As of July 25, 14 ballot measures have been certified for Texas’ statewide ballot in 2023, including one new certification from July 18. All 14 measures are legislatively referred constitutional amendments on the ballot on Nov. 7, 2023. The one new ballot measure is:

Texas Property Tax Changes and State Education Funding Amendment (2023):

- A "yes" vote supports amending the state constitution to:

- increase the homestead tax exemption from $40,000 to $100,000;

- authorize the state legislature to limit the annual appraisal increase on non-homestead real property;

- exclude appropriations made to increase state education funding from the state appropriations limit; and

- authorize the state legislature to provide for four-year terms for members of the governing body of an appraisal entity in counties with a population of 75,000 or more.

- A "no" vote opposes this constitutional amendment to increase the homestead property tax exemption; authorize the state legislature to limit the annual appraisal of non-homestead real property; and exclude increased state education funding from the appropriations limit.

A total of 281 measures appeared on the statewide ballot in Texas from 1985 to 2022. Of the 281 measures, voters approved 248 (88.26%) and defeated 33 (11.74%). From 1985 through 2022, the number of measures on the yearly ballot ranged from zero to 25.

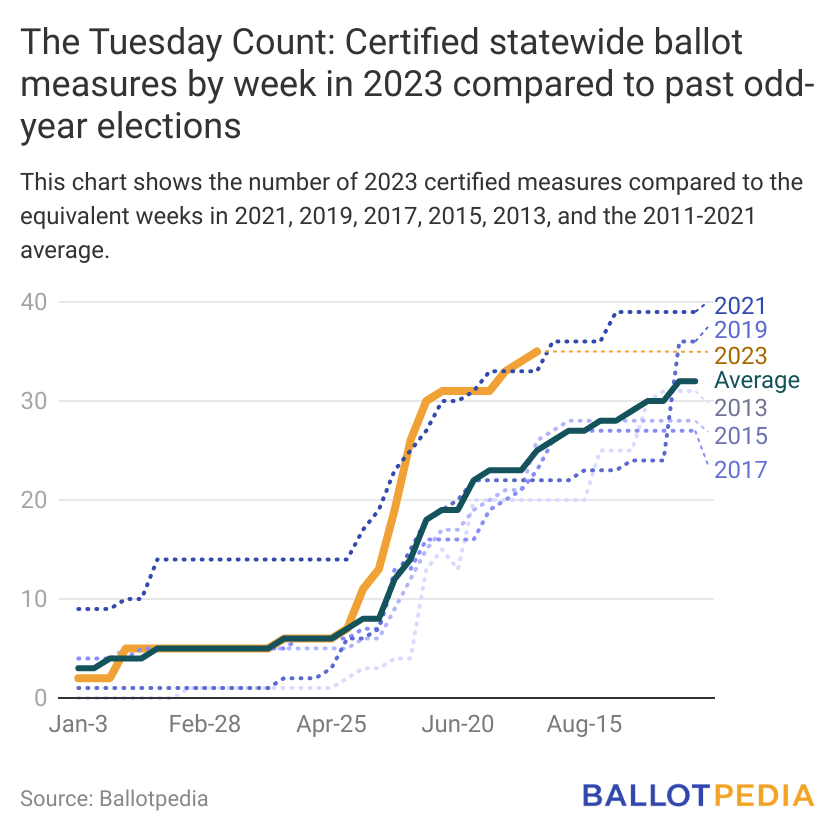

As of July 25, 35 statewide measures have been certified for the ballot in eight states for elections in 2023. That’s 10 more measures than the average number (25) certified at this point in other odd-numbered years from 2011 to 2021. The number certified—35—is also the highest number of any of those years. Texas has certified the most ballot measures with 14, while 42 states have certified the fewest ballot measures with zero.

Additional reading: