Tag: constitutional amendment

-

Arizona voters to decide on constitutional amendment prohibiting taxes on vehicle miles traveled and related limits in Nov. 2026

Arizona voters will decide on a constitutional amendment that would prohibit taxes on miles traveled in a motor vehicle and prevent state and local governments from limiting miles traveled by any individual in a motor vehicle. The amendment will appear on the ballot on Nov. 3, 2026. A vehicle miles traveled (VMT) tax, sometimes called…

-

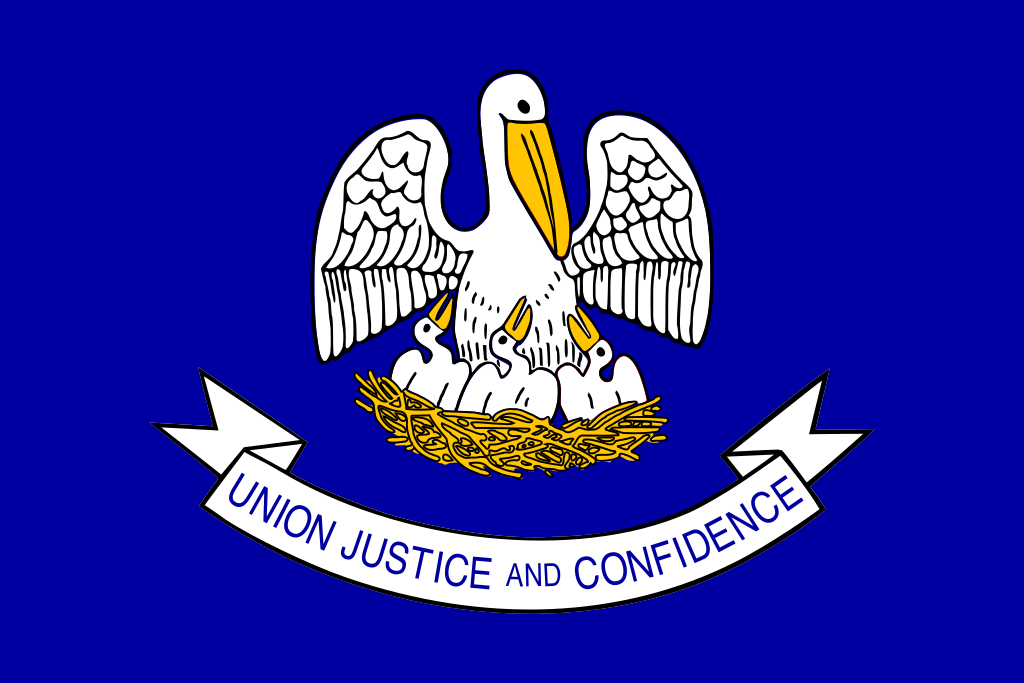

Louisiana legislature refers six constitutional amendments to 2026 ballot covering taxes, civil service, judicial retirement, and education

The Louisiana State Legislature voted to send six constitutional amendments to the 2026 ballot before adjourning on June 12. The six amendments will be decided at two different elections; five will appear on the ballot on April 18, 2026, and one on Nov. 3, 2026. The constitutional amendments cover a variety of topics, including the…

-

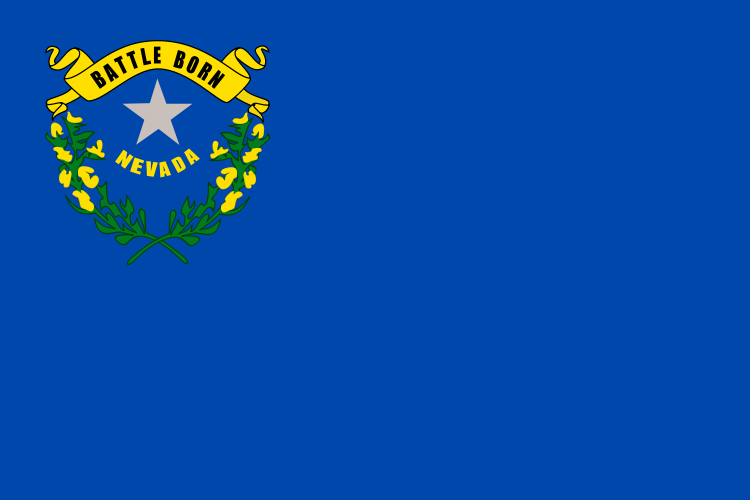

Nevada Gov. Lombardo vetoes bills to require voter ID and open primaries to unaffiliated voters

On June 12, Gov. Joe Lombardo (R) vetoed two election bills that passed the legislature in the final days of the 2025 session, including new voter ID and drop box requirements, and changes to rules for unaffiliated voters in primary elections. Voter ID AB 499 would have required in-person voters to present a valid photo…

-

Louisiana voters to decide on raising judicial retirement age from 70 to 75 in April 2026

Louisiana voters will decide on a constitutional amendment that would increase the judicial retirement age from 70 to 75. It will appear on the ballot on April 18, 2026. Currently, 31 states and the District of Columbia have mandatory retirement ages for judges. These laws require judges to retire either upon reaching a specified age…

-

New Yorkers to decide on constitutional amendment regarding the forest preserve land at Mount Van Hoevenberg Olympic Sports Complex in November 2025

New York voters will decide on a constitutional amendment to authorize a land exchange related to the Mount Van Hoevenberg Olympic Sports Complex on Nov. 4, 2025. The amendment was referred to the ballot by the New York State Legislature. In New York, a constitutional amendment is referred to the ballot by passing both chambers…

-

Rhode Island Senate approves environmental rights amendment; three states have similar constitutional provisions

The Rhode Island State Senate passed a constitutional amendment to establish a right to clean air, clean water, healthy soil, a life-supporting climate, and preservation of the environment. Senate Resolution 327 (S. 327), introduced by State Sen. V. Susan Sosnowski (D-37), passed the Senate in a vote of 32-4 on June 3. The constitutional amendment…

-

Texans to decide on parental rights amendment in November, first ballot measure of its kind since 1996

Texas voters will decide whether to add language to the state constitution to provide that parents have the right “to exercise care, custody, and control of the parent’s child, including the right to make decisions concerning the child’s upbringing” and the responsibility “to nurture and protect the parent’s child.” In Texas, a two-thirds vote in…

-

Missouri voters to decide on overturning abortion rights amendment, banning gender transition procedures for minors

The Missouri State Legislature placed an amendment on the ballot that would overturn Amendment 3 (2024), which amended the state constitution providing for the fundamental right to reproductive freedom, including abortion. Voters will decide on the new amendment in November 2026. This will be the first state where voters will be deciding to overturn an…

-

Texas voters will decide on an amendment to ban taxes on securities transfers and certain financial transactions in November

The Texas State Legislature has voted to send the first constitutional amendment to voters for Nov. 4, 2025. House Joint Resolution 4 (HJR 4) would amend the Texas Constitution to prohibit the state legislature from enacting an occupation tax on registered securities market operators or a tax on securities transactions. A registered securities market operator…

-

Arkansas voters to decide on three constitutional amendments in 2026 addressing the right to bear arms, a citizenship requirement for voting, and the creation of economic development districts

Arkansas voters will decide on three constitutional amendments on Nov. 3, 2026, referred to the ballot by the state legislature. The amendments would expand the constitutional right to bear arms, require citizenship to vote, and allow the creation of economic development districts. Right to bear arms amendment Senate Joint Resolution 11 was sponsored by Sen.…