Tag: Disclosure Digest

-

Donor Privacy and Disclosure Digest: December 2023

Posted on

Note: Today’s newsletter is the final edition of Donor Privacy and Disclosure Digest. We are so grateful for your readership over the past four years. Want in-depth reporting about federal courts, election policy, school board politics, and more? Check out and subscribe to Ballotpedia’s other newsletters here. Welcome to the final edition of Ballotpedia’s Donor…

-

Donor Privacy and Disclosure Digest: November 2023

Posted on

Welcome to Ballotpedia’s Donor Privacy and Disclosure Digest! This month’s issue will be our second-to-last edition. Our final edition will arrive on Dec. 7. We are so grateful for your readership over the past four years and want to thank subscribers for supporting Ballotpedia’s coverage of donor privacy and disclosure policy. We appreciate you being…

-

Donor Privacy and Disclosure Digest: October 2023

Posted on

Welcome to Ballotpedia’s Donor Privacy and Disclosure Digest! This monthly newsletter provides news and information on key policy changes, a breakdown of state legislation, and an overview of pivotal legal decisions and case developments. In this issue, you’ll find: Arizona Citizens Clean Elections Commission considers rules for Prop. 211 implementation In a Sept. 21 meeting,…

-

Donor Privacy and Disclosure Digest: September 2023

Posted on

Welcome to Ballotpedia’s Donor Privacy and Disclosure Digest! This monthly newsletter provides news and information on key policy changes, a breakdown of state legislation, and an overview of pivotal legal decisions and case developments. In this issue, you’ll find: California update: Senate bill requiring political communication disclosures advances in House. In the courts: The latest…

-

Donor Privacy and Disclosure Digest: August 2023

Posted on

Welcome to Ballotpedia’s Donor Privacy and Disclosure Digest! This monthly newsletter provides news and information on key policy changes, a breakdown of state legislation, and an overview of pivotal legal decisions and case developments. In this issue, you’ll find: Missouri enacts bill amending privacy act: Missouri governor signs legislation modifying the state’s Personal Privacy Protection…

-

Donor Privacy and Disclosure Digest: July 2023

Posted on

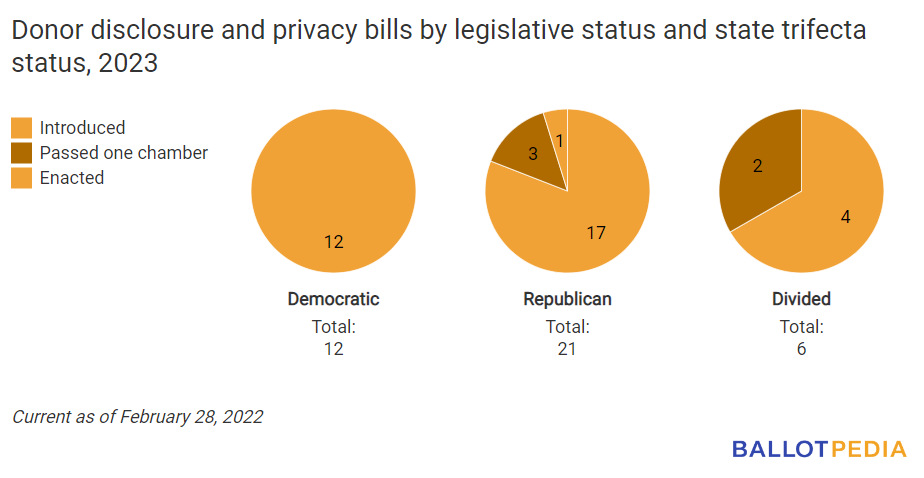

Welcome to Ballotpedia’s Donor Privacy and Disclosure Digest! This monthly newsletter provides news and information on key policy changes, a breakdown of state legislation, and an overview of pivotal legal decisions and case developments. In this issue, you’ll find: Mid-year donor privacy and disclosure legislation review: A look at legislative trends this year compared to…

-

Donor Privacy and Disclosure Digest: June 2023

Posted on

Welcome to Ballotpedia’s Donor Privacy and Disclosure Digest! This monthly newsletter provides news and information on key policy changes, a breakdown of state legislation, and an overview of pivotal legal decisions and case developments. In this issue, you’ll find: Missouri Legislature passes bill amending privacy act: The Missouri General Assembly approves modifications to the state’s…

-

Ballotpedia’s Donor Privacy and Disclosure Digest is back!

Posted on

Welcome back! If you have missed Ballotpedia’s coverage of nonprofit donor privacy and disclosure policy, you will be happy to hear we are debuting our first issue of Ballotpedia’s Donor Privacy and Disclosure Digest. This monthly newsletter provides news and information on key policy changes, a breakdown of state legislation, and an overview of pivotal…

-

Disclosure Digest: Federal lawsuit challenges Alaska donor disclosure law

Posted on

Welcome to The Disclosure Digest! Keep an eye out for new editions published on Tuesdays through June 2022. Federal lawsuit challenges Alaska donor disclosure law On April 7, five Alaska residents and several independent expenditure groups filed a lawsuit against the Alaska Public Offices Commission in U.S. district court challenging donor disclosure requirements enacted through…

-

Disclosure Digest:

Posted on

Welcome to The Disclosure Digest! Keep an eye out for new editions published on Tuesdays through June 2022. Oklahoma House passes ballot measure disclosure bill The Oklahoma House of Representatives passed a bill establishing disclosure requirements for committees supporting or opposing ballot questions on March 21. HB3147 would broaden existing definitions of certain political committees…