Author: James McAllister

-

U.S. weekly unemployment insurance claims fall to 180,000

New applications for U.S. unemployment insurance benefits fell 5,000 (2.7%) for the week ending April 23 to a seasonally adjusted 180,000. The previous week's figure was revised up from 184,000 to 185,000. The four-week moving average as of April 23 rose to 179,750 from a revised 177,500 as of the week ending April 16. The…

-

Minnesota House passes bill to fund unemployment insurance fund and send checks to frontline workers

The Minnesota House of Representatives passed a $3.7 billion bill on April 25 that would raise the balance of the state’s Unemployment Insurance Trust Fund and repay unemployment insurance debts to the federal government. The move would reduce the unemployment insurance tax burden on employers, which increased March 15 to help refill the fund following…

-

U.S. weekly unemployment insurance claims fall to 184,000

New applications for U.S. unemployment insurance benefits fell 2,000 (7.4%) for the week ending April 16 to a seasonally adjusted 184,000. The four-week moving average as of April 16 rose to 177,250 from a revised 172,750 as of the week ending April 9. The number of continuing unemployment insurance claims, which refers to the number…

-

Missouri House passes bill that could reduce unemployment insurance benefits period to eight weeks during low unemployment

The Missouri House of Representatives passed House Bill 1860 94-41 on April 14, which would reduce the maximum length of unemployment insurance benefits to eight weeks during times of low unemployment. Missouri’s current program indexes unemployment insurance benefits, meaning it provides shorter periods of benefits during times of low unemployment and longer periods of benefits…

-

Massachusetts officials announce $2.6 billion bond sale to replenish the state's unemployment insurance trust fund

Massachusetts Governor Charlie Baker's (R) administration announced on April 15 that the state intends to issue $2.6 billion of bonds to help replenish the state's unemployment trust fund and pay back $1.77 billion of federal loans to the fund. The state legislature in 2021 approved bond sales to help fund the unemployment trust fund. The…

-

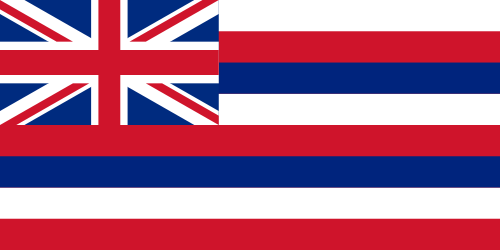

Hawaii reports increased number of unemployment insurance phishing scams

The Hawaii Department of Labor and Industrial Relations (DLIR) announced April 7 an increased number of reports of phishing scams tied to unemployment insurance claims. The schemes involve scammers who impersonate the DLIR in text messages, emails, and social media posts that ask for personal information that is supposed to relate to unemployment insurance claims.…

-

U.S. weekly unemployment insurance claims drop to lowest level since 1968

New applications for U.S. unemployment insurance benefits dropped 5,000 for the week ending April 2 from the previous week's revised figure to a seasonally adjusted 166,000. The number is the lowest recorded since the week ending Nov. 30, 1968. The weekly drop also brought the four-week moving average as of April 2 down to 170,000…

-

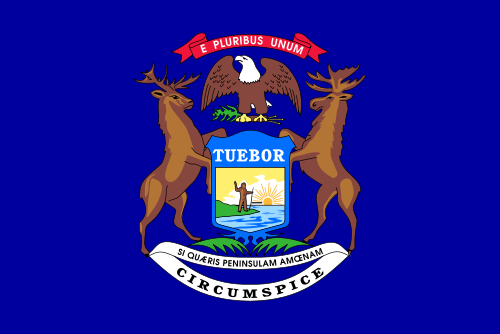

Michigan pauses collection of pandemic unemployment insurance overpayments

The Michigan Unemployment Insurance Agency announced April 8 a temporary pause on the collection of unemployment insurance overpayments issued during the coronavirus pandemic. The pause prevents the state from garnishing wages or intercepting state tax returns until at least May 7. The agency said the pause would give officials time to determine which claimants are…

-

Massachusetts announces plan to waive up to $1.6 billion in non-fraudulent unemployment insurance overpayments

Massachusetts Gov. Charlie Baker's (R) administration announced on April 14 a plan to waive $1.6 billion in non-fraudulent unemployment insurance overpayment collections. The plan would offer waivers for some workers who claimed benefits during the pandemic but were asked to repay them because the state deemed them ineligible after the payment of benefits. In total,…

-

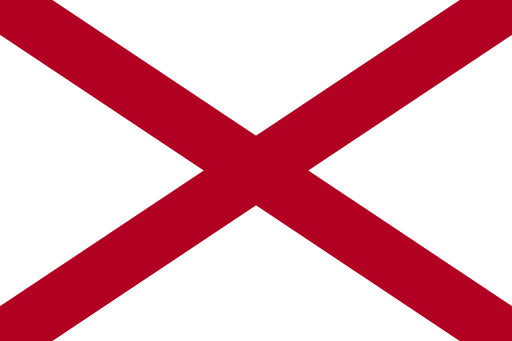

Alabama adds requirement for unemployment insurance eligibility

Alabama Gov. Kay Ivey (R) signed Senate Bill 224 on April 12, requiring unemployment insurance claimants to contact at least three prospective employers each week during their benefits period to remain eligible for payments. The bill defines a contact as an application or other genuine solicitation for an open job. The Alabama Department of Labor…