

Smart & Safe Florida, a campaign supporting a ballot initiative to legalize marijuana in Florida, has collected 786,688 valid signatures, 88% of the 891,523 valid signatures needed to be placed on the ballot in 2024. The initiative would legalize marijuana for adults 21 years old and older. Individuals would be allowed to possess up to…