Author: Jackie Mitchell

-

Voters in Huntington Beach, California, to decide initiatives on children’s library book review board and library ownership on June 10

Voters in Huntington Beach, California, will decide on two ballot initiatives—Measure A and Measure B—concerning the city’s libraries on June 10, 2025. The initiatives require a simple majority vote to pass. To qualify for the ballot, supporters needed to collect signatures from 10% of the city’s registered voters for each initiative. Measure A would repeal…

-

Oklahoma enacts pay-per-signature ban, residency requirement, signature distribution requirement, and funding disclosure rules for ballot initiative petitions

Oklahoma Governor Kevin Stitt (R) signed Senate Bill 1027 (SB 1027) on May 27, enacting changes to the state’s initiative and referendum processes. The bill passed in the Oklahoma State Legislature with all Democrats voting against and all but six Republicans in favor. Oklahoma is one of 26 states with an initiative process. Citizens in…

-

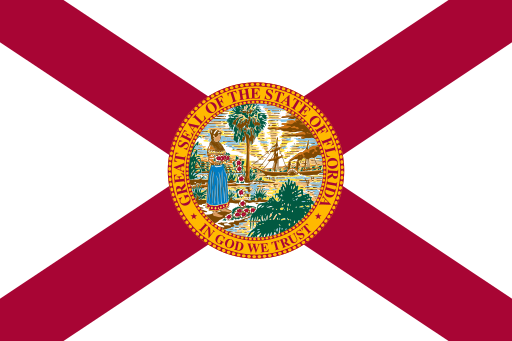

Florida enacts law changing initiative process requirements; legal challenge filed in federal court

Gov. Ron DeSantis (R) signed HB 1205 on May 2, 2025. Changes included requirements for paid signature gatherers, such as registration, training, and residency requirements, voter signature requirements, limitations on ballot initiative sponsoring committees, and petition form standards. HB 1205 passed the legislature with unanimous support from Republicans and unanimous opposition from Democrats. The one…

-

Colorado voters to decide on two measures related to school meal program funding and tax deductions

This November, voters in Colorado will decide on two ballot measures related to funding the Healthy School Meals for All Program, which was created by voter approval of Proposition FF in 2022. One measure would retain existing revenue from Proposition FF, while the other would expand the program’s funding by further reducing state income tax…

-

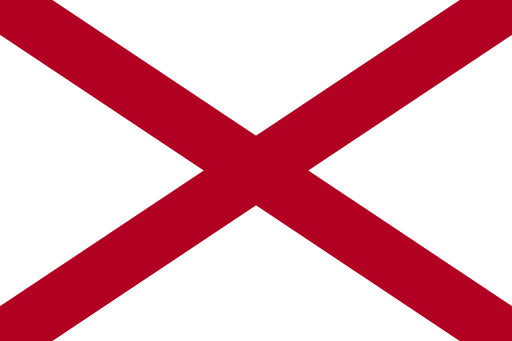

Alabama voters to decide on expanding list of non-bailable offenses under Aniah’s Law in May 2026

Alabama voters will decide at the May 2026 primary election whether to expand a bail law, known as Aniah’s Law, by adding to the list of crimes for which bail can be denied. When a defendant is charged with a crime and not yet convicted, an amount of money—a specific range tied to specific crimes—referred…

-

North Dakota voters to decide on ballot measure limiting constitutional amendments to a single subject at June 2026 primary election

Voters in North Dakota will decide on a constitutional amendment on June 9, 2026, that would establish a single-subject requirement for constitutional amendments. The proposal follows a 2024 measure that voters rejected, which would have established a single-subject rule for all citizen-initiated measures and enacted other changes. Single-subject rules require ballot measures to focus on…

-

Arkansas enacts ballot title readability law, joining five other states since 2018

A new Arkansas law requires initiative ballot titles to be written at or below an eighth-grade reading level. Gov. Sarah Huckabee Sanders (R) signed House Bill 1713 (HB 1713) into law on April 14, 2025. The law is one of six enacted since 2018 that address the readability of ballot language. The House approved the…

-

Arkansas voters to decide on three constitutional amendments in 2026 addressing the right to bear arms, a citizenship requirement for voting, and the creation of economic development districts

Arkansas voters will decide on three constitutional amendments on Nov. 3, 2026, referred to the ballot by the state legislature. The amendments would expand the constitutional right to bear arms, require citizenship to vote, and allow the creation of economic development districts. Right to bear arms amendment Senate Joint Resolution 11 was sponsored by Sen.…

-

Washington voters to decide in November on amendment allowing Long-Term Services and Supports (LTSS) Trust Fund to be invested in stocks and equities

Washington voters will decide on a constitutional amendment in November that would allow the Long-Term Services and Supports (LTSS) Trust Fund, also known as the WA Cares Fund, to be invested in stocks and equities. The WA Cares Fund was established in 2019 to provide a lifetime benefit of $36,500 to eligible beneficiaries. WA Cares…

-

North Dakota joins two states asking voters to increase approval requirements for ballot measures

North Dakota voters will decide on a constitutional amendment that would establish a 60% supermajority requirement in order for voters to approve new constitutional amendments. The supermajority requirement would apply to both constitutional amendments proposed by initiative petition and amendments referred to the ballot by the state legislature. This amendment will appear on the ballot…