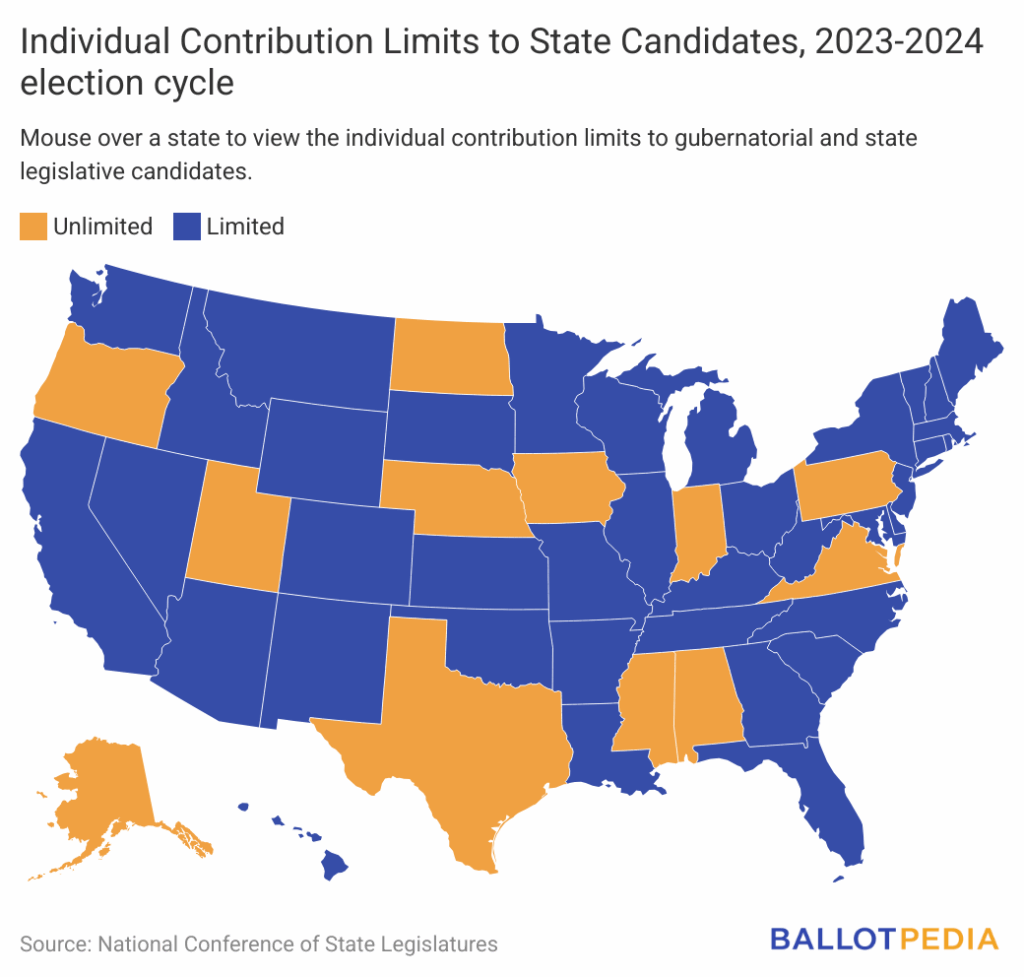

During the 2023-2024 election cycle, 12 states permitted unlimited contributions from individuals to state-level candidates. Unlike presidential and congressional elections, where federal law stipulates uniform campaign finance laws, each state is responsible for implementing and enforcing its own campaign finance laws for state-level elections.

Generally speaking, campaign finance laws regulate the sources and amounts of contributions to political candidates and campaigns, as well as the disclosure of information about campaign funds. These laws are a source of ongoing debate. Proponents of more stringent campaign finance laws claim that the current laws do not go far enough to mitigate corruption and the influence of undisclosed special interests. Opponents claim that strict disclosure requirements and donation limits impinge upon the rights to privacy and free expression, hampering participation in the political process.

During the 2023-2024 election cycle, the remaining 38 states had individual contribution limits that differed depending on the office sought. Below are the ranges for governor, state senator, and state representative.

- Governor

- Lowest: $625 per election (Colorado)

- Highest: $36,400 per election (California)

- State Senator

- State Representative

The map below separates states by those with unlimited individual contributions and those with limits on individual contributions.

Each state also has its own set of reporting requirements. These requirements dictate when campaign finance disclosure reports are due and what to include (most often an itemized list of contributions and expenditures). Typical reporting timelines include: biannually and quarterly (often, but not always, in non-election years); monthly in the last months before an election; a month before an election; 15 days before an election; and a week before an election. A supplementary report to cover contributions received in the last days before an election and a year-end report due in January following an election are also often required.

The contribution limits and reporting requirements above are only samples. For a complete list of contribution limits and reporting requirements across every state, click here.