Category: Ballot measures

-

Online sports betting is heading to the California ballot in November

On June 27, the California secretary of state reported that an initiative to legalize online and mobile sports betting had qualified for the ballot. The final random sample count concluded that over 1.1 million of the nearly 1.6 million signatures submitted were valid. The required number of signatures for the initiative was 997,139. The initiative,…

-

Campaign submits signatures for initiative to decriminalize certain psychedelic plants and fungi and create a therapy program

On June 27, 2022, the campaign Natural Medicine Colorado reported submitting 222,648 signatures for a ballot initiative to decriminalize certain psychedelic plants and fungi. The ballot initiative would appear on the ballot in November. The psychedelic plants and fungi, also known as hallucinogenic or entheogenic plants and fungi, that would be decriminalized for personal use…

-

Voters in five states will decide in November on removing constitutional language permitting enslavement or servitude as criminal punishments or debt payments

In 2022, voters in five states — Alabama, Louisiana, Oregon, Tennessee, and Vermont — will decide on ballot measures to repeal language from their state constitutions that allows slavery or involuntary servitude for the punishment of a crime, or, in Vermont, for the payment of debts, damages, or fines. As of 2022, 10 states had…

-

An initiative related to California dialysis clinics qualifies for the November ballot

On June 20, the California Secretary of State announced an initiative to enact staffing requirements, reporting requirements, ownership disclosure, and closing requirements at dialysis clinics had qualified for the November ballot. Californians for Kidney Dialysis Patient Protection, the campaign behind the initiative, submitted over 1 million signatures. The random sample concluded that 725,890 signatures were…

-

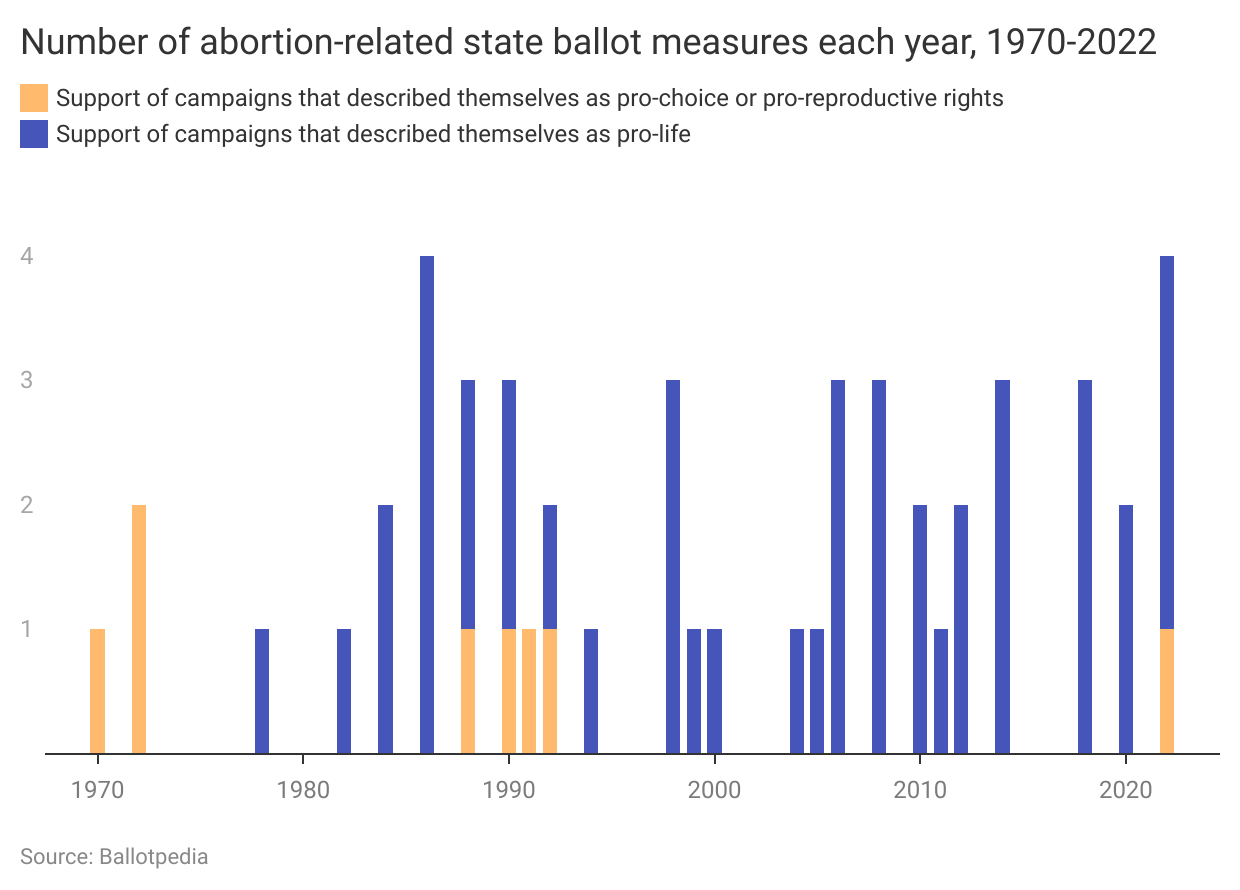

Measures regarding abortion have been on the ballot 47 times in 23 states since 1970; at least 4 more will be decided this year

Abortion has been a perennial issue for statewide ballot measures across the U.S. since the 1970s, and 2022 is continuing that trend. There will be at least four ballot measures addressing abortion this year, which is the most since 1986. Measures have been certified for the ballot in Kansas, Kentucky, Montana, and Vermont. Should one…

-

South Carolina Legislature refers two constitutional amendments to the 2022 ballot to increase General Reserve and Capital Reserve Funds

South Carolina voters will decide on two constitutional amendments in 2022. One of the amendments would increase the General Reserve Fund from 5% of state general fund revenue to 7%. The increase would be 0.5% percentage points each year until reaching 7%. The state’s General Reserve Fund can be used to cover year-end operating deficits.…

-

California initiative to require additional funding for K-12 art and music education qualifies for the ballot

On June 8, the California Secretary of State announced that an initiative to require additional funding for K-12 art and music education had qualified for the ballot. Californians for Arts and Music Education in Public Schools, the campaign sponsoring the initiative, submitted 1,030,221 signatures for verification in April. Counties conducted a random sample, and the…

-

Louisiana Legislature adjourns 2022 session; eight measures to appear on November ballot and three to appear on December ballot

The Louisiana State Legislature adjourned its 2022 legislative session on June 6, referring six constitutional amendments to this year’s ballots. These amendments join five other constitutional amendments that the Legislature referred during its 2021 session. Eight measures will appear on the November 8 ballot and three will appear on the December 10 ballot. On November…

-

Amendment C defeated in South Dakota

Amendment C was defeated by South Dakota voters on June 7, 2022. With 99.7% of precincts reporting, the ‘No’ vote was at 67.43% (122,387), and the ‘Yes’ vote was at 32.57% (59,111), with a total of 163,014 voting on the amendment. The amendment would have changed the voter requirement threshold for future ballot measures, and…

-

Initiative to cap interest rates for payday loans submits signatures for Michigan ballot

On June 1, the campaign Michiganders for Fair Lending submitted signatures for a ballot initiative that would appear on the November ballot. The initiative would put an annual interest cap of 36% in place for payday loans. Michiganders for Fair Lending argues that the typical payday loan carries a 370% annual rate, and that high…