Tag: SCOTUS

-

SCOTUS grants review in 2 cases for October 2020-2021 term

On June 15, the Supreme Court of the United States (“SCOTUS”) granted review in two cases for its upcoming October 2020-2021 term. The Supreme Court will begin hearing cases for the term on October 5, 2020. The court’s yearly term begins on the first Monday in October and lasts until the first Monday in October…

-

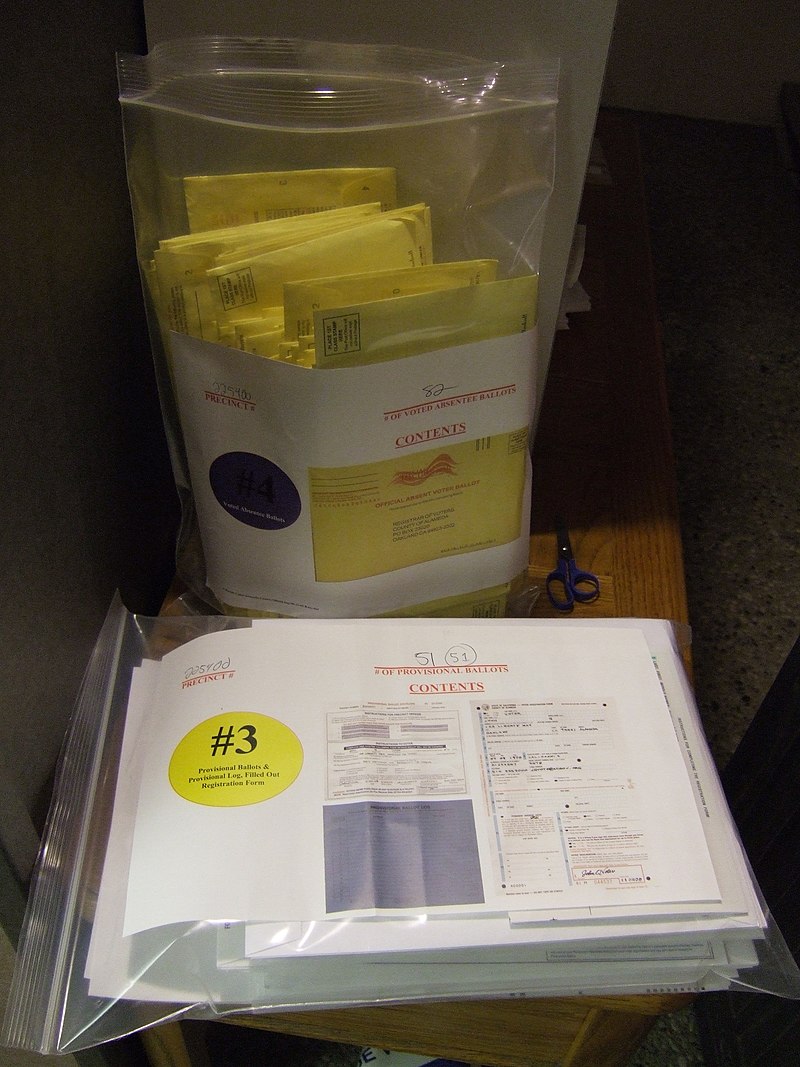

Texas Democrats appeal absentee voting decision to U.S. Supreme Court

On June 16, the Democratic Party of Texas appealed to the U.S. Supreme Court an appellate court order staying a district court decision that had extended absentee voting eligibility in response to the COVID-19 outbreak. On May 19, Judge Samuel Frederick Biery of the U.S. District Court for the Western District of Texas ordered that…

-

U.S. Supreme Court rules on Title VII and sexual orientation, and the U.S. Forest Service’s authority to grant rights-of-way

The U.S. Supreme Court issued two opinions in five cases. In Bostock v. Clayton County, Georgia (consolidated with Altitude Express Inc. v. Zarda and R.G. & G.R. Harris Funeral Homes v. EEOC), SCOTUS ruled “an employer who fires an individual merely for being gay or transgender violates” Title VII of the Civil Rights Act of…

-

Supreme Court issues opinion in one case on June 8

On June 8, 2020, the Supreme Court of the United States (“SCOTUS”) issued a unanimous ruling in one case, Lomax v. Ortiz-Marquez. The case originated from the U.S. Court of Appeals for the 10th Circuit and was argued before SCOTUS on February 26, 2020. The case: Arthur James Lomax is a prisoner at the Limon…

-

SCOTUS issues opinions in five cases

On June 1, 2020, the Supreme Court of the United States (“SCOTUS”) issued rulings in five cases argued during its October 2019-2020 term: Financial Oversight and Management Board for Puerto Rico v. Aurelius Investment LLC (Consolidated with Aurelius Investment v. Puerto Rico, Official Committee of Debtors v. Aurelius Investment, United States v. Aurelius Investment, and…

-

Unanimous U.S. Supreme Court rejects appointments clause challenge to Puerto Rican debt board

On June 1, a unanimous U.S. Supreme Court ruled that the Appointments Clause of the U.S. Constitution does not require members of the Puerto Rican Financial Oversight and Management Board (FOMB) to face confirmation by the U.S. Senate. The Appointments Clause gives the president authority to appoint officers of the United States, subject to confirmation…

-

U.S. Supreme Court rejects challenge to California law limiting church attendance

On May 29, 2020, the United States Supreme Court rejected a challenge to California’s religious gathering limits, which order attendance in churches or places of worship to a maximum of 25% or 100 attendees. The 5-4 decision was joined by Chief Justice Roberts who warned against intervening in emergencies: “Where those broad limits are not…

-

U.S. Supreme Court rules plaintiffs can seek punitive damages for 1998 bombings

The U.S. Supreme Court issued an opinion in Opati v. Republic of Sudan. The case originated in the United States Court of Appeals for the District of Columbia Circuit and was argued on February 24, 2020. It concerned the Foreign Sovereign Immunities Act (FSIA) and questioned if the Act prohibited plaintiffs from recovering punitive damages against…

-

U.S. Supreme Court rules Lucky Brand not barred from raising new claims in trademark infringement case

Lucky Brand Dungarees v. Marcel Fashion Group was argued on January 13, 2020. The case came on a writ of certiorari to the U.S. Court of Appeals for the 2nd Circuit. It concerned trademark infringement and three legal challenges between apparel companies Marcel Fashion Group, Inc. (“Marcel”) and Lucky Brand Dungarees, Inc. (“Lucky Brand”). The…