In case you're not familiar, here's a quick background on ESG. ESG investing is an asset management approach that considers environment, social issues, and corporate governance practices. It's a type of stakeholder investing which says shareholder returns should not be the only goal. Stakeholder investing contrasts with traditional approaches that exclusively consider financial factors like balance sheets, income statements, and valuations to maximize risk-adjusted returns (also known as shareholder investing). To learn more about ESG and commonly considered investing factors, click here.

States passed 27 bills this year either supporting or opposing environmental, social, and governance (ESG) investing. States approved 34 such laws in 2024, 45 in 2023, 17 in 2022, 13 in 2021, and three in 2020.

States with Republican trifectas enacted legislation opposing ESG investing, while states with Democratic trifectas enacted legislation supporting ESG investing. Of the 27 bills passed in 2025, 21 opposed ESG in Republican trifectas, and three supported ESG in Democratic trifectas. The remaining bills were passed in divided governments.

Let’s take a closer look at states’ ESG approaches with respect to their trifecta status and examine which states have been the most and least active on ESG this year.

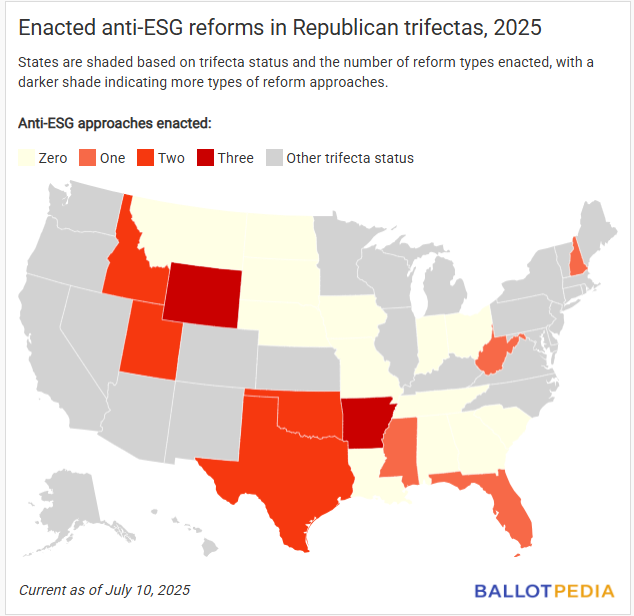

States with Republican trifectas opposing ESG

Twenty-three states currently have Republican trifectas, and 10 enacted legislation opposing ESG. In those 10 states:

- Seven passed anti-discrimination laws prohibiting banks and government agencies from using ESG scores (also known as social credit scores) to determine individual or business eligibility for financial services.

- Four passed sole fiduciary laws prohibiting or discouraging officials or advisers managing funds on behalf of a state from considering ESG factors in public investments (like pension funds).

- Three passed anti-boycott laws prohibiting the state from contracting with or investing in companies that intentionally boycott certain companies or industries without a business purpose.

- Three passed public disclosure requirement laws requiring additional transparency on the ESG policies, investments, and considerations of state investment boards and other government agencies.

- One (Idaho) passed a consumer and investor protection law giving individuals the ability to sue for ESG discrimination under Idaho’s consumer protection laws.

The map below shows which Republican trifecta states enacted the most types of legislation opposing ESG in 2025:

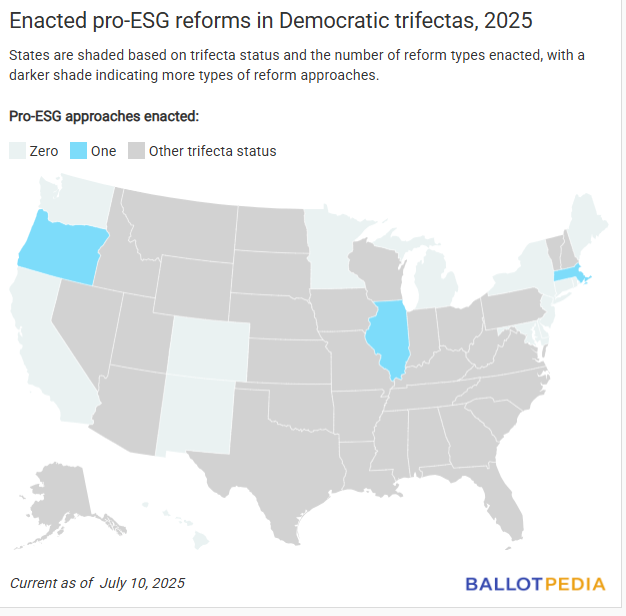

States with Democratic trifectas supporting ESG

Seventeen states have Democratic trifectas, and three passed laws supporting ESG.

- Two states (Illinois and Massachusetts) enacted legislation requiring ESG criteria in state contracts.

- One state (Oregon) enacted non-financial criteria consideration legislation requiring public investment fiduciaries to consider ESG factors in their investment strategies

The map below shows which Democratic trifecta states enacted the most types of legislation supporting ESG in 2025:

Additional reading

- For comprehensive analysis and details on ESG legislation by trifecta status, including divided governments, click here.

- To learn more about other ESG reform proposals, click here.

- To learn more about ESG, click here.

- For more information on arguments about ESG, click here.

Additionally, Ballotpedia's Economy and Society newsletter covers developments in the world of ESG and hits inboxes every Tuesday.