Category: Ballot measures

-

Fair Maps Nevada did not turn in signatures for its redistricting initiative by the extended August 3 deadline

Fair Maps Nevada, the campaign behind the Nevada Independent Redistricting Commission Initiative, did not submit signatures by the August 3 deadline. Originally the deadline was June 24, but it was extended by a court ruling. On July 24, 2020, Doug Goodman, founder and executive director of Nevadans for Election Reform; Sondra Cosgrove, chair of Fair…

-

Voters in Gilbert, Arizona, approved the 2020 General Plan for city land development

Voters in Gilbert, Arizona, passed Proposition 430 on Tuesday approving the 2020 General Plan for city land development with 81.84% of the vote. Proposition 430 was put on the ballot through a vote of the Gilbert Town Council on March 3, 2020. The last general plan was approved in 2010. In 2020, Ballotpedia is covering…

-

Missouri voters approve Amendment 2 to expand Medicaid

Missouri voters approved Amendment 2 in a vote of 53% to 47% on Tuesday. Amendment 2 was a citizen initiative to expand Medicaid eligibility in Missouri to adults that are between the ages of 19 and 65 whose income is 138% of the federal poverty level or below. In 2020, this amounted to an annual…

-

Oregon Secretary of State verifies 59,000 signatures for redistricting initiative; courts to decide if it’s enough to qualify

On July 30, 2020, the Oregon Secretary of State’s office announced that People Not Politicians, the campaign behind the Independent State and Congressional Redistricting Commission Initiative, had submitted 59,493 valid signatures. People Not Politicians submitted its first batch of 64,172 unverified signatures on July 13. The campaign submitted an additional 1,819 signatures on July 17…

-

Oklahoma campaign finance reports published show Yes on 802 campaign raised nearly 19 times as much as No on 802 campaign

Oklahoma State Question 802 was on the June primary ballot in Oklahoma where it was approved by a vote of 50.49% to 49.51%. The measure expanded Medicaid eligibility to adults between 18 and 65 whose income is 138% of the federal poverty level or below. Campaign finance reports were not due from the campaigns until…

-

Signatures submitted for five more Colorado initiatives by August 3 deadline

Sponsors of five additional initiatives submitted signatures to the Secretary of State’s office by the August 3 deadline. To join the four citizen-initiated measures and three legislative referrals already certified for the November 2020 ballot, 126,632 valid signatures are required. Sponsors of Initiative #257 submitted more than 200,000 signatures on July 28 to qualify a…

-

New Jersey will vote on a constitutional amendment to postpone legislative redistricting if census data isn’t received by February 15

At the election on November 3, New Jersey voters will decide a constitutional amendment to postpone state legislative redistricting until after the 2021 election if federal census data isn’t received by February 15, 2021. Therefore, the current state legislative districts, which have been used since 2011, would remain in use for the 2021 election. New…

-

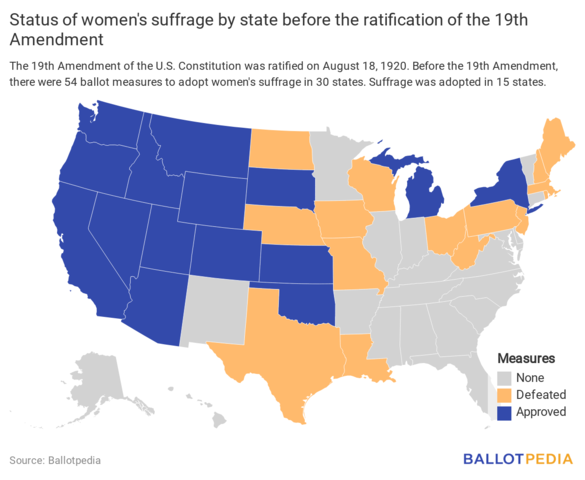

Before the 19th Amendment, the women’s suffrage movement campaigned for 54 ballot measures in 30 states

The 19th Amendment of the U.S. Constitution was ratified on August 18, 1920. The 19th Amendment prohibited the government from denying or abridging the right to vote on account of sex, meaning that women were guaranteed the right to vote in the U.S. Constitution. Before the 19th Amendment, the women’s suffrage movement also campaigned for…

-

New York environmental bond removed from the November ballot, with governor citing an unstable financial situation

On July 30, 2020, New York Gov. Andrew Cuomo (D) announced that a $3.00 billion bond measure related to environmental projects was removed from the general election ballot. In April 2020, as part of the state budget bill, the New York State Legislature passed a provision for the bond measure. Gov. Cuomo proposed the bond…

-

Oklahoma voters to decide initiative to prevent sentencing enhancements due to previous non-violent felonies in November

State Question 805 qualified for the ballot on July 29, after the state supreme court had found that the campaign submitted 248,521 valid signatures and after the 10-day challenge period ended on July 28 without any signature validity challenges filed. Yes on 805, sponsors of the amendment, turned in 260,000 signatures to the Secretary of State’s office…