Tag: ballot

-

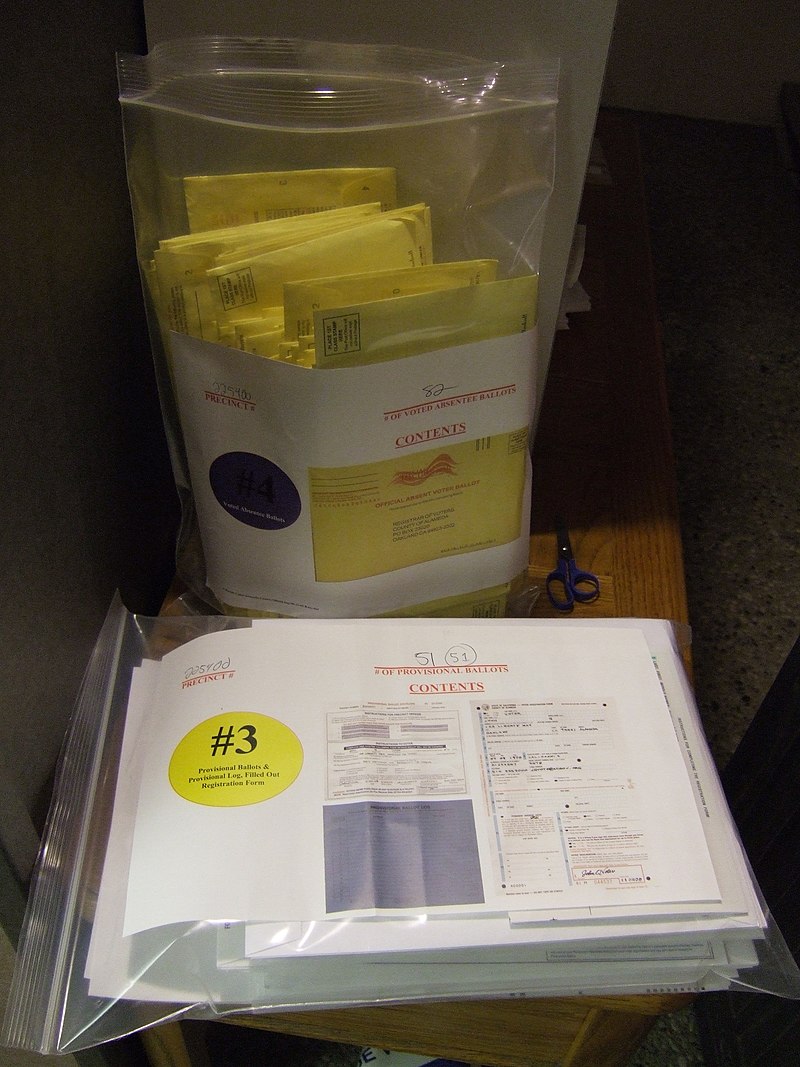

1.5% of all absentee/mail-in ballots were rejected in 2022

Voters cast 36,683,450 absentee/mail-in ballots in the 2022 general election. Of that total 549,824—or 1.5%—were rejected, roughly equal to the 1.4% rejection rate in 2018, the most recent midterm election, and up from the 1.0% and 0.8% rejection rates in the 2016 and 2020 presidential election cycles, respectively. Between the midterm election cycles in 2018…

-

Absentee/mail-in ballot return deadlines in 2023 elections

Eight states—Kentucky, Louisiana, Mississippi, New Jersey, Pennsylvania, Virginia, Wisconsin, and Washington—are holding statewide elections this year. Rules governing who can return completed absentee/mail-in ballots vary by state. Absentee/mail-in voting is voting that does not happen in person on Election Day but instead occurs another way, usually by mail. All states allow for some form of…

-

Delaware Supreme Court ends no-excuse mail ballots, same-day voter registration

On Oct. 7, 2022, the Delaware Supreme Court issued a ruling in Albence v. Biggin and Mennella, finding that a state law permitting no-excuse mail-in voting and same-day voter registration was unconstitutional. Voters may now only receive mail ballots under certain conditions and the deadline to register to vote in the Nov. 8 general election…

-

Signatures submitted for abortion rights initiative in Michigan

On July 11, the campaign Reproductive Freedom for All submitted 753,759 signatures for the ballot initiative, which would appear on the ballot in Michigan this November. In Michigan, the campaign Reproductive Freedom for All submitted 753,759 signatures for a ballot initiative related to abortion rights on July 11. At least 425,059 of the signatures need…

-

Campaign in North Dakota submits signatures for marijuana legalization initiative

In North Dakota, a campaign behind a marijuana legalization initiative reported submitting 25,672 signatures on July 11, 2022. New Approach North Dakota Chairman Dave Owen said, “This signature drive showed us that, from Williston to Grand Forks, people all across our state are ready for responsible cannabis policy reform… We’re looking forward to all of…

-

California initiative requiring state to adopt regulations on plastic waste certified for 2022 ballot

California initiative requiring state to adopt regulations on plastic waste certified for 2022 ballot News On July 19, a citizen-initiated measure to require California to adopt regulations designed to reduce the use of single-use plastic packaging was certified for the ballot on November 8, 2022. The ballot initiative would also enact a maximum one-cent per…

-

New Jersey voters will decide amendment to allow college sports betting on in-state games, New Jersey-based teams

On November 2, N.J. voters will decide at least two constitutional amendments, including an amendment to expand college sports betting. The ballot measure would allow wagering on postseason college sports competitions held in N.J. and competitions in which an N.J.-based college team participates. Currently, the state constitution permits sports betting except on games held in…

-

Colorado governor signs transportation bill removing 2021 bond issue from ballot

On June 17, Colorado Governor Jared Polis signed Senate Bill 260, thereby removing a bond issue that was set to appear on the state’s 2021 general election ballot. The Colorado State Legislature passed Senate Bill 260 on June 2, 2021. It included a provision to remove the bond issue that was set to appear on…

-

Alabama State Legislature refers third 2022 constitutional amendment to prevent voting policy changes six months before general elections

The Alabama State Legislature referred a constitutional amendment to the 2022 ballot that would require that any legislation changing the conduct of a general election must be implemented at least six months before the next affected general election. The amendment was introduced as House Bill 388 by State Representative Jim Carns (R). On April 6,…

-

Federal judge strikes down 5% petition requirement for minor-party and unaffiliated U.S. House candidates in Georgia

On March 29, 2021, Judge Leigh Martin May, of the U.S. District Court for the Northern District of Georgia, struck down a Georgia law requiring minor-party and unaffiliated candidates for the U.S. House of Representatives to submit petitions signed by at least 5 percent of the district’s registered voters in order to appear on the…