Tag: ballot measures

-

Michigan Supreme Court to hear arguments on Detroit charter proposal, which includes police policy changes

The Michigan Supreme Court will hear arguments on July 7 over Detroit’s Proposal P that is scheduled to go before voters on Aug. 3. Proposal P would replace Detroit’s charter with a new charter. Among many topics addressed by the charter revision, Proposal P contains several provisions related to police policy in the city, including…

-

Cleveland Community Police Commission and police oversight initiative faces signature deadline next week

The Cuyahoga County Board of Elections announced on June 25 that proponents of an initiative to rewrite Cleveland’s charter on police oversight and discipline authority fell several hundred signatures short of the required number. Citizens for a Safer Cleveland has 15 additional days to collect enough valid signatures to make up the difference and qualify…

-

Reviewing news about police-related local ballot measures

So far this year, Ballotpedia has tracked six certified local ballot measures concerning police oversight, the powers and structure of oversight commissions, police practices, law enforcement department structure and administration, reductions in or restrictions on law enforcement budgets, law enforcement training requirements, and body and dashboard camera footage. We’re also tracking potential measures later this…

-

Oregon voters to decide on removing slavery and involuntary servitude as criminal punishment from state constitution in 2022

On June 24, the Oregon State Legislature voted to send a constitutional amendment to voters in November 2022 that would remove language that allows slavery or involuntary servitude for duly convicted individuals. The amendment would also add language to authorize an Oregon court or a probation or parole agency to order alternatives to incarceration for…

-

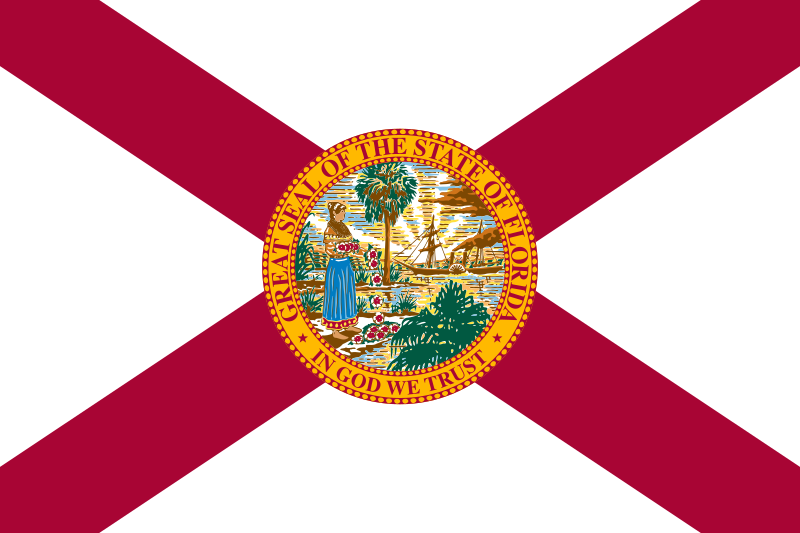

Florida sports betting legalization initiative filed with support from FanDuel and DraftKings

Florida Initiative 21-13, sponsored by Florida Education Champions, was cleared for signature gathering on June 23, 2021. The measure would authorize sports betting at sports venues, pari-mutuel facilities, and online in Florida. The Florida State Legislature would need to pass legislation to implement the constitutional amendment such as providing for licensing, regulation, consumer protection, and…

-

Arizona voters to decide a 2022 amendment that would change legislature’s ability to repeal initiatives

In 2022, voters in Arizona will decide a ballot measure to allow the state legislature to amend or repeal voter-approved ballot initiatives in cases where the Arizona Supreme Court or U.S. Supreme Court declare that a portion of the ballot initiative is unconstitutional or illegal. In Arizona, the legislature must propose a ballot measure to…

-

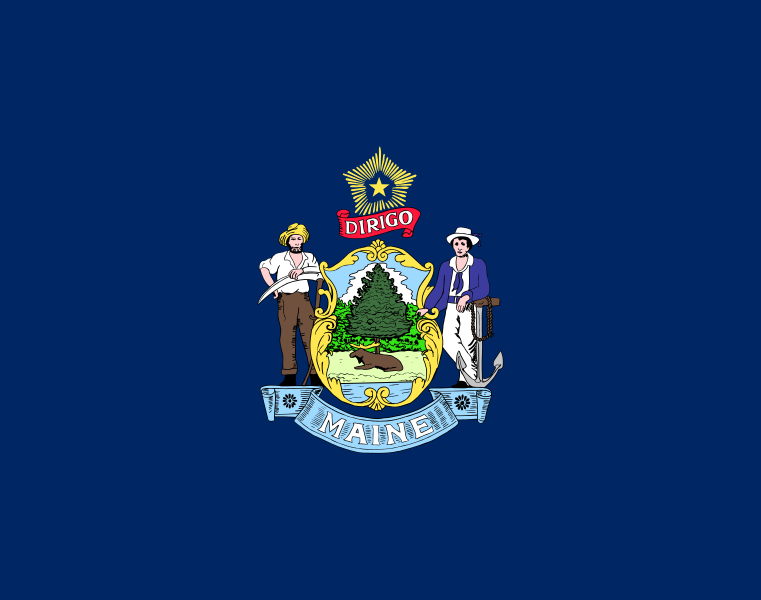

Maine governor vetoes bill prohibiting ballot measure contributions from foreign government-owned entities

On June 23, 2021, Gov. Janet Mills (D) vetoed Legislative Document 194, which was designed to prohibit contributions, expenditures, and participation to influence ballot measures by entities with 10% or more ownership by foreign governments. Mills’ veto letter said, “Even more troubling is this bill’s potential impact on Maine voters. Government is rarely justified in…

-

Davidson County court blocks July referendum to amend Nashville’s charter

On June 22, Davidson County Chancellor Russell Perkins ruled that a petition for six charter amendments backed by 4 Good Government was invalid and blocked the amendments from appearing on the July 27 ballot. Perkins ruled that the petition included two proposed election dates, but local law requires that petitioners specify a single election date.…

-

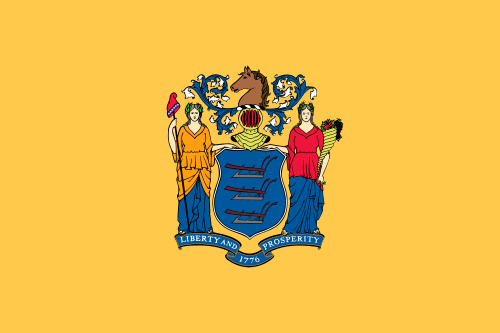

New Jersey voters will decide amendment to allow college sports betting on in-state games, New Jersey-based teams

On November 2, N.J. voters will decide at least two constitutional amendments, including an amendment to expand college sports betting. The ballot measure would allow wagering on postseason college sports competitions held in N.J. and competitions in which an N.J.-based college team participates. Currently, the state constitution permits sports betting except on games held in…

-

Colorado governor signs transportation bill removing 2021 bond issue from ballot

On June 17, Colorado Governor Jared Polis signed Senate Bill 260, thereby removing a bond issue that was set to appear on the state’s 2021 general election ballot. The Colorado State Legislature passed Senate Bill 260 on June 2, 2021. It included a provision to remove the bond issue that was set to appear on…