This November, voters in Colorado will decide on two ballot measures related to funding the Healthy School Meals for All Program, which was created by voter approval of Proposition FF in 2022. One measure would retain existing revenue from Proposition FF, while the other would expand the program’s funding by further reducing state income tax deduction limits.

The retention measure would allow the state to retain and spend $11.3 million in tax revenue collected above the initial estimates for Proposition FF to fund the Healthy School Meals for All Program. If the measure is rejected, the state would be required to refund $12.4 million to taxpayers, which includes the $11.3 million and 10% simple interest.

Proposition FF, which was approved by 57% of voters, limited the state income tax deduction for individuals with federal taxable income over $300,000 to $12,000 for single filers and $16,000 for joint filers. Prior to Proposition FF, the limits were $30,000 and $60,000, respectively. The measure was expected to generate approximately $100.7 million annually to fund the Healthy School Meals for All Program, which reimburses schools for providing free meals to all students and provides food-related funding to schools.

The expansion measure would further reduce state income tax deductions for individuals with federal taxable income over $300,000, affecting approximately 194,000 taxpayers, according to the fiscal note prepared by the Colorado Legislative Council Staff. It would lower the deduction limits from $12,000 to $1,000 for single filers and from $16,000 to $2,000 for joint filers. The change is expected to increase taxes by an average of $377 for single filers and $560 for joint filers and generate approximately $95 million annually in additional revenue for the program.

The two measures were placed on the ballot through House Bill 1274. The Senate passed the bill on May 6 by a vote of 23-1, with all 23 Democrats voting in favor and 11 of 12 Republicans voting against. The House approved the bill on May 7 by a vote of 42-22, with all 42 Democrats voting in favor and all 22 Republicans voting against. One Democratic representative was absent.

The measures require voter approval under the Colorado Taxpayer's Bill of Rights (TABOR) since they would increase state revenue.

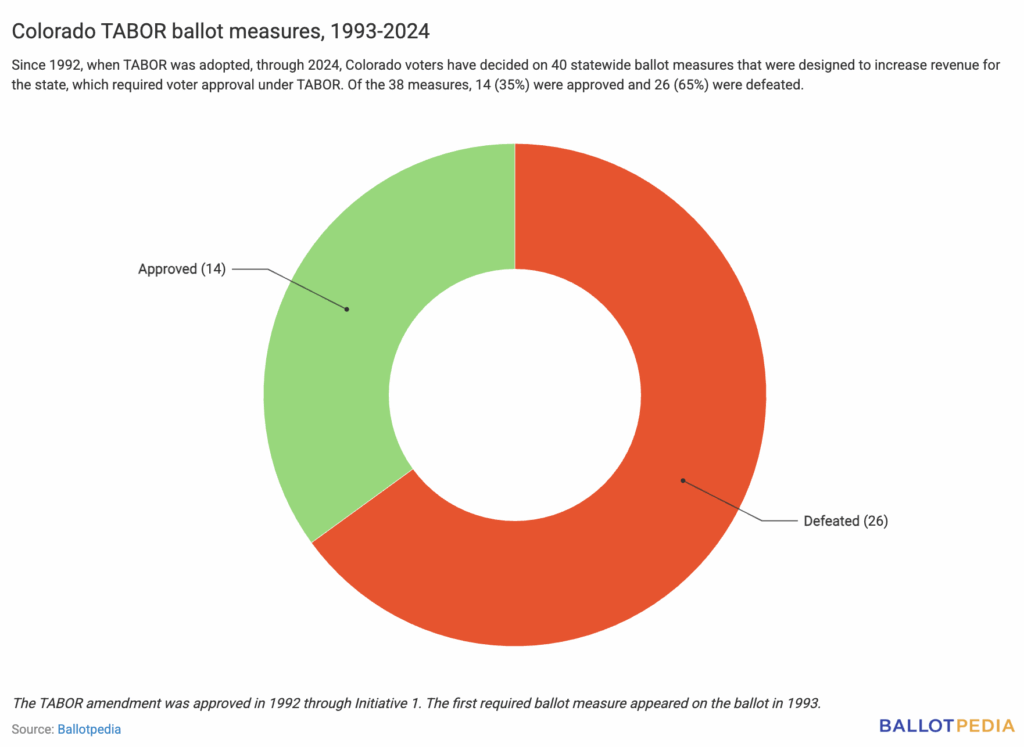

Since 1992, when TABOR was adopted, through 2024, Colorado voters have decided on 40 statewide ballot measures that were designed to increase revenue for the state, which required voter approval under TABOR. Of the 40 measures, 14 (35%) were approved and 26 (65%) were defeated.

In 2024, voters approved Proposition JJ, which allowed the state to retain tax revenue collected above $29 million annually from the tax on sports betting proceeds authorized by voters through Proposition DD in 2019.

In 2023, voters approved Proposition II, which allowed the state to keep and spend revenue exceeding official projections from increased taxes on cigarettes, tobacco, and nicotine products, which voters approved as Proposition EE in 2020.

Measures that can go on the ballot during odd years are limited to topics that concern taxes or state fiscal matters arising under TABOR. During odd-numbered years between 1993 and 2023, a total of 22 measures appeared on the ballot, of which seven were approved (32%) and 15 were defeated (68%).