Category: State

-

South Dakota voters to decide on constitutional amendment to condition Medicaid expansion on continued federal funding in Nov. 2026

In South Dakota, voters will decide on a constitutional amendment to condition state Medicaid expansion on federal funding remaining at or above 90%. Voters will decide on the amendment in the election on Nov. 3, 2026. If federal funding falls below 90%, the constitutional requirement for Medicaid expansion would no longer apply. Voters adopted this…

-

State supreme court vacancy count for February 2025

In this month’s state supreme court vacancy update, Ballotpedia tracked announced retirements, nominations, appointments, confirmations, and the swearing-in of justices from February 1 to February 28, 2025. Ballotpedia tracks court vacancies in all 52 state supreme courts. Announced retirements: Two chief justices announced their intentions to retire later this year. Michigan Supreme Court Chief Justice…

-

Thirty states have adopted English as an official language, 11 through ballot measures since 1920

President Donald Trump (R) issued an executive order “[designating] English as the official language of the United States” on March 1, 2025. While the federal government had never before provided for an official national language, 30 states have designated English as their official language. Three—Alaska, Hawaii, and South Dakota—also recognize some indigenous languages as co-official…

-

Idaho enacts universal private school choice tax credit, becoming the 14th state with a universal school choice program

What’s the story? Gov. Brad Little (R) signed House Bill (HB) 93 into law on Feb. 27, 2025, making Idaho the 14th state to adopt a universal private school choice program. Universal private school choice programs provide families with public funds to cover expenses incurred by private education. Vouchers, ESAs, and education tax credits are…

-

Arkansas governor signs four bills revising initiative and referendum rules, including signature gathering period, ballot language approval, and circulator requirements

Arkansas Gov. Sarah Huckabee Sanders (R) signed four bills into law, changing state and local initiative and referendum processes. The bills are Senate Bill 102, Senate Bill 207, House Bill 1221, and House Bill 1222. Senate Bill 102 (SB 102) applies state initiative requirements to local initiative petitions. Changes include: SB 102 passed with support…

-

Democratic state financial officers support ESG in letter to regulators

Seventeen Democratic state financial officers sent a letter to the acting heads of the Securities and Exchange Commission (SEC) and the Department of Labor (DOL), asking them to not restrict the use of environmental, social, and governance (ESG) factors in financial decisions. The letter responds to one sent last month by Republican state financial officers…

-

Maine initiative on voter ID, absentee ballots, and dropboxes certified to legislature; will appear on the November 2025 ballot unless lawmakers enact it

In Maine, signatures for a citizen initiative to require photo voter identification, among other changes, were verified on Feb. 19, 2025. Secretary of State Shenna Bellows (D) announced that the campaign submitted 86,904 valid signatures. A minimum of 67,682 valid signatures was required. The proposed initiative will now go to the state legislature for consideration.…

-

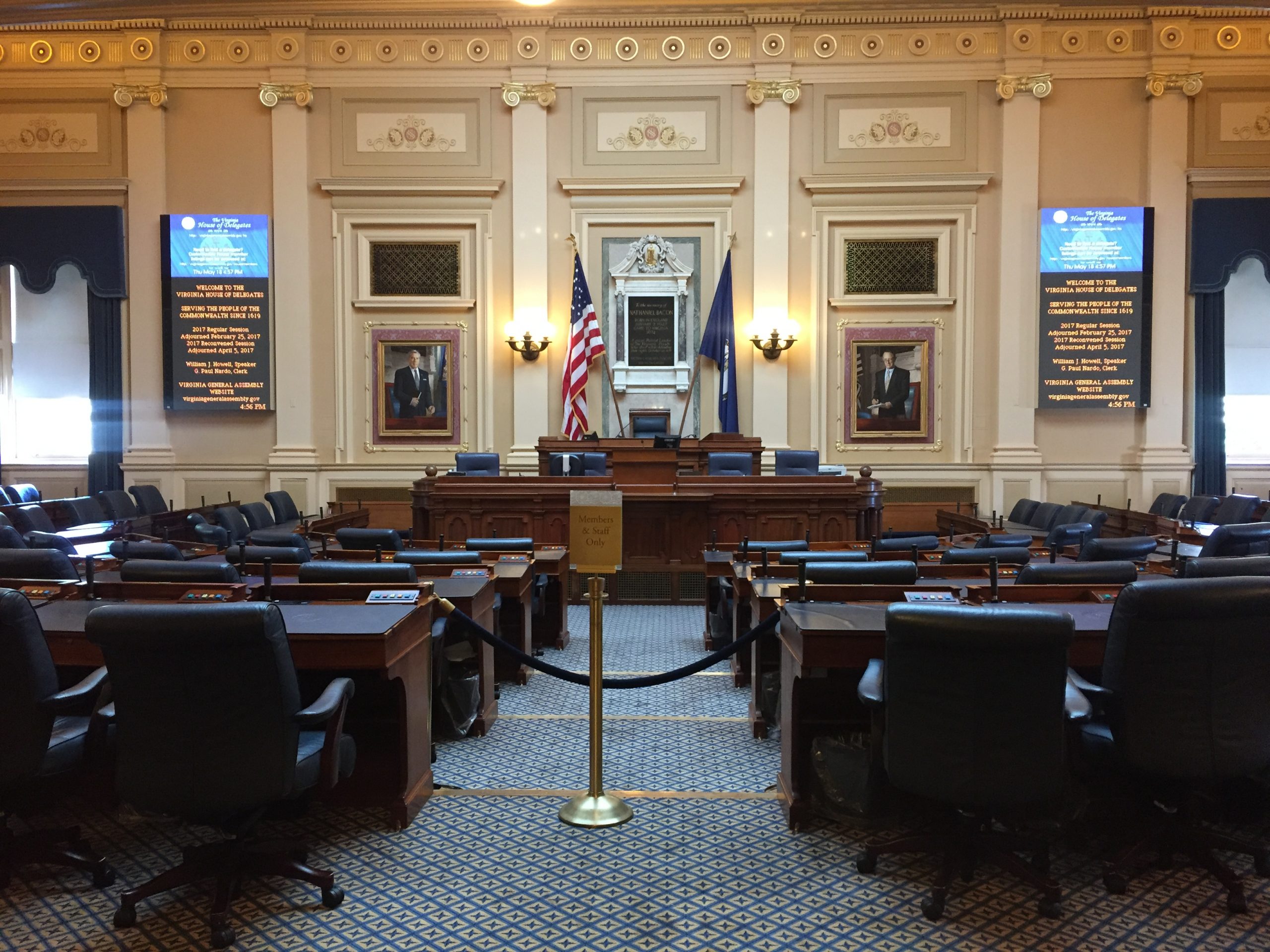

Virginia legislature advances three constitutional amendments on abortion, same-sex marriage, and felon voting rights restoration to the 2026 legislative session

The Virginia State Legislature gave final approval to three constitutional amendments, advancing them for approval by the legislature during its 2026 session. If the amendments are approved by the legislature in 2026, they will appear on the Nov. 2026 ballot. In Virginia, for a constitutional amendment to qualify for the ballot, it must pass the…

-

Virginia legislature advances three constitutional amendments on abortion, same-sex marriage, and felon voting rights restoration to the 2026 legislative session

The Virginia State Legislature gave final approval to three constitutional amendments, advancing them for approval by the legislature during its 2026 session. If the amendments are approved by the legislature in 2026, they will appear on the Nov. 2026 ballot. In Virginia, for a constitutional amendment to qualify for the ballot, it must pass the…

-

Tennessee enacts private school choice scholarship bill, becoming the 13th state with a universal school choice program

Tennessee Gov. Bill Lee (R) signed the Education Freedom Act of 2025 (EFA) into law on Feb. 12, 2025. The bill — House Bill 6004 — creates a universal private school student scholarship program under which all students are or will be eligible to receive the scholarship. Going into 2025, Tennessee had two existing education…