Author: Jackie Mitchell

-

Voters in North Dakota to decide on congressional age limit ballot initiative on June 11

A citizen-initiated ballot measure to establish an age limit for congressional members is on the ballot in North Dakota’s primary election on June 11, 2024. The campaign, Retire Congress North Dakota, submitted 42,107 signatures for the initiative on Feb. 9. At least 31,164 signatures needed to be valid to qualify for the ballot. On March…

-

Washington State Legislature passed three citizen-initiated ballot measures from the Let’s Go Washington PAC, which is the most passed in state history

The Washington State Legislature adjourned this year’s legislative session on March 7. Legislators passed three citizen-initiated measures into law—the most ever for a single year. From 1912, when the state’s initiative process was established, to 2023, just six Initiatives to the Legislature (ITLs) have received legislative approval. With three approved this year, the total increases…

-

Let’s Go Washington submitted six citizen-initiated measures; three will appear on the Nov. ballot, and three were approved by the legislature

The Washington State Legislature adjourned its 2024 legislative session on March 7, 2024. During the session, the legislature was presented six initiatives sponsored by Let’s Go Washington after the group submitted 2.6 million signatures for them. Three of the initiatives were adopted by the state legislature. Three will appear on the Nov. ballot for voters…

-

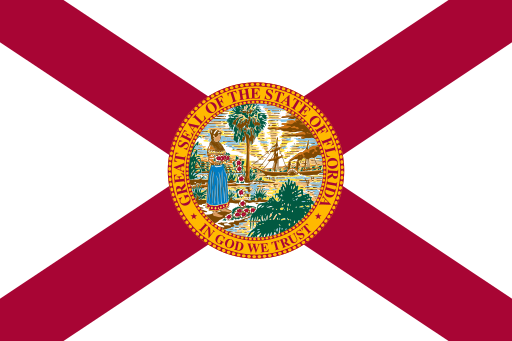

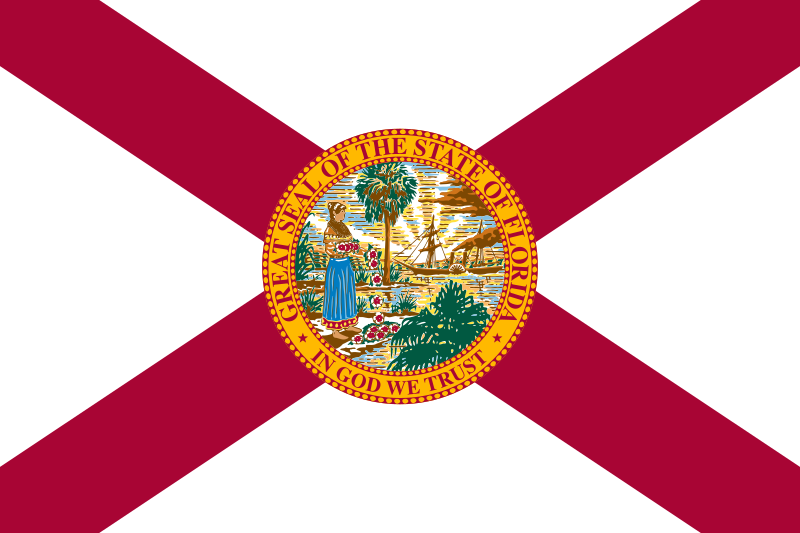

Florida legislature sends constitutional amendment to repeal public campaign financing to Nov. 2024 ballot

The Florida State Legislature referred a constitutional amendment to the Nov. ballot that would repeal Section 7 of Article VI of the Florida Constitution, which provides for public campaign financing for candidates who agree to spending limits. The amendment was sponsored by state Sen. Travis Hutson (R-7). Florida enacted a public campaign financing law in…

-

Florida voters will decide on constitutional amendment to adjust homestead exemption for inflation

The Florida State Legislature approved House Joint Resolution 7017, a constitutional amendment, on March 6. Voters will decide on the amendment at the general election in Nov. 2024. The amendment would provide for an annual inflation adjustment for the value of the homestead property tax exemption that applies to non-school taxes. The adjustment would be…

-

Voters in Alabama rejected Amendment 1, which addressed local legislation

In Alabama, voters rejected Amendment 1, a constitutional amendment related to local legislation. The vote was 48.67% ‘Yes’ to 51.33% ‘No.’ The amendment would have eliminated the requirement for a budget isolation resolution for legislators to vote on local laws and constitutional amendments before the approval of budgets and without a 60% vote. In 1984,…

-

Georgia Senate passes constitutional amendment to legalize sports betting; will appear on 2024 ballot if passed in the House

The Georgia State Senate passed Senate Joint Resolution 579, related to sports betting, on Feb. 27 by a vote of 42-12 with two members absent and one not voting. The resolution would amend the Georgia Constitution to authorize the state legislature to provide for sports betting. Eighty percent of the tax revenue derived from sports…

-

Alabama voters will decide on a constitutional amendment on March 5 to remove restrictions on local legislation

Alabama’s March 5 primary election will feature a constitutional amendment, Amendment 1, concerning local legislation. Amendment 1 would remove the budget isolation resolution restriction on local laws and local constitutional amendments, thereby allowing them to be considered before budgets are approved without the 60% supermajority vote requirement. In 1984, Alabama voters approved a constitutional amendment…

-

Signatures submitted for North Dakota initiative creating age limits for congressional candidates

The campaign Retire Congress North Dakota submitted 42,000 signatures for a ballot initiative on Feb. 9, 2024. The ballot initiative would be the first to propose age limits for congressional members. The campaign is targeting the ballot for June 11, 2024, which is the state’s primary election. The ballot initiative would prohibit a person from…

-

San Francisco ballot measure to urge school district to offer algebra to 8th graders will be on March ballot

Voters in San Francisco, California, will decide on seven ballot measures on March 5, 2024, including Proposition G, which issues a policy declaration regarding the school district’s mathematics curriculum. Specifically, Proposition G would make it the official policy of San Francisco to encourage the San Francisco Unified School District (SFUSD) to offer Algebra 1 to…