Author: Josh Altic

-

Vermont Town Meeting day on Tuesday; Montpelier voters to elect town officials and vote on 15 ballot questions

Most towns in Vermont will hold town meetings on Tuesday, March 1. These meetings are held every year on the first Tuesday of March. Citizens of the towns elect officials, but they also directly decide on the town’s annual budget, specific appropriations, and other policy issues through ballot questions called articles. Towns in Vermont use…

-

Arizona voters could decide an amendment in 2022 designed to prevent critical race theory in schools

On Nov. 8, 2022, Arizona voters could decide a constitutional amendment designed to prevent what the measure’s proponents calls critical race theory. On Feb. 17, the Arizona House of Representatives approved House Concurrent Resolution 2001 (HCR 2001), passing the amendment by a vote of 31-28. The vote was along party lines, with Republicans in favor…

-

Michigan Supreme Court overturns distribution and paid circulator registration requirements for initiative petition drives

On Jan. 24, the Michigan Supreme Court ruled provisions of a 2018 law adding restrictions to the state’s initiative process unconstitutional. The decision overturned two provisions of House Bill 6595 (HB6595): a distribution requirement to allow no more than 15 percent of required signatures to come from a given congressional district and a registration requirement…

-

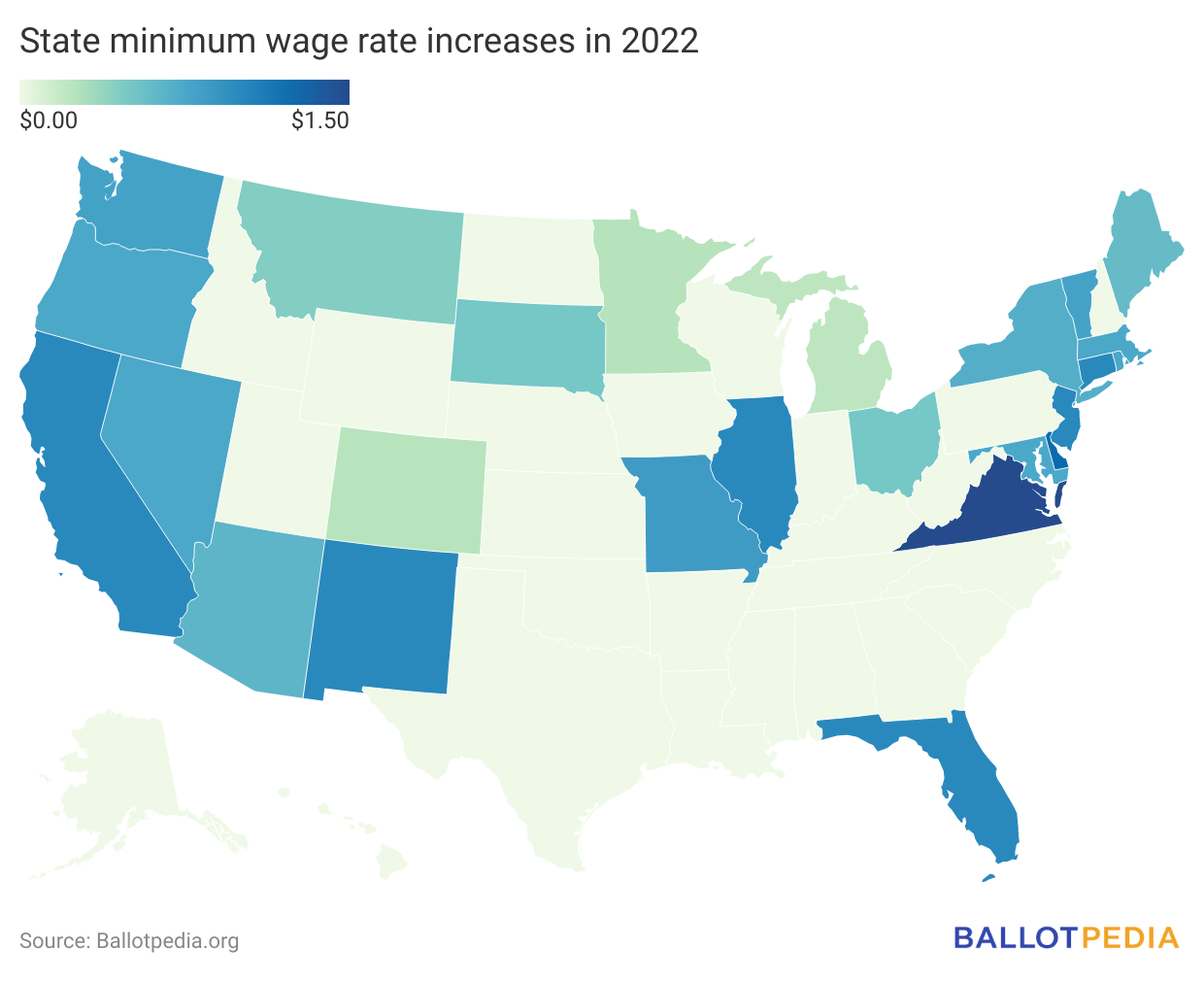

Minimum wage increases in 25 states in 2022

Ballotpedia recently published our annual analysis of statewide minimum wage increases in the coming year. In 2022, the minimum wage will increase in 25 states and Washington, D.C. The increases ranged from $0.22 in Michigan to $1.50 in Virginia. Twenty increases took effect on Jan. 1. Four take effect on July 1. One takes effect…

-

Ballotpedia’s year-end analysis of statewide ballot measures

On Dec. 17, Ballotpedia published its year-end analysis of the 39 statewide ballot measures voters decided in 2021. Voters in nine states approved 26 measures and defeated 13 on four different election dates. The year-end analysis drills down into the types and origins of the measures, the outcomes, campaign finance and signature-gathering costs, and ballot…

-

Nov. 2 local ballot measure results final with Dec. 6 recount results in Colorado Springs

On Dec. 6, the El Paso County, Colorado, Elections Department announced the conclusion of a recount on a Colorado Springs School District bond measure, Issue 4B. Issue 4B failed by 11 votes with 27,476 votes against and 27,465 votes in favor. It would have authorized the district to issue $350 million in bonds for school…

-

Voters in three cities approved ranked-choice voting measures on Nov. 2

Voters in Ann Arbor, Michigan, Broomfield, Colorado, and Westbook, Maine, approved ballot measures to enact ranked-choice voting (RCV) for mayor and city council elections. Westbrook’s measure also enacts RCV for school committee elections. A ranked-choice voting system (RCV) is an electoral system in which voters rank candidates by preference on their ballots. If a candidate…

-

Voters in seven states have decided 11 veto referendums targeting redistricting maps since the first in 1915

States have recently approved new congressional and legislative district maps or are in the process of redistricting after the 2020 census. So it seemed like a good time to look back at instances in the past when opponents of specific redistricting maps collected signatures for veto referendum petitions asking voters to repeal the maps. Voters…

-

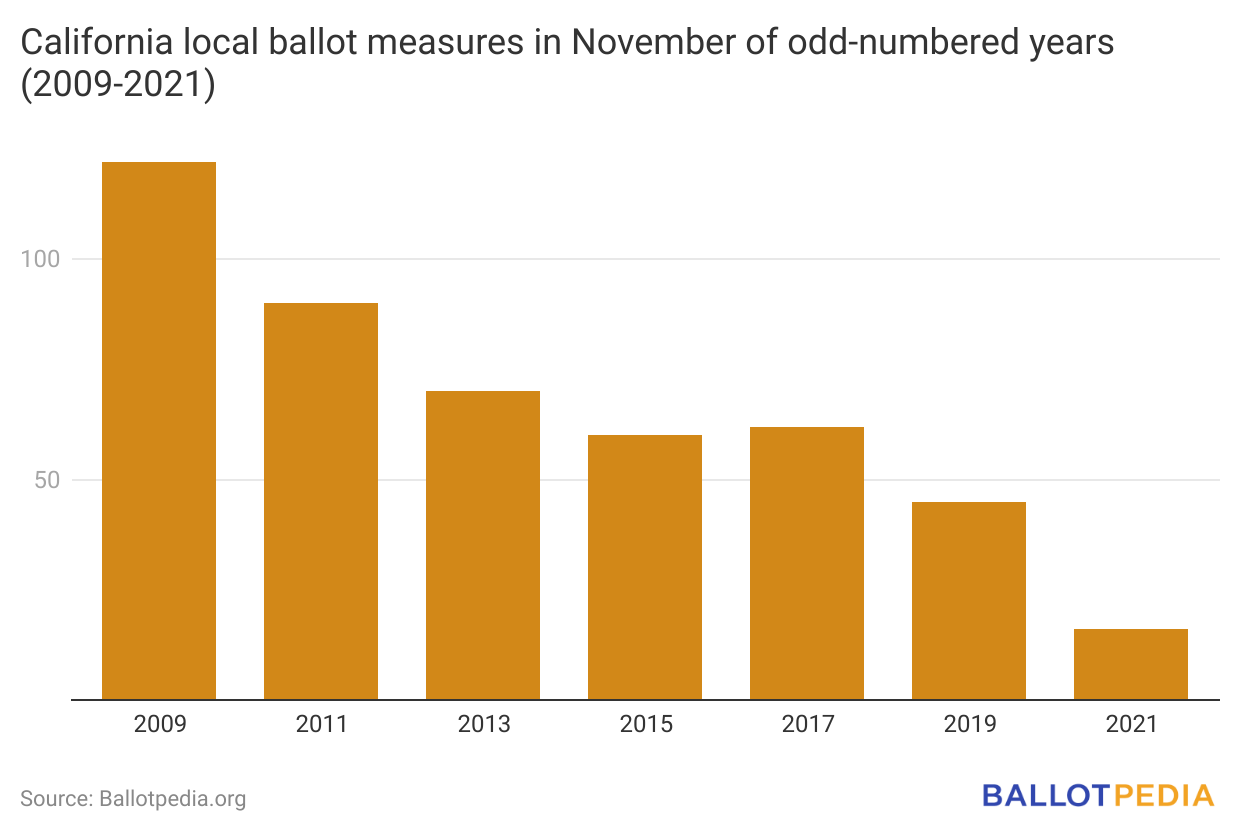

78% fewer local ballot measures on Nov. 2 ballots in California than average since 2009

On Nov. 2, voters in 15 different cities, school districts, and special districts in 10 different California counties will decide 16 local ballot measures. The average number of local California ballot measures on the November ballot in odd-numbered years since 2009 was 74. In 2019, there were 45, and in 2017 there were 62. One…

-

Cincinnati city council fixes error that would have made Issue 3 increase city council salaries instead of decrease them

On Sept. 30, the Cincinnati City Council passed an emergency ordinance to fix an error in the legal text of Issue 3 on the Nov. 2 ballot. The error would have made Issue 3 increase city council pay instead of decreasing it. Issue 3, a citizen initiative, was designed to decrease city council pay to…